Summary

- The stock of Plug Power enjoyed some great appreciation during the last years, which seems hard to explain when purely looking at the fundamentals.

- The stock performance of almost 2,000% over the last 5 years is an illustration of the increased momentum of the hydrogen market.

- Plug Power shows some important parallels with Tesla, on which I will elaborate in this article.

- If the sentiment can remain positive while growth continues, short-term fundamentals might not matter much.

How can a company in a niche sector which has continuously burned cash over the years have a market capitalization of over $17B? Plug Power (PLUG) is a pure-play hydrogen company that has yet to run a profit. Still, the stock has returned a total of almost 2,000% over the last 5 years.

In this article, I will investigate the promises and expectations behind Plug Power and compare the stock to another stock with large promises: Tesla (TSLA).

Great stock performance, but a lofty valuation

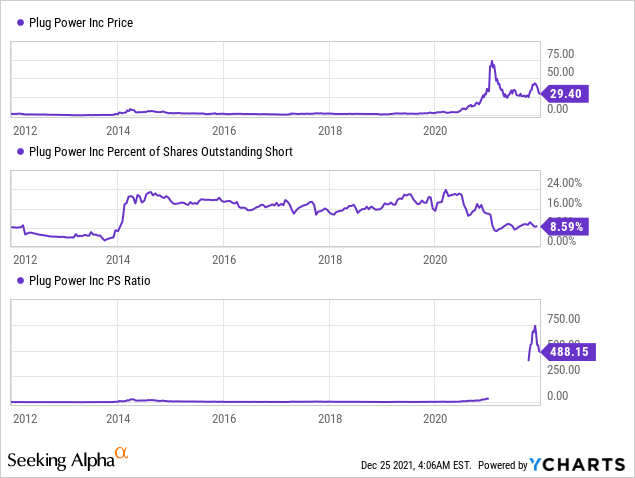

Plug Power has behaved somewhat like a battleground stock during the last couple of years. Ever since the 2014 hydrogen rally, Plug Power has remained a stock that lured investors who believe in the technology, but also attracted quite some short-sellers, judged by its current short interest of almost 10 percent.

More recently, the stock has experienced a huge liftoff, most likely fueled by the announcement of the Build Back Better Plan of president Biden. Since then, Plug Power's stock more or less came back to earth again, even though it is still trading at a very high price to sales ratio.

Please review the following charts for illustration of these metrics:

Plug Power development of share price, short interest, and price to sales ratio during the last 10 years. (source: YCharts)

A true story stock

A story stock refers to a company's shares whose value reflects expected outperformance, the culmination of some new innovation, or favorable press coverage, rather than its market value being solely based on fundamentals like assets and income (Source:Investopedia)

A story can be a powerful backbone of stock performance. Though the hydrogen market is still somewhat of a niche, the story of Plug is one of great expectations.

Hydrogen is indeed a promising market. Let us explore the potential benefits and promises of hydrogen:

- Green hydrogen can help to decarbonize multiple sectors in which it is difficult to reduce emissions, like long-haul transport, chemical industry, and iron and steel production.

- Green hydrogen can contribute to improvements in air quality and energy security.

- Hydrogen can be produced using a multitude of sources, such as renewables, nuclear energy, natural gas, oil, and even coal. Transportation can be done using pipelines or in liquefied form. It can be transformed into electricity very easily.

- Hydrogen can play an important role in coping with the variable outputs of renewable energy sources. Wind and solar energy output are not always in sync with electricity demand, and hydrogen can be used as a store or energy in times when renewable energy production outpaces demand. These storages can be used in times when renewable energy output is lower than demand, and can be saved for days, weeks, or even months, and can even be transported over long distances if needed.

- Clean hydrogen is currently used in an expanding number of projects worldwide, and it seems to be a matter of time before the technology is scaled up and costs are brought down.

- Currently, hydrogen is mostly used in oil refining processes and for the production of fertilizers. Sectors in which it is still hardly used, like transport, buildings, and power generation seem large untapped markets.

As such, hydrogen could play an important supporting role in the renewable energy transition, supplying markets that are difficult or impractical to reach for batteries.

Plug Power has a focused strategy, is already an established business in the hydrogen market, and has a large growing number of commercial relationships. This might mean that the company has the potential to become one of the first pure-play hydrogen companies which could transition from a story stock to a large positive cash flow company.

The commercial relationships and collaborations which Plug is undertaking are among the most important future drivers of growth for the company, among which are collaborations with Airbus(OTCPK:EADSF),Phillips66(PSX),Acciona(OTCPK:ACXIF),BAE Systems(OTCPK:BAESF),Baker Hughes(BKR), and Brookfield Renewable(BEP).

Parallels with early-stage Tesla

I think it is very interesting to compare Plug Power with Tesla. This seems to make sense since they were both one of the largest first movers in big markets: EV for Tesla and hydrogen for Plug. Tesla also was (and might still be) a good example of a story stock, with their large promises of electrifying the automotive sector.

