Pandemic fears have returned since the discovery of the Omicron variant, and vaccine-related stocks are back in the spotlight. Today, we take a closer look at Moderna and Pfizer stocks.

COVID-19 keeps haunting the markets. New variant Omicron has renewed fears worldwide about a new health and economic crisis, since little is still known about how this variant affects vaccinated and non-vaccinated people.

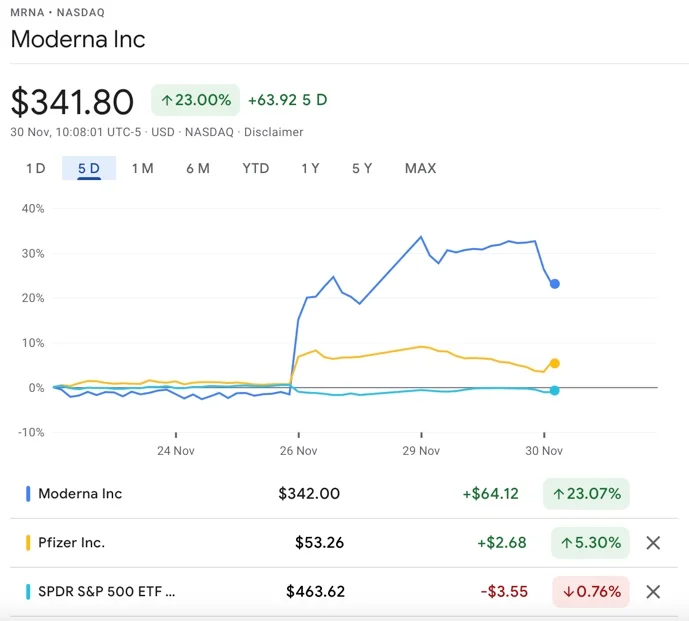

The stock market sold off on Friday, November 26, after Omicron news hit the wire. The S&P 500 dropped 2% amid uncertainty. One of the few gainers was Moderna stock, which jumped 20% on Friday’s trading session, while Pfizer stock was up a more modest 2.5%.

Between two of the main COVID-19 vaccine makers, we assess Moderna and Pfizer stocks and ask ourselves: which is a better buy as Omicron fear lingers?

Wall Street is neutral on Moderna

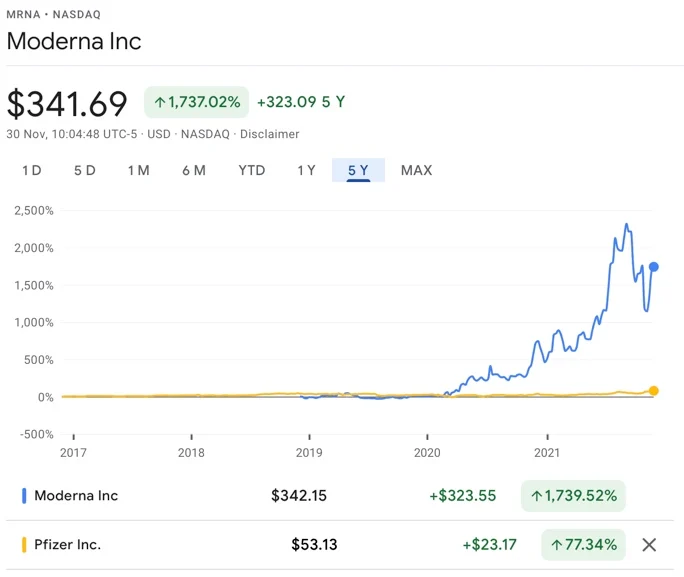

Moderna stock currently has a hold consensus among 13 analysts and an average price target of $298, which suggests 17% downside from current levels. Wall Street’s assessment suggests that the stock price may have moved ahead of fundamentals, as MRNA has gained more than 1,200% since the COVID-19 pandemic started.

The most recent report on Moderna stock came from Piper Sandler’s Edward Tenthoff, who reiterated his buy recommendation and forecasted a $348 price target on the back of Omicron news. The analyst sees the company prepared for the emergence of new variants and "ideally suited to rapidly swap in new versions of the Spike antigen" to make new COVID-19 vaccines.

Morgan Stanley’s Matthew Harrison reiterated his neutral rating on MRNA a week ago with a $313 price target. The analyst mentioned that the announcement of Moderna’s flu vaccine data before year-end could be a positive catalyst for the stock. If the results are positive, the market could price in about $10 billion in long-term flu and COVID vaccine revenue, bumping shares by 10%.

Pfizer: moderate buy, but experts are skeptical

Wall Street is currently bullish on Pfizer, based on stock ratings. However, average price target consensus suggests that valuations could be stretched thin, following the November rally. PFE has a moderate buy recommendation based on 13 reports and a $50 average price target.

JPMorgan‘s Chris Schott raised the firm's price target on Pfizer to $53 from $42 and kept a neutral rating. Covid remains a focal point of the Pfizer story, and Comirnaty and Paxlovid sales are "set to clearly exceed expectations”. While the analyst sees limited upside from the company's core business, he would not be surprised to see shares rally in the near-term on omicron headlines.

The most recent update on PFE came from Mizuho Securities’ Vamil Divan. He is skeptical on Pfizer stock and sees 16% downside risk. But according to the analyst, Omicron may increase near-term demand for Pfizer’s COVID-19 vaccine, especially for booster doses.

Wall Street Memes’ take

COVID-19 vaccine makers may naturally benefit in the near-term from Omicron fears. Moderna, for instance, has risen more than 1,200% since the beginning of the COVID-19 pandemic in March 2020, while Pfizer stock has climbed 79% during the same period.

Pfizer is much larger than Moderna, with a market cap size of $300 billion compared to Moderna’s $133 billion. Both companies have strong vaccine pipelines and technology, but Moderna likely benefits from the current pandemic for being more of a pure-play stock.

Due to business model diversification, we see MRNA as a better short-term bet on COVID-19 developments. However, for this same reason and due to richer 2023 P/E of 32x, the stock is likely to be more volatile and present higher downside risk. PFE, on the other hand, could be a better long-term bet on healthcare at large, especially considering de-risked 2023 P/E of only 13x.

精彩评论