ARK Invest chief Cathie Wood reiterated her views on Tuesday that deflation rather than inflation is the biggest market threat, and that innovation companies like EV and fintech firms represent the best deflation hedge.

However, all six of ARK Invest's actively managed exchange traded funds underperformed the broad-based market indexes during Q3, according to figures the quarterly report included.

The ETFs also have a split performance from a year-to-date viewpoint, with three being positive and three being negative through 2021's first nine months.

YTD price action on ARKs actively managed ETFs:

ARK Fintech Innovation ETF(NYSEARCA:ARKF): +7.34%.

ARK Autonomous Technology & Robotics ETF(BATS:ARKQ): +6.37%.

ARK Next Generation Internet ETF(NYSEARCA:ARKW): +3.48%.

ARK Space Exploration ETF(BATS:ARKX): -1.55%.

ARK Innovation ETF(NYSEARCA:ARKK): -5.98%.

ARK Genomic Revolution Multi-Sector ETF(BATS:ARKG): -20.87%.

Daily price action: ARKK +2.28%, ARKQ +1.90%, ARKW +1.96%, ARKG +3.51%, ARKF +1.39%, and ARKX +1.38%.

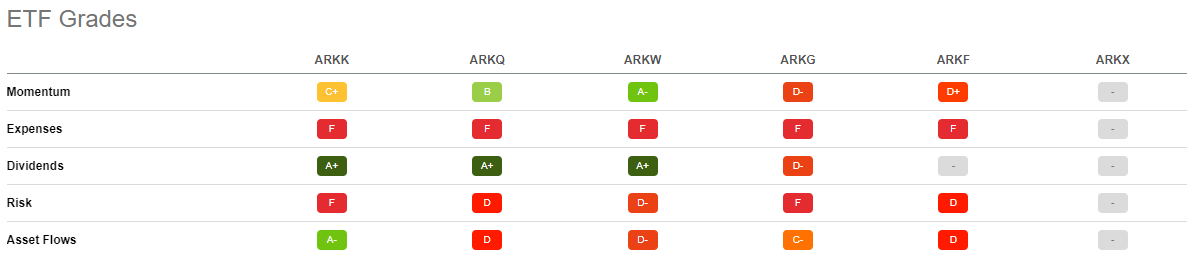

Below is a depiction of each fund’s momentum, expenses, dividends, risk, and asset-flows grades according to Seeking Alpha's proprietary quant ratings. For a more extensive analysis, you can see Seeking Alpha’s complete quantitative analysis here.

“In ARK’s view, inflation fears have been overblown and are likely to give way to the risks of deflation," Wood wrote in a commentary accompanying ARK’s latest quarterly report.

She wrote that market participants are beginning to focus on inventories built up not at the organizational level, but rather at the consumer households’ level due in part to the COVID-19 crisis.

“Once the household inventory accumulation is better understood, fears could shift from inflation to deflation and sluggish growth rates," Wood argued.

She predicted that nominal GDP growth will most likely be considerably lower than expected over the next five years.

As such, Wood predicted that “scarce double-digit growth opportunities will be rewarded, and growth stocks in general and innovation-driven stocks in particular could be the prime beneficiaries.”

The financier also echoed her previously disclosed stance that the two sectors that will be "disrupted the most by innovation during the next five years [will be] energy and financial services."

Wood said that's creating opportunities in autonomous electric vehicles and digital wallets/cryptocurrencies -- two areas where ARK funds have focused.

精彩评论