With an eye on momentum catalysts, short interest, and popularity, we picked two meme stocks that are worth watching through at least the end of 2021.

Trading meme stocks is a high-risk high-reward proposition, as it’s quite difficult to know when momentum starts and ends. Monitoring major discussion forums to identify potential highflyers is a strategy that can sometimes yield impressive results.

With a focus on stocks’ popularity, elevated short interest, and imminent broad market catalysts, we’ve landed on two “meme” stocks to watch until at least New Year’s Eve: Vinco Venturers(BBIG) and Ocugen(OCGN).

#1. Vinco Ventures — $BBIG

Fairport, NY-based Vinco Ventures (BBIG) operates thirteen consumer and digital marketing brands, including The 911 Help Now, Global Clean Solution, and Ferguson Containers. The company’s business model is based on “aggressive acquisitions.” Shares are up nearly 25% since early December – most of this rise may stem from Vinco Ventures’ deal to sell warrants to an institutional investor.

Looking a bit further back, in September, Vinco Ventures announced a joint venture with Zash Global Media to acquire Lomotif, a TikTok-style social media platform that is very popular in India. Lomotif, through its subsidiary Emmersive Entertainment, also recently launched a platform for music streaming and NFT’s.

After the acquisition announcement, Vinco Ventures stock’s popularity started skyrocketing on popular discussion boards, and the stock’s price grew a whopping 268% over ten trading days, from August 26 to September 9.

Another catalyst for BBIG’s astronomical rise is that the company has been the target of many short sellers; roughly 20% of the company's float is currently shorted.

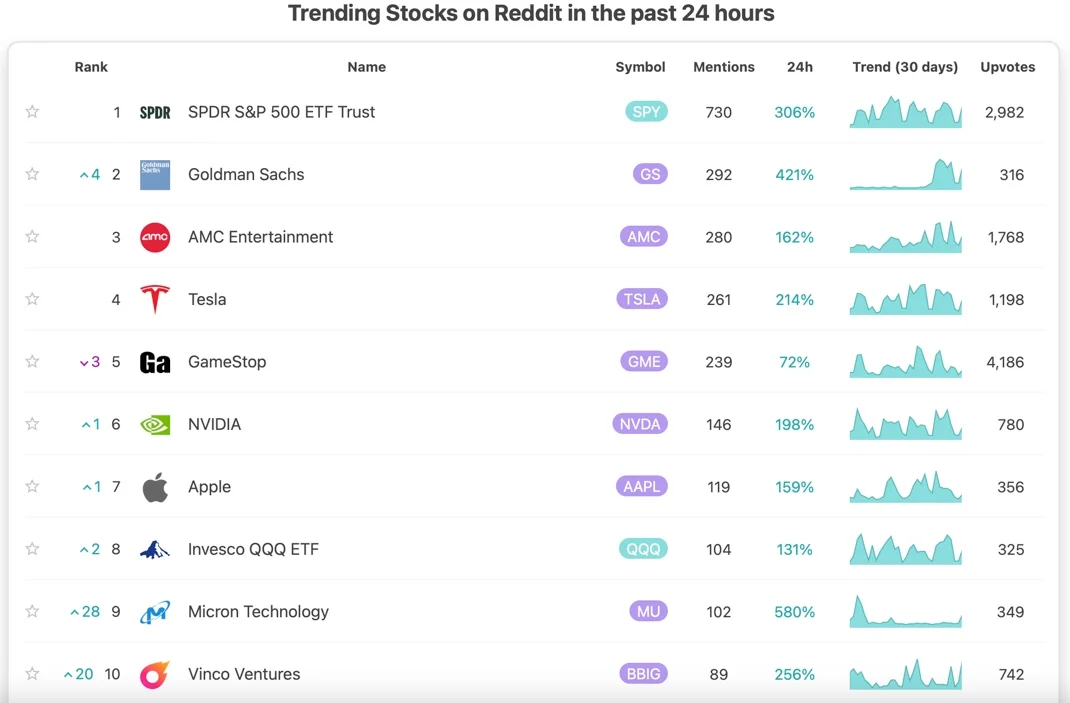

A combination of these factors lead to BBIG becoming a meme stock, and it continues to trend in discussions on major Reddit forums (see below).

