Summary

- AMD's recent CPU and GPU offerings have been more competitive with Intel and NVIDIA's products.

- AMD’s EPYC server chips have proved to be comparable or even superior to certain Intel chips and have led to AMD gaining server CPU market share.

- Even so, Intel is the leader in the processor market and holds long-term advantages over AMD in R&D, marketing, and pricing.

- Nvidia is ahead of AMD in GPU technology and is leveraging its GPUs into adjacent end markets such as artificial intelligence.

Intel (INTC) was once the microchip industry equivalent of the Colossus of Rhodes, a monument to the power of Moore’s law. However, the firm stumbled with its 10-nanometer process, and recently announced its 7-nm process will be delayed until 2023.

This left the door open to Advanced Micro Devices Inc. (AMD), and that firm has taken full advantage of the opportunity. AMD has taken a large share of the CPU market and is making inroads into the once nearly impenetrable server market.

AMD now has seven consecutive quarters of double-digit revenue growth under its belt, and it appears the firm is gaining momentum: management now guides for 60% revenue growth for the full year, up from the 50% forecast provided in the previous quarter.

However, AMD also competes with NVIDIA Corporation (NVDA), and the latter company’s GPU technology is stealing market share. NVDA has also been successful in gaining access to adjacent markets with its GPUs, especially AI and automotive markets.

The Ins And Outs of Intel

An understanding of Intel also provides insights into AMD. This is due to the overlap between the two companies, particularly in regards to x86 chips. Intel developed the x86 chip in 1978. To satisfy demands by IBM that Intel would not be the sole supplier of the chips, INTC provided x86 instruction set architecture licensing to AMD.

Consequently, Intel and AMD have a duopoly position in the PC and server markets, as nearly all computer software is written for x86 architecture. The result is that both have a wide moat related to the x86 ecosystem.

Gaming consoles in particular are based on x86 architecture due to those platforms generally providing more powerful CPUs and GPUs with multiple compute cores. Like PCs, consoles operate with games that use x86 based software. Once again, this stifles potential competition from ARM-based devices.

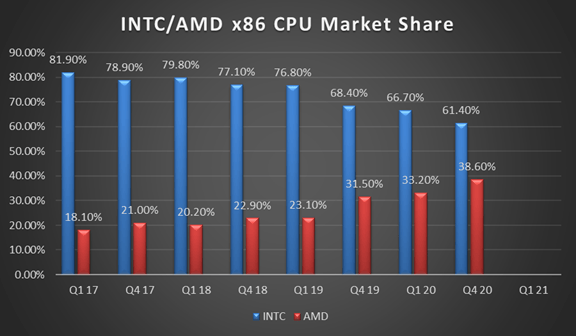

Until fairly recently, AMD was a distant second to INTC as a supplier of x86 chips. However, AMD teamed with Taiwan Semiconductor(NYSE:TSM)to use that manufacturer’s 7nm process to surpass INTC in process technology. Combined with AMD’s developing new innovative chip designs, this one-two punch resulted in INTC losing significant market share.

At the end of Q1, AMD held 19.30% of the x86 desktop market, a 70 basis point gain year-over-year. In Q2 AMD corralled 8% of the server market, up from a 5% market share in Q4 of 2019.

Despite these setbacks, it seems premature to view Intel as a moribund business. INTC is one of the largest semiconductor companies in the world. The firm dominates the server market, and still holds 60% of the global x86 CPU market.

The company has an enormous R&D budget, and it is expanding into new markets, primarily Artificial Intelligence, Field-Programmable Gate Array chips, and automotive offerings, through its acquisitions of Habana Labs, Altera, Movidius, and Mobileye.

Investors should not be swayed by the claim that Intel’s new 10nm chips are inferior to 7nm solely on the basis that 7 is superior to 10. While once used to denote the technology level of a chip design, it has been misused to the point of being useless.

