Challenging conditions in the IPO market continued this past week. The two major deals on the calendar postponed, and the remaining micro-caps pushed back their debuts by a week. Seven SPACs completed offerings, and three IPOs and four SPACs submitted initial filings.

Four Springs Capital Trust(FSPR) postponed its $252 million IPO, which was set to be the largest deal of the week. The REIT previously attempted to go public in 2017, and had expanded its portfolio since then. Bitcoin minerRhodium Enterprises(RHDM) postponed its $100 million IPO as Bitcoin prices continue to drop.

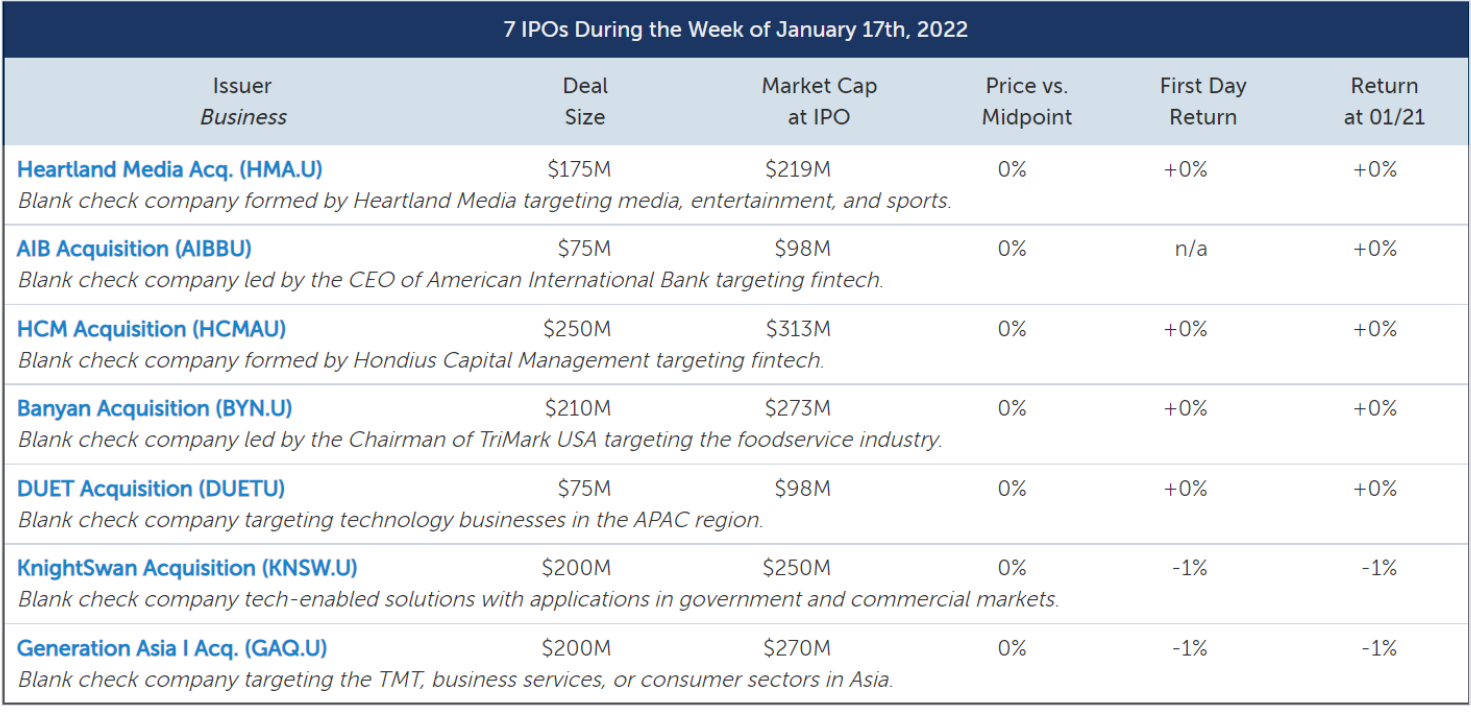

Seven SPACS went public this past week led by Hondius Capital’sHCM Acquisition(HCMAU), which raised $250 million to target the fintech sector.

