Apple stock has just made all-time highs, but one Wall Street bull thinks that shares can climb another 25% in the next year. Is this a reasonable expectation?

Apple stock made new all-time highs in November. On Monday, I argued that Apple has become an expert at dominating and reshaping the consumer tech markets in which it operates. In part for this reason, AAPL shares look like a buy to me, even at a historical peak price of $160.

That said, Tigress Financial’s Ivan Feinseth has recentlyseta new Street-high share price target of nearly $200. At those levels, AAPL would present about 25% gain potential over the next 12 months. Is this a reasonable expectation? Might it even be too conservative a number?

What AAPL at $200 means

From a P/E perspective, Apple’s next-year valuation multiple would need to expand to 32.8 times for the stock to climb 25% from here and reach $200 apiece by this time in 2022. For reference, the comparable forward multiple today is only 28.2 times. Forward P/E only climbed well into the 30s recently in late August 2020, moments before AAPL corrected sharply into the end of Q3.

All the above, of course, assumes that consensus 2023 EPS of $6.09 remains unchanged. Apple stock could also head to $200, maybe even without any valuation expansion, if the company manages to deliver consensus-beating results in the next few quarters. This could happen as a result of strong iPhone sales in the holiday quarter, for example.

What history says

History does not always repeat, but it often rhymes. From that point of view, Apple’s 25% climb in 12 months seems a bit more unlikely, considering that AAPL currently sits at an all-time high.

The Apple Maven has explained that an investment in Apple stock tends to offer the highest return in the following 12 months if shares are bought during a steep drawdown. On average, one-year gains have been nearly 50% when the stock was bought after a 30%-plus decline from the top.

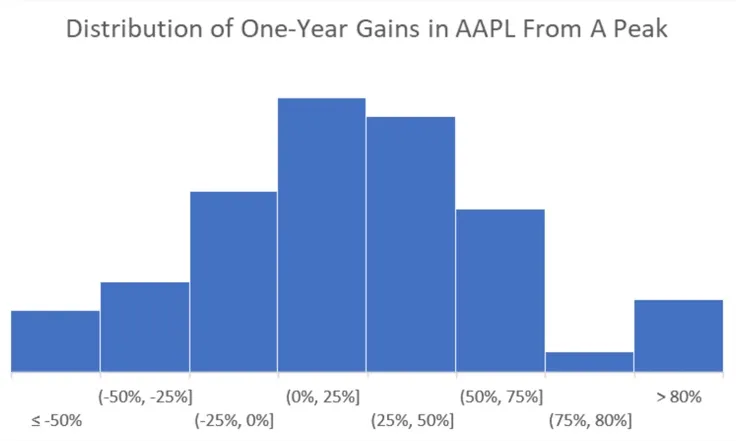

Instead, if an investor bought AAPL only at all-time highs since the launch of the first iPhone in 2007 and held shares for exactly one year, his or her average return would have been “only” 19%. Gains of 25% or more, however, have not been all that rare, as the histogram below illustrates.

The Apple Maven’s take

I continue to think that AAPL is a great buy-and-hold play at $160 per share. However, earning 25% from an all-time high is no easy feat, even though it has happened before.

I would not necessarily count on Apple stock generating stratospheric returns in the next 12 months or so. The odds are against it happening from a peak price, especially after shares managed to produce gains of 140% in the past 24 months alone. But more modest, still market-beating gains are certainly not out of question, considering the robust business fundamentals.

精彩评论