However, there are a number of concerns that must be acknowledged. Intel lags competitors in the smartphone market. As consumers shift to mobile devices, this could result in a sustained headwind as smartphones take the place of PCs. On the other hand, it should be acknowledged that INTC’s server processor business has seen growth associated with the surge in mobile devices and cloud computing.

Intel also faces increased competition from AMD in the data center space, as well as customers developing their own ARM-based chips for CPUs.

An Overview of AMD

In years past, INTC held the lion’s share of the x86 market. This was due in part to Intel’s leading-edge manufacturing combined with AMD’s wafer supply agreements with less than stellar GlobalFoundries.

However, a seismic shift occurred due to three factors: driven by innovative designs, AMD brought competitive products to market, AMD shifted to TSMC for production, and Intel faced repeated manufacturing delays. The two charts below document the progress the company has made.

Like Intel, AMD’s primary products are CPUs and GPUs. AMD’s chips are designed for PCs, game consoles, servers, and blockchain applications. And like INTC, AMD’s offerings are largely protected from competition due to the preponderance of software for PCs and servers being designed for x86 architecture.

AMD’s strong growth has largely come at the expense of Intel as AMD has steadily chipped away at the former company’s CPU market share.

AMD’s focus on CPU and GPU semi-custom processor applications has resulted in their use in Microsoft Xbox and Sony PlayStation game consoles.

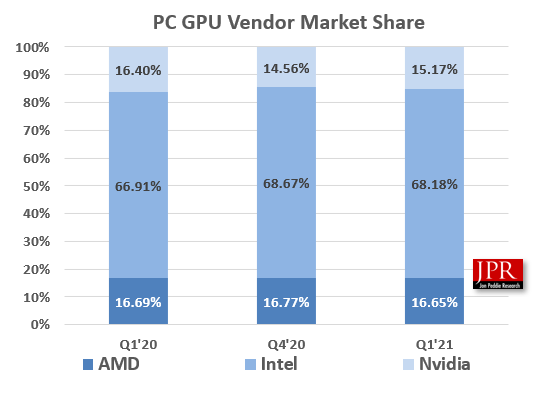

In regards to PC integrated GPUs, AMD is roughly in parity with NVIDIA while INTC dominates with roughly 68% of the market.

However, NVIDIA dominates the discrete GPU space with an 80% plus market share with AMD sweeping up what is left. NVIDIA’s discrete GPUs are arguably superior to AMD’s (more on that later); therefore, investors should not look for growth here.

Although AMD’s EPYC server CPU products were competitive with that of rivals, initially the company relied on aggressive pricing to promote its first generation of EPYC offerings. However, the EPYC line has gained wider acceptance, and with the Milan processors, the company is gaining market share. As server CPUs provide a better profit margin than the company’s other products, expansion into that space should aid in driving revenue.

Late last year,AMD entered intoa deal to acquire Xilinx (XLNX), a leader in field programmable gate array (FPGA) chips. FPGAs can be used for a wide variety of applications. Because shifting to a competing FPGA provider requires retraining of engineers in software and design tools, customers are loath to make a switch to a competing vendor. Consequently, if the Xilinx deal goes through, AMD will have acquired a wide moat business. Management guides for operational efficiencies of approximately $300 million within 18 months of closing the transaction.

The Xilinx acquisition should bolster AMD’s data center and artificial intelligence businesses.

AMD agreed to acquire Xilinx for $35 billion in an all-stock transaction.

A Survey of NVIDIA

NVDA's focus on the graphics processing units market has led the company to a dominant position in the discrete GPU space. The firm is the leader in discrete GPUs for computing platforms, especially gaming consoles. The fact that Intel licensed intellectual property from NVIDIA to integrate GPUs into its PC chipset testifies to the lead the company maintains.

