- Cathie Wood's flagship ARK Innovation ETF(NYSEARCA:ARKK)experiences its most significant one day of capital outflows in 10-months dating back to Mar. of 2021. ARKK experienced $352M exit the door on Wednesday, and over $500M leave the fund over the last two days per Bloomberg data.

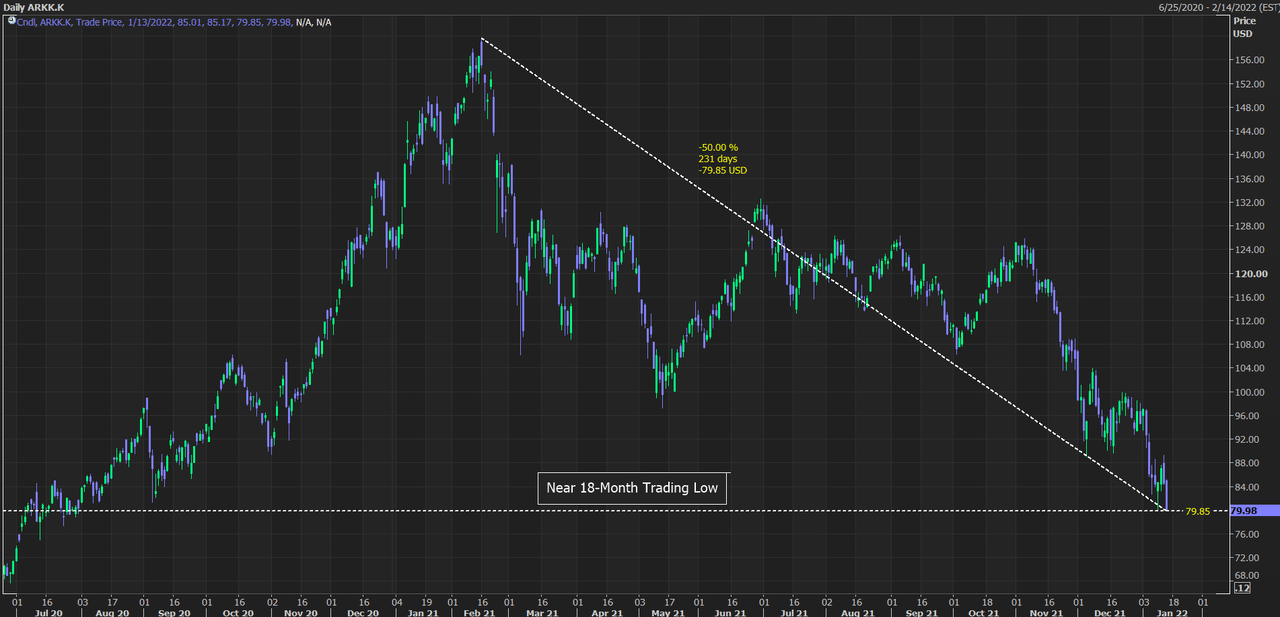

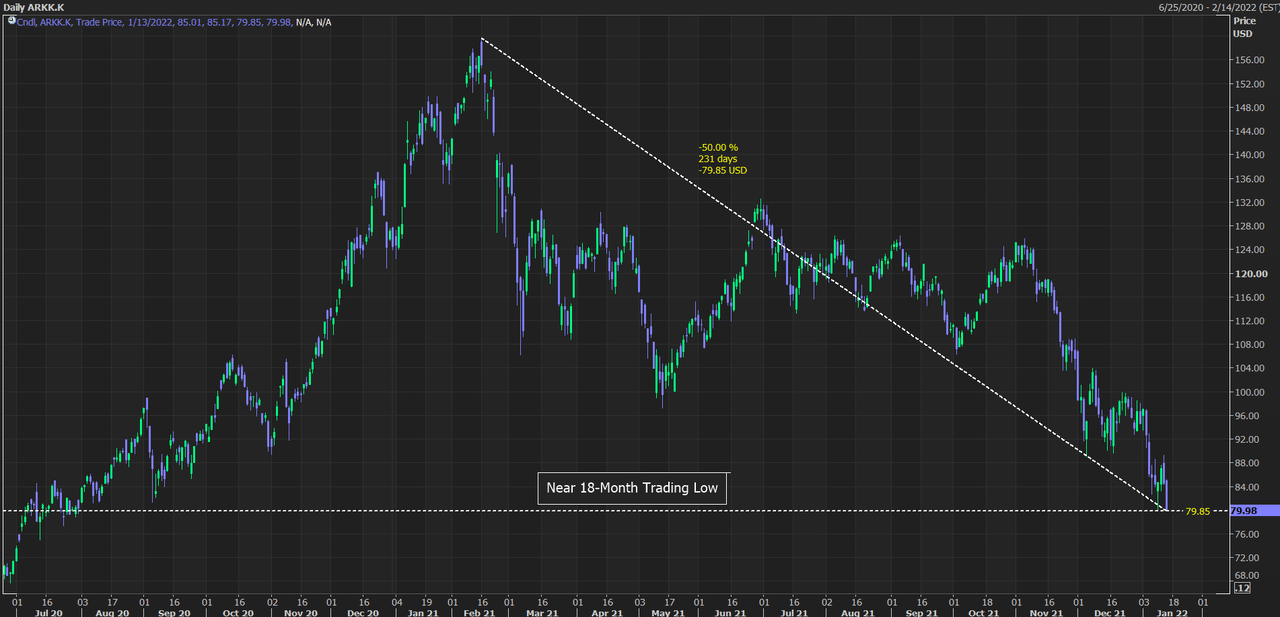

- ARKK is also approaching an 18-month trading low as the ETF trades at $79.90 a share. Moreover, the innovation fund is also50%off its all-time trading peak, which took place on Feb. 16. See below chart.

- ARKK also finds itself down16.8%in 2022, which is quite a step down when comparing the exchange traded fund to the benchmark Vanguard S&P 500 ETF(NYSEARCA:VOO), which is-2.17%and tracks the S&P 500.

- Not supporting ARKK are some of its key holdings, such as Zoom Video Communications(NASDAQ:ZM), which is ARKK's second-heaviest holding at 6.40%. ZM is currently sitting at a near 20-month low and down55.5%over the last year.

- Moreover, ROKU Inc.(NASDAQ:ROKU), the fund's fourth-largest weighted stock at 5.94%, is at a 16-month trading low and down58.8%over a one-year time frame.

- Teladoc Health(NYSE:TDOC)ARKK's third-largest holding at 6.17% touched a near 25-month low earlier this week on Monday and is down66.1%over the past year.

- Selling pressure remains strong for ARKK. Vincent Deluard, global macro strategist at StoneX, stated: "The median ARKK holding has lost 55% since its 52-week high... if insiders are not buying now,why should investors?"

免责声明:本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性做出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任。

精彩评论