While not included below, Japan-basedYoshitsu(TKLF) began trading after initially pricing its IPO earlier this month. The retailer became the latest micro-cap to soar on its debut, gaining 700% on its first day; it finished the week up 638%.

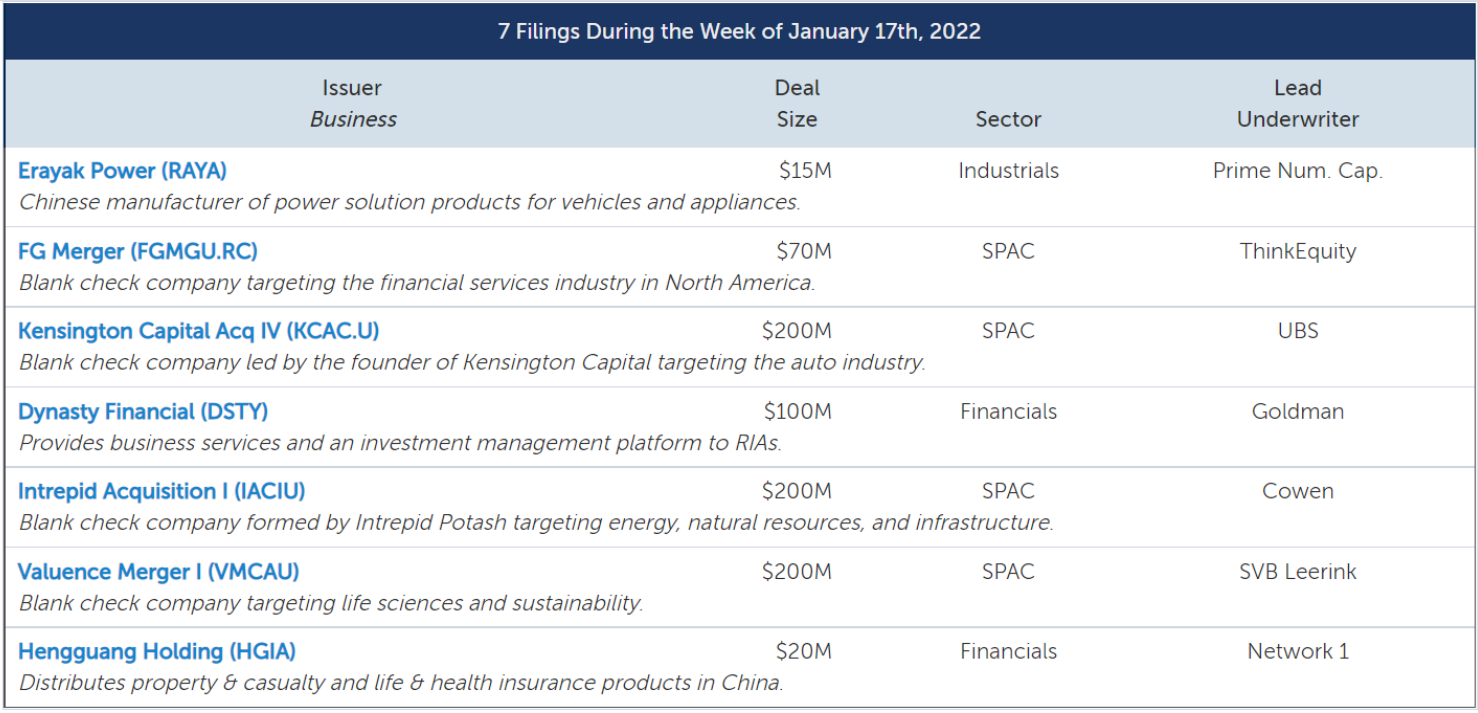

Three IPOs submitted initial filings. RIA services platformDynasty Financial Partners(DSTY) filed to raise $100 million, Chinese insurance firmHengguang Holding(HGIA) filed to raise $20 million, and Chinese micro-capErayak Power Solution Group(RAYA) filed to raise $15 million.

Four SPACs submitted initial filings. Auto-focusedKensington Capital Acquisition IV(KCAC.U), Intrepid Potash’sIntrepid Acquisition I(IACIU), and life sciences and sustainability-focusedValuence Merger I(VMCAU) all filed to raise $200 million.

精彩评论