- Financial stocks got an "alpha signal" and could be set to outperform the S&P(SP500)(NYSEARCA:SPY)in the next few months, according to the latest BofA Securities client flow survey.

- Financial Select Sector SPDR Fund (NYSEARCA:XLF)are up about 0.2% premarket, the leading S&P sector with the 10-year Treasury yield (NYSEARCA:TBT)(NASDAQ:TLT) up another 2 basis points to 1.31%.

- Weekly buybacks in Financials from clients were the highest on record since 2010 and nearly a record as a percent of market cap, BofA says.

- "Buybacks by corporate clients accelerated from the prior week to the highest level since mid-March, driven by Financials," strategists led by Jill Carey Hall write in a note. "Financials has now overtaken Tech as the sector with the largest dollar amount buybacks so far this year."

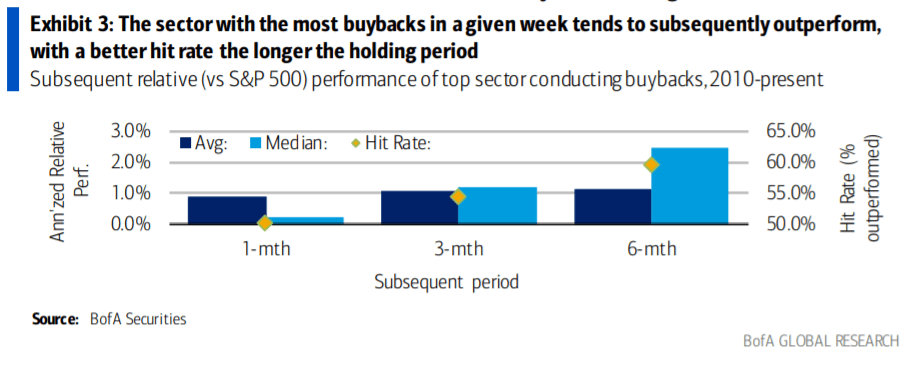

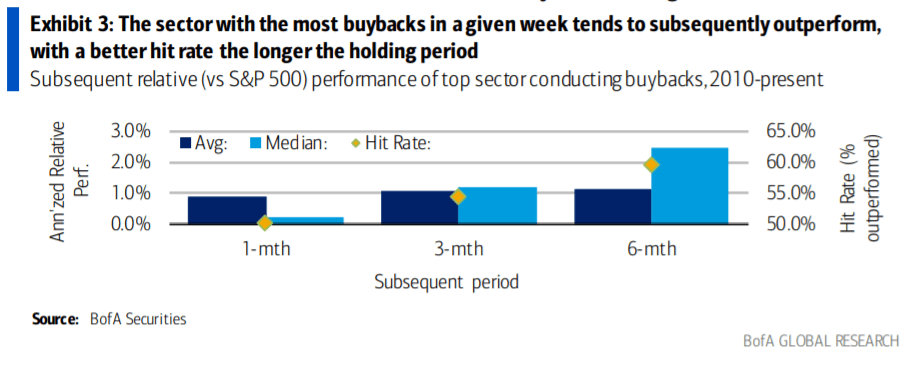

- "Based on our flows data from 2010 to today, we have found that the S&P 500 sector buying back the largest dollar amount in a given week have tended to outperform over the next several months with a >50% hit rate," Hall says.

- "YTD, corporate client buybacks across sectors are +49% y/y but still far from pre-COVID levels: -14% vs. 2019 at this time, and one of the weakest years post-crisis so far when normalized by market cap," Hall adds.

- Overall, clients broke a two-week selling streak, buying a relatively small net amount of $300M.

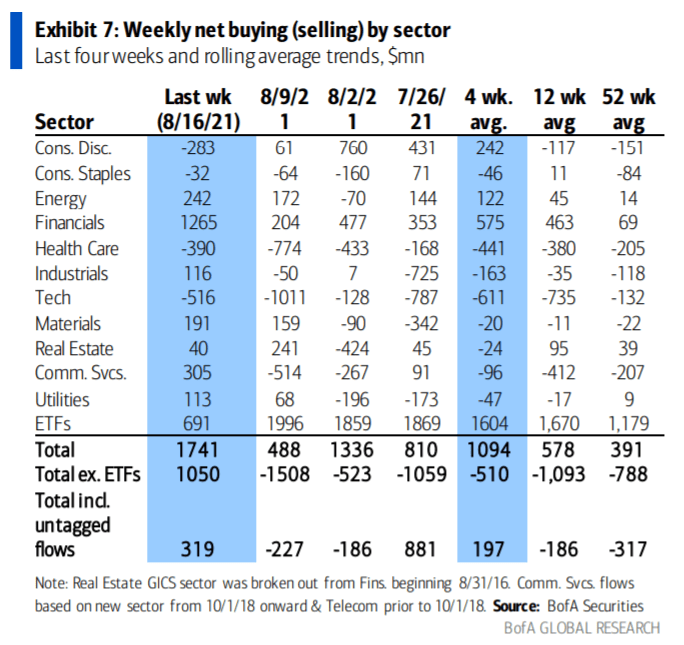

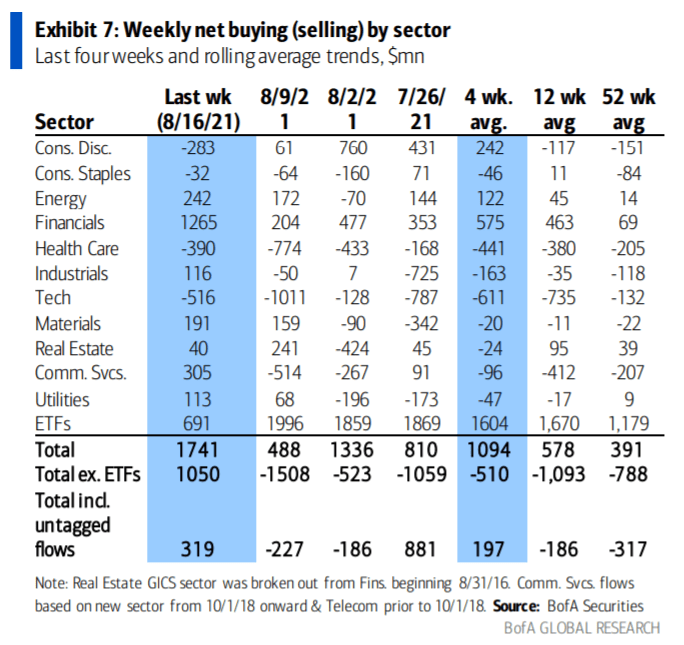

- Hedge funds drove the buying with the biggest inflow in five months, while institutional and retail investors sold.

- Seven of the 11 S&P sectors saw inflows. Financials were on top with the sixth-largest inflows on record. Technology Select Sector SPDR Fund (NYSEARCA:XLK), Health Care Select Sector SPDR Fund (NYSEARCA:XLV), Consumer Discretionary(NYSEARCA:XLY)and Consumer Staples(NYSEARCA:XLP)had net selling.

- Excluding buybacks, The Communication Services Select Sector SPDR Fund (NYSEARCA:XLC), Materials Select Sector SPDR Fund (NYSEARCA:XLB) and Energy Select Sector SPDR Fund (NYSEARCA:XLE) led inflows.

- This morning, Dick's Sporting Goods raised its buyback program to $400M, along with issuing a special dividend.

免责声明:本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性做出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任。

精彩评论