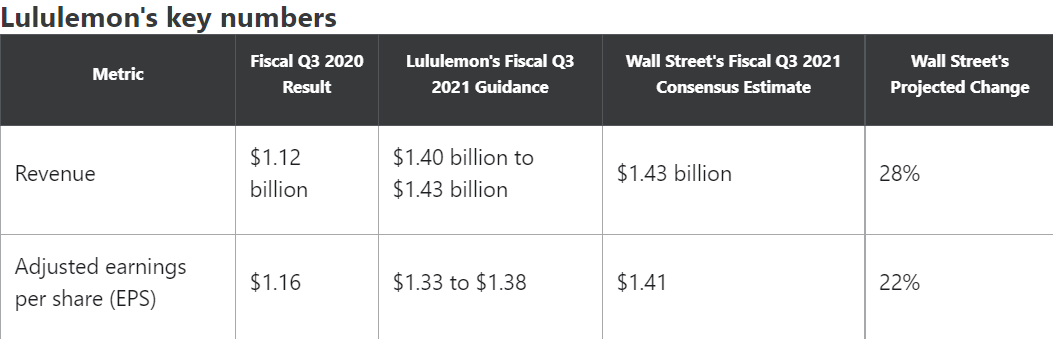

Lululemon Athletica is slated to report its results for the third quarter of fiscal 2021 (essentially the August-to-October period) after the market close on Thursday, Dec. 9.

Investors in the athletic apparel retailer are probably feeling optimistic about the report. Last quarter, revenue and earnings crushed Wall Street's consensus estimates, third-quarter guidance for both the top and bottom lines came in higher than analysts had been expecting, and management significantly hiked its full-year outlook for both revenue and earnings. Moreover, many investors are enthused about the company's potential to be a major player in the growing home connected-fitness market, thanks to its acquisition of Mirror last year.

In 2021, Lululemon stock is outrunning the market. Through Nov. 26, it's up 31.3% versus the S&P 500's 23.9% return.

Here's what to watch in Lululemon's upcoming report.

For context,last quarter(essentially the May-to-July period), Lululemon's sales soared 61% year over year to $1.45 billion, sprinting by the 47% growth Wall Street had expected. Growth was driven by a 142% surge in company-operated stores' revenue to $695.1 million, as many consumers returned to shopping in brick-and-mortar stores. Direct-to-consumer sales rose 8% to $597.4 million. Adjusted EPS skyrocketed 123% to $1.65, leaving the analyst consensus estimate of $1.19 in the dust.

Last quarter's results were particularly strong because of the easy year-ago comparable. The year-ago period occurred early in the pandemic when consumers were cutting back their spending on non-essential products.

Mirror

Management hasn't been providing sales data for Mirror, "a nearly invisible interactive home gym," to use Lululemon's words. But investors can expect an update on the earnings call about the company's relatively new home connected-fitness business.

On last quarter's earnings call in early September, CEO Calvin McDonald said the company had Mirror shop-in-shops in 150 Lululemon stores with plans to increase that number to 200 by the holiday season. He added that the company would soon introduce Mirror to the Canadian market. Indeed, in early October, Lululemon announced that Mirror would be available in 40 of its stores across Canada and available for online purchase in the country beginning on Nov. 22.

Guidance for the holiday quarter

As always, Lululemon's guidance, relative to Wall Street's expectations, should be a major factor in the market's reaction to its upcoming report. Investors will likely be putting significant weight on the quarterly outlook because the holiday period is particularly important to retailers. For fiscal Q4 (essentially the November-to-January period), Wall Street is modeling for revenue to jump 28% year over year to $2.21 billion and adjusted EPS to also increase 28%, to $3.30.

精彩评论