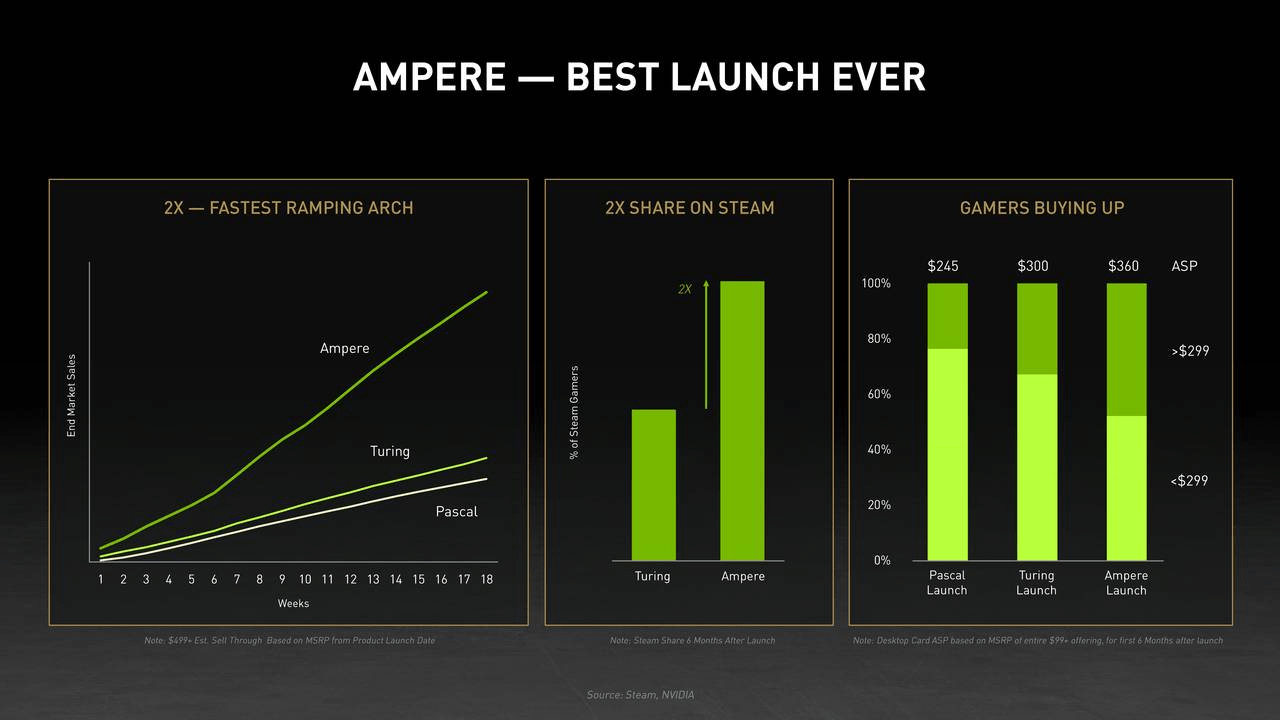

The chart below provides a record of the burgeoning ASP the company has been able to command over the last half decade, beginning with the Pascal architecture in 2016, and progressing through Turing to Ampere.

The firm’s chips are also found in many high-end PCs, and NVDA has particular strength in the incipient AI and self-driving vehicle markets.

GPUs are being teamed with CPUs to enhance computation workloads. This stratagem is designed to bolster the ability of AI systems to perform computationally intensive tasks. AI related to autonomous vehicles is a developing strength for NVIDIA. Another arena in which the firm is making its mark is in cloud

AI and data centers pose the most likely avenue of growth for NVDA. To strengthen its position in both businesses, the company moved last year to acquire ARM Holdings (ARMHF) from parent company Softbank for $40 billion.

ARM is the globe’s largest licensor of chip designs. Its chips are ubiquitous and can be found in mobile phones, smart TVs, and tablet computers. 160 billion chips have been made using ARM designs.

Perhaps of equal importance is that 13 million developers work with ARM devices. To place that in context, NVDA has 2 million developers working on its array of devices.

Unfortunately for investors, bothChinaand theU.K.are reportedly balking at approving the deal.

