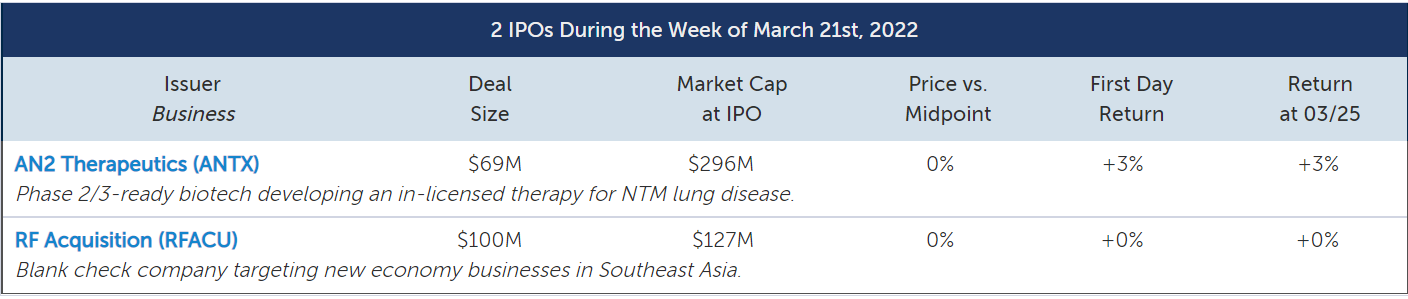

The IPO market stayed relatively quiet, with only one IPO and one SPAC pricing this past week. Pipeline activity maintained its slow pace, with only two small IPOs and one SPAC submitting initial filings.

AN2 Therapeutics (ANTX) priced its upsized IPO at the midpoint to raise $69 million at a $296 million market cap. The company is developing an in-licensed therapy for non-tuberculous mycobacterial lung diseases. AN2 Therapeutics aims to begin its Phase 2/3 trial by the end of the 1H22 and expects data mid-2023.

RF Acquisition (RFACU) was the sole SPAC to come to market, and raised $100 million to target new economy businesses in southeast Asia.

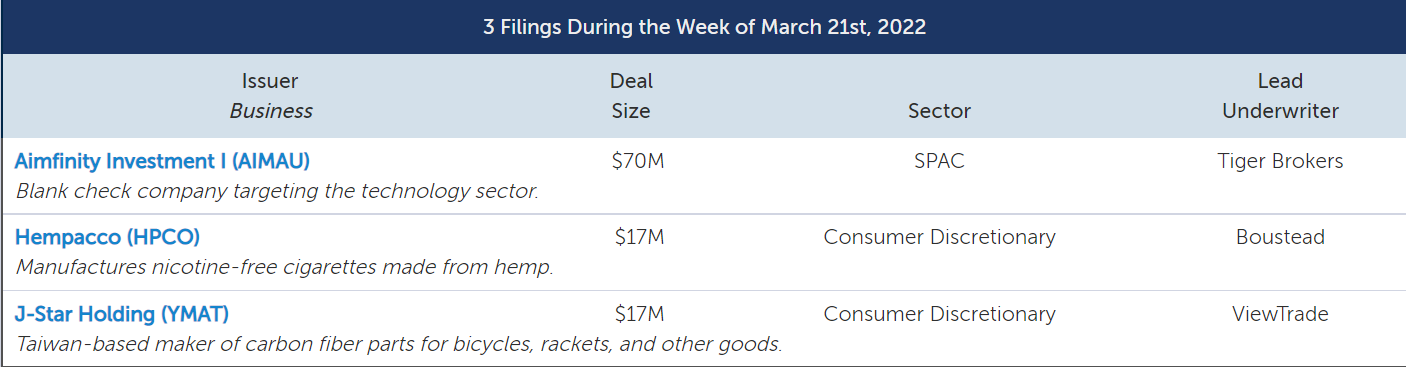

Two IPOs submitted initial filings this past week. Taiwanese carbon fiber part manufacturer J-Star Holding (YMAT) and hemp cigarette manufacturer Hempacco (HPCO) both filed to raise $17 on the Nasdaq.

Aimfinity Investment I (AIMAU) was the sole SPAC to submit an initial filing. The company filed to raise $70 million to target the technology sector.

IPO Market Snapshot

The Renaissance IPO Indices are market cap weighted baskets of newly public companies. As of 3/24/2022, the Renaissance IPO Index was down 22.5% year-to-date, while the S&P 500 was down 4.8%. Renaissance Capital's IPO ETF (NYSE: IPO) tracks the index, and top ETF holdings include Uber Technologies (UBER) and Snowflake (SNOW). The Renaissance International IPO Index was down 22.9% year-to-date, while the ACWX was down 6.2%. Renaissance Capital’s International IPO ETF (NYSE: IPOS) tracks the index, and top ETF holdings include Volvo Car Group and Kuaishou.

精彩评论