Summary

- 2022 promises to be another exciting year for investors.

- Diversity is the name of the game, and these long-term picks could provide market-beating returns for years to come.

- Happy New Year, everyone!

What Are The Best Long-Term Stocks For 2022?

A new year will bring new challenges and opportunities for investors. Inflation, interest rates, bubbles, COVID-19 variants, the FTC, new technologies, transformative companies, record buybacks, high yields, and other variables promise to make this an exciting time. With this in mind, diversity is an integral part of a well-rounded portfolio for long-term investors. For this reason, I have chosen three picks from different baskets and include a rock-solid REIT pick, VICI Properties (VICI), a Big Tech pick, Alphabet (GOOG/GOOGL), and a dividend stalwart selection, AbbVie (ABBV).

VICI Properties

VICI is a real estate investment trust (REIT) with properties dedicated to gaming and entertainment. It has properties nationwide, including on the Las Vegas Strip. VICI was initially formed as a spinoff of Caesars Entertainment (CZR) in 2017. More than 30% of its current exposure is to the Las Vegas Strip, and this will increase with the acquisition of MGM Growth Properties (MGP).

Banks in the U.S. are required to undergo stress tests if they meet specific requirements. These tests are designed to ensure that they can function in the case of a financial calamity. VICI went through its own ultimate stress test in the Spring of 2020 and passed with flying colors. The entire Las Vegas Strip was shut for a period, and properties around the country were also profoundly affected. VICI's share price cratered during this time.

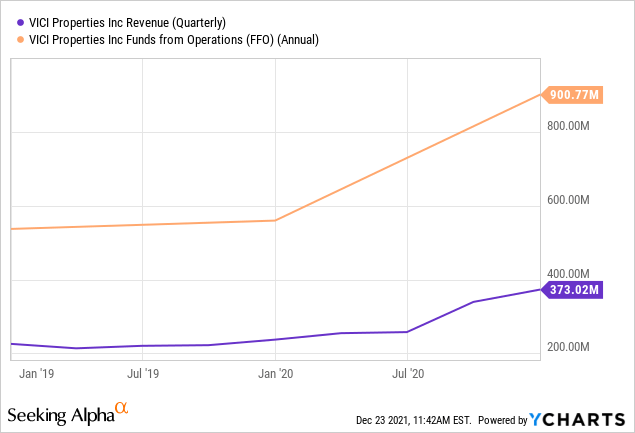

The company's revenue, however, actually went up. The adjusted funds from operations also increased in 2020.

Looking at the chart above, one would never suspect a calamity in gaming was going on during this time. VICI actually increased the dividend in Q2 2020.

VICI is currently yielding a very safe 5%. The dividend has just been raised in Q3 2021 from $0.33 quarterly per share to $0.36. VICI has raised the dividend each year since its inception, and this should continue. VICI reports that 97% of its long-term rental agreements include escalators tied to inflation. When the consumer price index (CPI) rises, so do the rents. In this way, VICI is a 5% yielding inflation hedge with a rising dividend and accretive acquisition closing soon. In short, an excellent pick for long-term investors.

Google is growing revenues prolifically and across multiple segments. The company had a brilliant 2021, and this momentum should carry on into 2022.

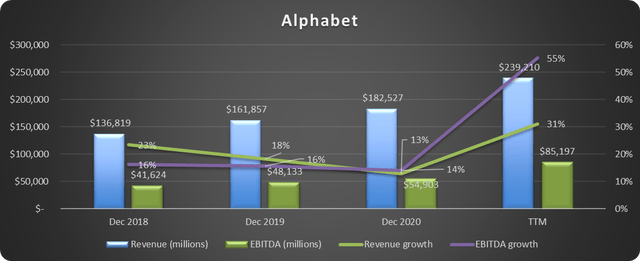

As shown, revenue over the trailing twelve months (TTMs) has reached $239 billion, easily surpassing fiscal 2020 revenue of $183 billion. Growth slowed a bit in 2020 as advertisers cut back on spending; however, this came roaring back in 2021.

In addition, margins are increasing.

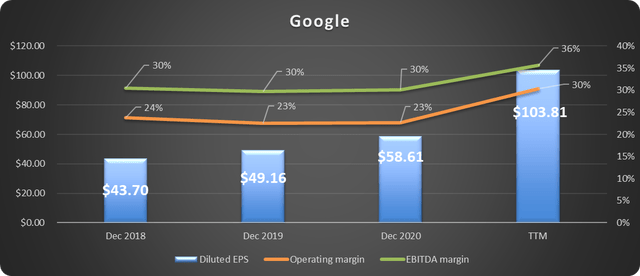

Over the TTMs, Google has posted an EBITDA margin of 36%. This is excellent profitability. Much of this can be attributed to increased revenue for cloud services and YouTube. These segments have substantial expansion potential and should serve long-term investors well. News of the FTC cracking down on AWS could be welcome news to Google shareholders.

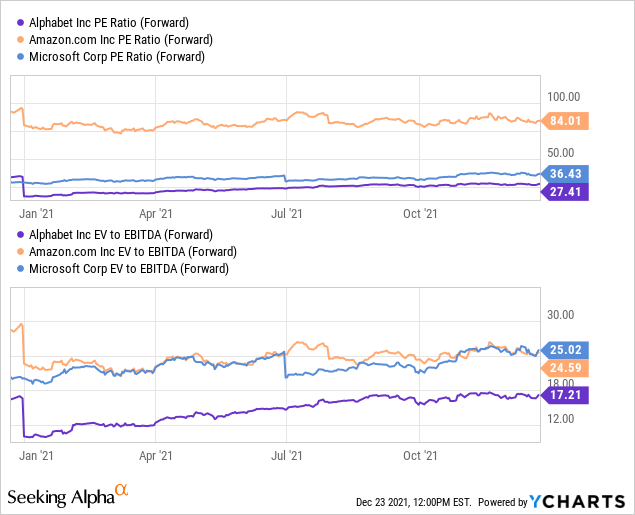

Google also has some of the best valuation metrics of the Big Tech giants, as shown below.

AbbVie

AbbVie has been an excellent dividend growth stock for many years, and this is likely to continue. Because of the concerns over the Humira franchise patent cliffs, and other potential legislation regarding drug prices, AbbVie often trades at a discount. Investors who watch for dips can be rewarded handsomely. I discussed this in further detail in this previous article.

Biosimilars for Humira are coming to U.S. markets in 2023. This will likely cut the revenues AbbVie receives from Humira in half in the first year, judging by the results of introducing biosimilars in Europe. AbbVie has made several moves to get ahead of this in recent periods, including developing new drugs, expanding treatment options for existing drugs, and expanding the product line through acquisition. Examples include Rinvoq and the Allergan acquisition. As of Q1 2020, Humira made up over 54% of all revenue for AbbVie. This was down to 36% by Q2 2021, while total revenue rose considerably.

AbbVie's dividend is safe, with a payout ratio below 50%. It has also been raised for eight consecutive years. The five-year dividend growth rate is near 18%. This makes AbbVie an excellent pick for long-term dividend growth investors.

Bottom Line

VICI, Google, and AbbVie are stellar companies with extremely positive long-term potential. Each provides an investor's portfolio with different exposure and different potential. VICI is a tested gaming giant with a rising dividend and inflation protection. Google is as solid as they come with much upside and more limited risk than some in Big Tech due to the lower valuation. AbbVie is a dividend-producing machine where investors can snag a higher yield based on moderate risks. The three combined can be part of the bedrock of a well-rounded investment portfolio.

精彩评论