#2. Ocugen — $OCGN

Biopharmaceutical company Ocugen, which focuses mainly on gene therapies to cure diseases that cause blindness, has had its ticker trend multiple times since the beginning of October.

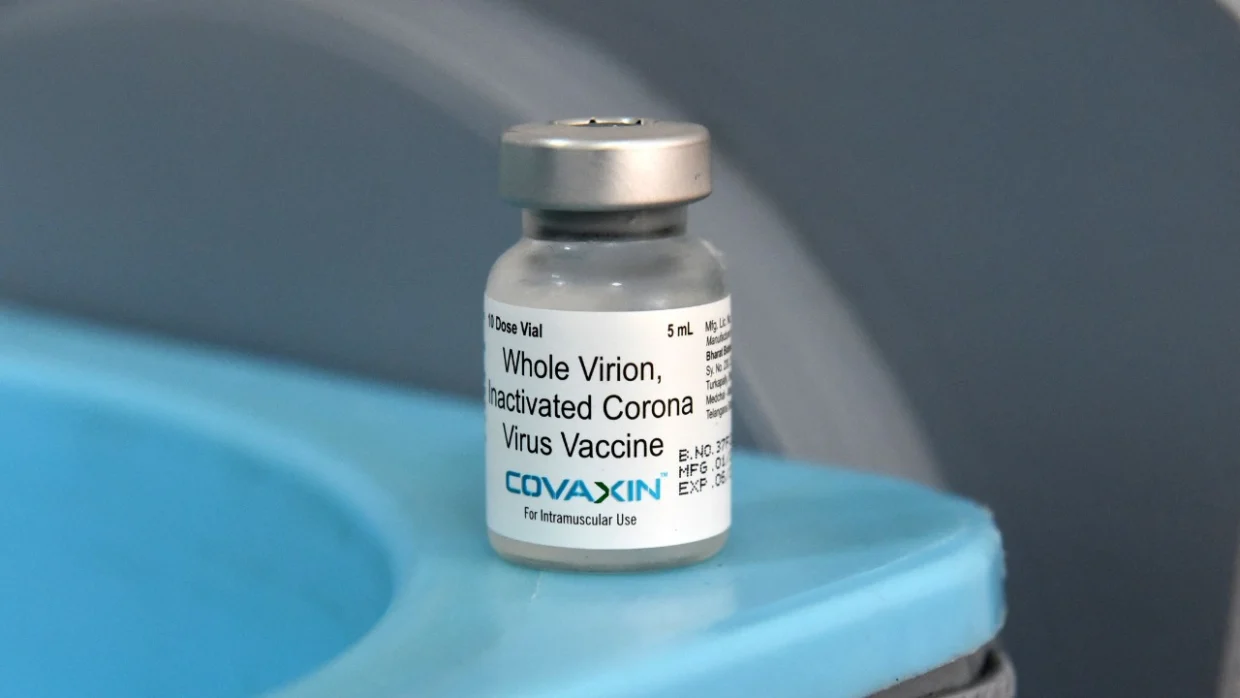

The company has become a meme focus, even though it is currently 70% off its early-November peaks. The most likely catalyst behind the price surge is the anticipated World Health Organization’s approval of a COVID-19 vaccine called Covaxin.

Ocugen is a co-development partner with Bharat Biotech on the vaccine, and it holds the rights to commercialize Covaxin in North America.Stage-3 results showed the drug to be efficient against the Delta variant, which will be helpful during the approval process.

However, the vaccine’s efficacy against the Omicron variant is still a big unknown. Ocugen plans on releasing its own study on the vaccine’s efficiency against the new variant as soon as the work has been completed.

Meanwhile, the stock remains a bear target. OCGN has 56 million shares shorted, representing a whopping 25% of the float. While heavy shorting signals skepticism and caution, it can also set up shares for a short squeeze, which could be triggered by massive buy volumes.

Eventual vaccine approval and a proven efficiency against the Omicron variant could be the catalyst that sparks just that type of bullish short-term activity.

精彩评论