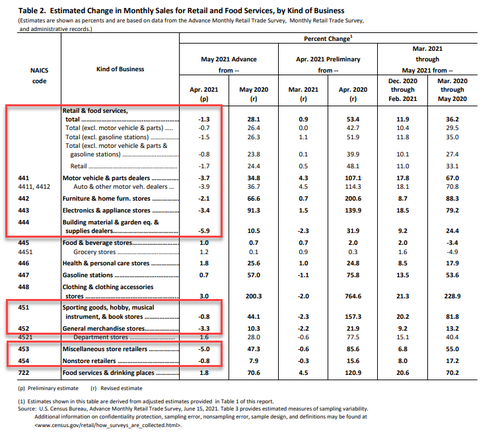

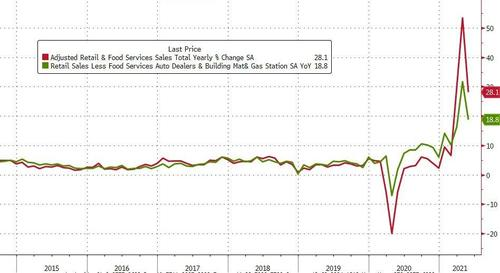

With a lack of stimmies to keep the spending dream alive, analysts expected a 0.8% MoM plunge in retail sales (confirming BofA's recent perfect streak of predictions), but the data was even worse, tumbling 1.3% MoM...

Given the expected impact of autos from the chip shortage,a "cleaner" number of the Ex-Autos print which was also a disaster,tumbling 0.7% MoM (much worse than the 0.4% improvement expected)

BofA's forecasts nailed it again:

- BofA said retail headline -1.4%, came in at -1.4%

- BofA said retail ex auto -0.6%, came in at -0.7%

Building Materials saw the biggest drop, along with Motor Vehicles (as noted above). Nonstore retailers (online) also saw a decline in sales...

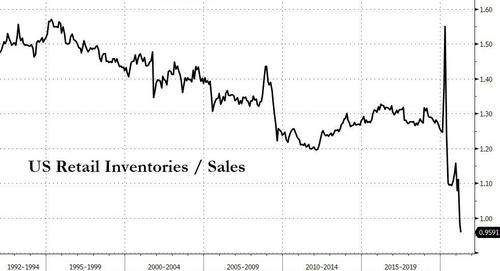

Finally, we note that retail inventories (supply) has reached a record low relative to retail sales (demand)...

How will The Fed interpret this? Transitory supply distress?

精彩评论