Earnings season is still going strong, with all its idiosyncrasies front and center. Generally stable stocks can go through a bout of volatility—and high-growth ones, by their very nature more unpredictable, can really spike or slump depending on the numbers.

Netflix(ticker: NFLX) stock stumbled in April after its subscriber growth figures missed the mark.Walt Disney (DIS) was the latest example. Investors cared more about disappointing user figures for Disney+ than the earnings beat. Then there are companies like smart-speaker maker Sonos (SONO), which has made a habit of double-digit moves in recent quarters as analysts struggled to size up its sales prospects.

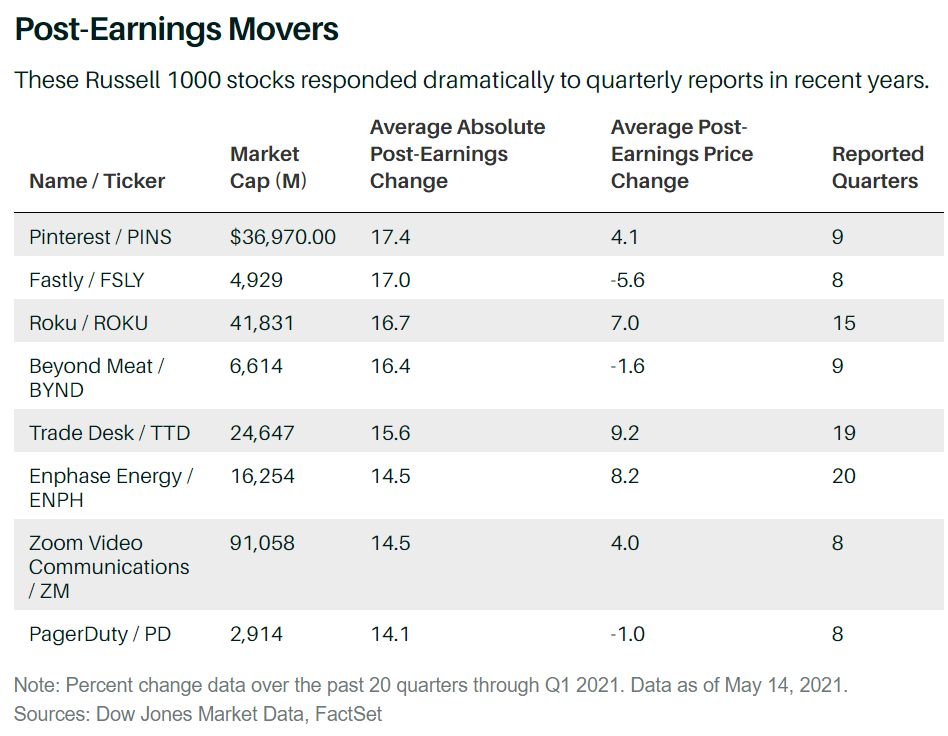

These earnings quirks got us thinking about which companies are most likely to pop up—or down—after reporting results. Using FactSet and Dow Jones Market Data, we screened for Russell 1000 firms that have reported at least eight quarters of results within the past five years. Then we looked for the average absolute post-earnings percentage changes in that time frame. We found eight stocks that do the dance.

Of the eight, a few things stand out. First, although we limited the screen to companies with at least two years of results, only one—solar-solutions designer and maker Enphase Energy(ENPH)—has been public for all of the five years we looked at.

Newly public companies also often have the wildest post-earnings moves because analysts are still learning how to size them up. Without a track record of delivering, or missing, on guidance figures, there’s more room for error. Analysts, who form the consensus estimates, are still learning the companies—and their peculiarities. Covid-19 has added another wrinkle since many companies withdrew guidance last year because of all the economic disruptions.

Most of these companies—social media and stay-at-home—fit into the broader pandemic trade, surging in the past year. But analysts have been debating whether the gains are sustainable, so it makes sense that any forward-looking indicators on earnings reports could send a stock flying or falling.

Pinterest (PINS), the social networking service, leads the pack with an absolute average post-earnings percentage change of 17.4. Its shares were hammered last month despite the company’s earnings and revenue figures topping consensus estimates. Analysts were disappointed by user-growth figures. Still, the stock has averaged a gain of 4.1% with nine reported quarters as a public company.

Beyond Meat (BYND) has been a poster child for Wall Street’s struggles in sizing up high-growth firms. And it has experienced its fair share of short squeezes since going public in 2019. The stock’s dramatic post-IPO rise drew a horde of short-sellers, who bet on a price decline. Such bearish sentiment has backfired a few times, leaving such analysts rushing to buy shares to cover their bets.

Fastly (FSLY) is another casualty of this spring’s earnings season. The stock plunged after reporting results, but has proven volatile since going public two years ago. It’s the worst performer of the group, averaging a drop of 5.6%.

Trade Desk (TTD) and Enphase Energy have locked in the biggest average gains at 9.2% and 8.2%, respectively. That’s despite Trade Desk shares sinking on earnings earlier this month.PagerDuty (PD) has averaged a decline of 1% after reporting results.

Other pandemic standouts Roku (ROKU) and Zoom Video Communications (ZM) also crack the top eight, at third and seventh, respectively. The latter is set to report fiscal first-quarter results on June 1. Investors may want to buckle in if history is any guide.

精彩评论