Head-To-Head Comparisons

Valuation Metrics

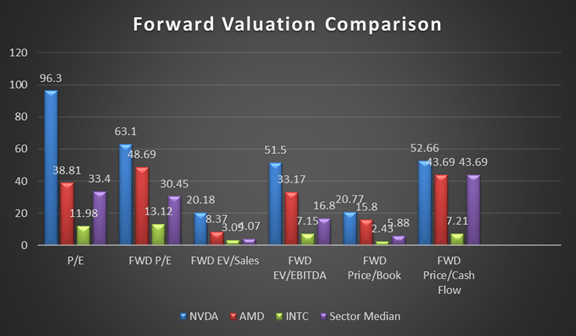

The following chart provides a variety of metrics related to each stock's valuation. All data labeled forward is analysts’ next fiscal year consensus estimate.

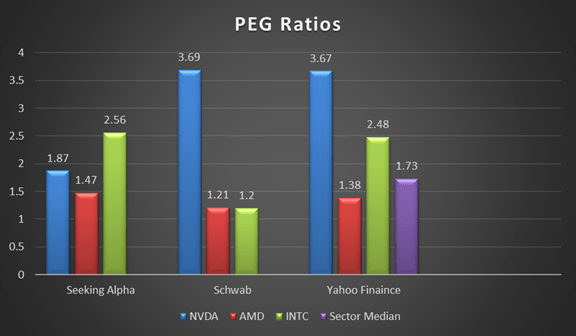

Next, I’m using a graph to provide PEG ratios for the three companies. As there can be fairly wide variations in PEG ratios due to analysts’ inputs, I prefer that readers have access to multiple sources when I find wide variance in the ratio.

Note that Seeking Alpha provides a three to five-year PEG, Schwab simply lists its metric as a PEG ratio, while Yahoo! Finance calculates a five-year ratio. This could explain some of the variance in the numbers provided.

Perusing the first chart, it is obvious that NVDA is the most overvalued. It is also interesting to note that in the current P/E and the forward price/cash flow estimates show AMD as valued near the sector median.

Count me as an investor that places great emphasis on a stocks PEG Ratio. Viewing the second chart, AMD has the best PEG of the three companies. I also note that analysts from each source calculated AMD’s PEG ratio as better than the sector median.

Do not misinterpret my findings. While INTC has a lower valuation in many respects, when considering other factors, I rate AMD higher overall. In other words, it is not the cheapest valuation but the best valuation, for lack of a better means to articulate my view.

=Advantage AMD

Analysts’ Price Targets

NVIDIA shares currently trade for $202.95. The average 12-month price target of 33 analysts is $186.49. The average price target of the 17 analysts that rated the stock following the latest earnings report is $210.53, about 3.7% above the current price of the stock.

AMD shares currently trade for $107.58. The average 12-month price target of 28 analysts is $108.56. The average price target of the 11 analysts that rated the stock following the latest earnings report is $117.27, roughly 9% above the prevailing share price.

Intel shares currently trade for $54.05. The average 12-month price target of 34 analysts is $59.86. The average price target of the 16 analysts that rated the stock following the latest earnings report is $58.97, a 9% premium over the current share price.

Investors should be aware that it has been nearly three months since NVDA posted quarterly earnings while INTC and AMD reported recently.

=Tie AMD/INTC

Growth Rates

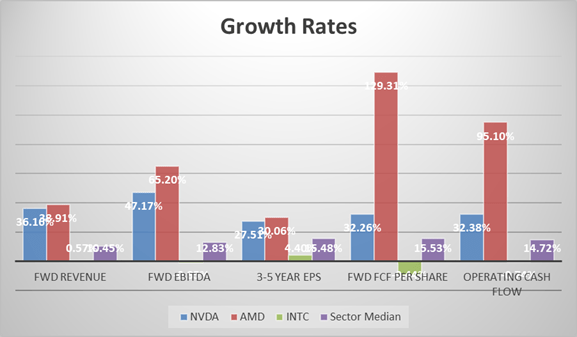

The next chart provides data for growth rates. Unless otherwise noted, the metrics reflect analysts' average two-year forecasts.

