Although currently AMC Entertainment stock(AMC) is far from where its investors would like it to be, its year-to-date performance has been overwhelming: up more than 1,500% in 2021.

Of course, it certainly helped that the stock was a discussion board darling. Its “meme stock” status on Reddit, social media, and all over the internet in general helped AMC’s stock performance beat those of even the Big Techs and Tesla (TSLA).

Provoked by institutional investors shorting AMC’s stock, the “Ape Army” fought back this year, bringing AMC to new highs. Among the ranks were brand-new investors who took to Google to find out more about the stock.

Let’s take a look at just how popular AMC has been on Google this year.

AMC is the most googled stock

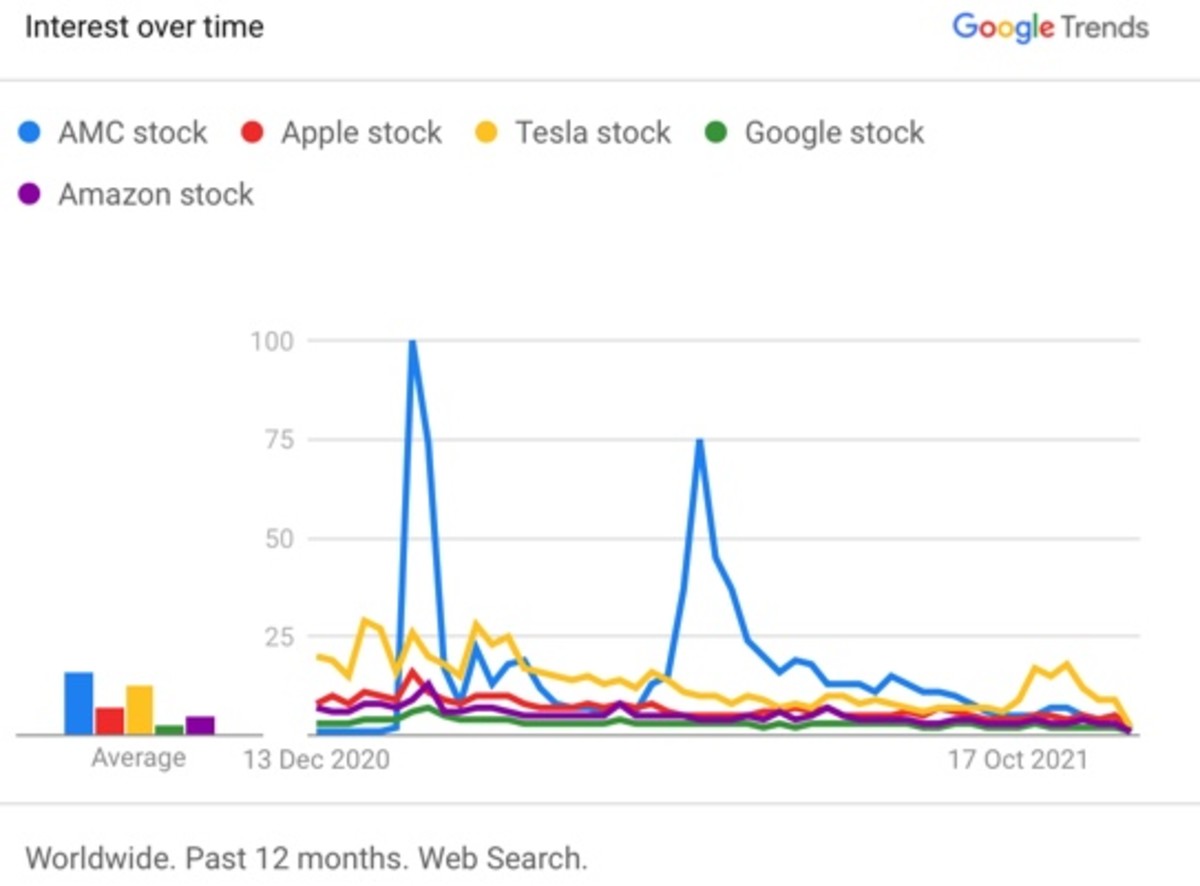

“AMC stock” has been the most googled stock-related term of 2021.

Take a look at this chart, which compares the term’s search volume versus Apple, Tesla, Google, and Amazon – some tech heavy-hitters for sure.

As you can see, AMC had two big spikes in Google popularity during the year. These correspond to high-volume activity in the stock as individual investors piled in.

AMC’s current momentum

AMC is still 26% down from its mid-September peaks, when the stock reached higher than $50 per share.

Since then, the stock has faced extreme market volatility and a slowdown in popularity on the major discussion forums.

We can assign the latest decline to concerns over the Omicron variant of COVID-19. Investors are worried that worldwide lockdowns might take effect if the rapidly spreading strain isn’t controlled.

Theoretically, AMC has a negative beta. This means it should trade in the opposite direction of the broader market. Negative beta stocks can be used as a safe haven during times of market turmoil.

However, as we’ve seen with Omicron, AMC has lately started following market trends. The entire entertainment industry has been rattled by variant fears, leading to wilder-than-normal volatility.

Will AMC flip to a positive beta stock and no longer provide investors with a market hedge? We’ll have to wait and see.

Our take

Although AMC’s stock has recently fallen, the meme stock’s popularity might be able to lift it again, just as it has several times before.

Investors should keep an eye out for shorting activity, which could send the AMC “Ape Army” to the battlefront again.

精彩评论