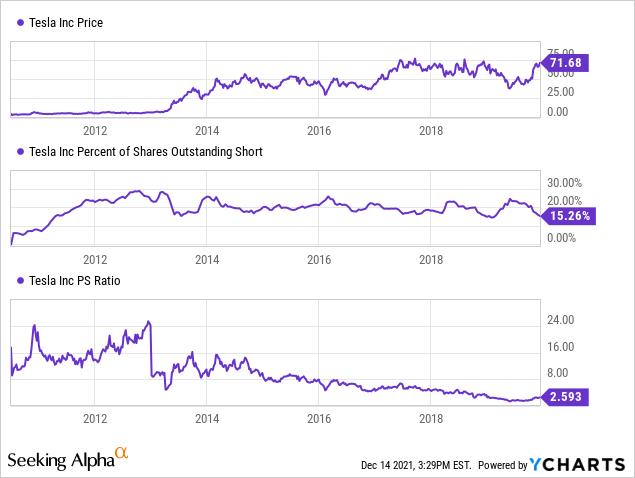

Let us look at the share price development, short percentage, and PS ratio of Tesla during the period from 2010 to the end of 2019:

Tesla's development of share price, short interest, and price to sales ratio between 2010 and the end of 2019. (source: YCharts)

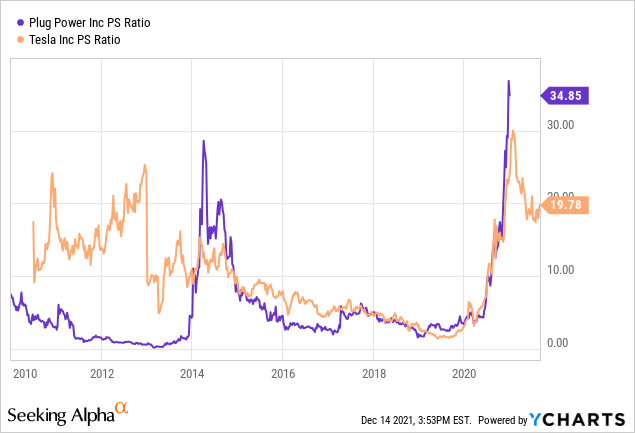

There are some noticeable differences between the share price development of Plug Power and an earlier-stage Tesla. First of all, from 2012 to 2019, the percentage of Tesla's stock sold short has consistently oscillated around 20%. Plug Power is already under 10% and has moved around 15% for the largest part of the last couple of years. But the biggest difference between the two stocks is probably that the price to sales ratio of Tesla has trended down quickly between 2010 and the end of 2019. Since Plug Power's price to sales ratio is heavily influenced by its recent outlier, let us take a look at a graph comparing the two between 2010 and September of this year:

Tesla and Plug Power development price to sales ratio between 2010 and September 2021. (source: YCharts)

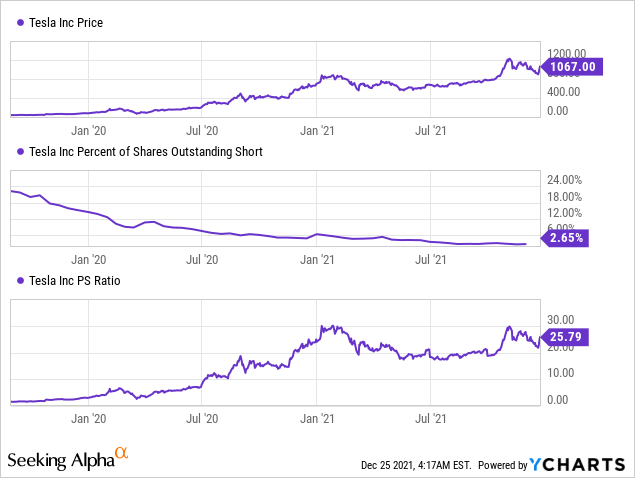

These two ratios look to have a lot more in common. But as we can already see, after the end of 2019, Tesla's price to sales ratio went sharply up again. The reason for this was, of course, the almost unprecedented skyrocketing of the Tesla stock starting from the end of 2019. This is illustrated in the following graph of what happened to Tesla shares from September 2019 until now:

Development of Tesla share price, short interest, and price to sales ratio between September 2019 and now. (source: YCharts)

As the stock price of Tesla skyrocketed, the short percentage went down sharply and the PS ratio went up.

The million-dollar question is of course, could this happen to Plug Power as well? Technically, if we look solely at the metrics of Plug compared with the metrics of Tesla just before the stock price exploded, the P/S ratio of Plug is still much too high to expect that the stock could go in the same direction in short order. I also believe that fundamentally, Plug would need to experience some serious growth for the stock to be able to regain its recent upward momentum.

Another similarity between Plug and Tesla is that negative earnings surprises have been many at Plug recently, this happened to Tesla as well in 2019. At the time, Tesla's stock price was not negatively impacted by those surprises. Currently, the market seems to shake off Plug Power's results as well, though the stock did drop by more than 50% since last year.

Currently, expectations still beat metrics

Like Tesla, Plug's share price seems to be governed more by growth expectations than by current stock metrics. Thiscouldmean that Plug would be able to go in the same direction as Tesla if enough investors remain convinced that their business model is profitable for the future and if growth can be expected to continue. Also, as for Tesla, in the long term, fundamental metrics will need to correspond with their lofty valuations. This means that the companies will need to deliver on their expectations.

These are some very large ifs.

Of course, the hydrogen market is different from the EV market. Since the energy density of hydrogen is very high, it will likely be able to compete in markets where batteries still have issues, like long-haul transport. On the other hand, on an energy efficiency level, batteries have some large benefits over hydrogen for smaller transport purposes. On aggregate, I am skeptical about hydrogen being able to be a strong competitor in the EV space, but it will likely play a large role in other modes of transport, as in energy storage.

Plug Power has been trading like a stock for believers, which shows some strong parallels with Tesla. Theoretically, the stock could follow the same direction as Tesla did, but this is anyone's guess and I believe it would take more growth to continue its upward momentum.

Plug Power is a promising business, but the company had some bad results recently. This did not impact the stock much during the last 2 years. In the short term, the stock price seems to be most impacted by sentiment and not by fundamentals. This makes it a wonderful stock for traders, but as a long-term investor, I am staying on the sidelines.

精彩评论