While investors familiar with these three companies would expect INTC to perform poorly in relation to NVDA and AMD in regarding growth, in several cases Intel is projected to experience negative growth rates.

Advanced Micro Devices projected growth leads that of NVIDIA in every category, and at times by very wide margins.

=Advantage AMD

I considered providing a chart outlining the profitability of each company; however, suffice it to say that each is highly profitable, and that a juxtaposition of the three would result in a tie.

I often provide a comparison that breaks down dividend metrics, but AMD does not pay a dividend, and NVDA has an anemic yield. INTC currently yields about 2.6%. The dividend is well funded.

Debt Metrics

NVIDIA had $12.67 billion in cash and $5.96 billion at the end of the last quarter. Should the ARM acquisition meet approval, the deal is structured so that $21 billion of the $40 billion purchase price will be in stock.

AMD has restructured its debt resulting in reduced interest costs. AMD had about $3.8 billion in cash and $313 million in long-term debt at the end of the most recent quarter.

Intel's has solid investment-grade credit ratings. The company held nearly $24.86 billion cash at the end of the last quarter and had $31.7 billion long-term debt.

All three firms have strong financial positions. Weighing the possibility that NVDA and AMD may add debt due to prospective acquisitions, I am rating the three firms as equals.

R&D Budgets

This is the first time I have compared the R&D budgets of companies for a head-to-head showdown. However, in the semiconductor industry, that can be of pivotal importance.

Last fiscal year, Intel devoted over $13.5 billion to R&D, NVDA spent nearly $2.83 billion, and AMD budgeted a bit over $1.9 billion on research and development.

AMD is at a clear disadvantage, and that weakness is magnified because it often competes against INTC and NVDA in different arenas. It should be noted that a portion of Intel’s R&D is funneled to its foundry business. Nevertheless, it is the clear winner here, and AMD is the obvious loser.

I should add that NVDA is chipping away at AMD’s share of the discrete GPU market, and I believe that trend will continue, in part due to the disparity in R&D budgets.

=Advantage INTC

Bottom Line: Which Is The Best Chip Stock?

To arrive at an answer, much depends on whether NVIDIA can complete its acquisition of ARM.

Because ARM processors are more power and cost-efficient than x86 chips, NVDA could gain market share in the data center space. Since around a third of Intel’s revenue flows from data centers, that could represent a headwind for INTC and a positive for NVDA. However, there is a good chance the deal will fail to close.

The degree of success Intel finds as its planned foundries come online is another factor that should be weighed.

A development to be weighed is that AMD has now reached parity with INTC in the PC market in terms of the quality of its products. Furthermore, AMD is gaining market share in the server market, and I expect that trend to continue.

On the other hand, AMD is losing share in the discrete GPU market to NVDA. NVDA has a technological lead in that space which will probably continue.

While AMD and NVDA are seen as growth machines, one should not ignore that Intel’s Internet of Things business increased by 47% in the last quarter. Mobileye also saw a surge in growth with revenue increasing 124%. Although these businesses only totaled $1.3 billion in revenue, a fraction of Intel's total revenue of $18.5 billion, they still represent areas of high growth.

However, note the header refers to “chip stock.” Consequently, technological advantages are but one part of the puzzle. Any investment decision must take current valuations and prospective growth rates into account.

With that in mind, I must rate NVIDIA as a HOLD due to current valuation and growth estimates. Note my rating is based on the current valuation of the stock. I acknowledge the exemplary leadership of the company and believe the long-term prospect for the stock is excellent.

I also rate INTC as a HOLD. I previously rated the company as a buy. While I still believe the firm will serve long-term investors well, I now believe its recovery will unfold over a long time span, and better opportunities are available.

I rate AMD as a BUY. This is based on the current valuations and growth rates outlined in this article. I’ll add that those metrics are buttressed by my perception that as Intel works on its recovery, AMD is likely to chip away at market share.

For additional insights into the technological aspects of an investment in AMD and INTC, I recommend an excellent article by SA contributor Keyanoush Razavidinani.

精彩评论