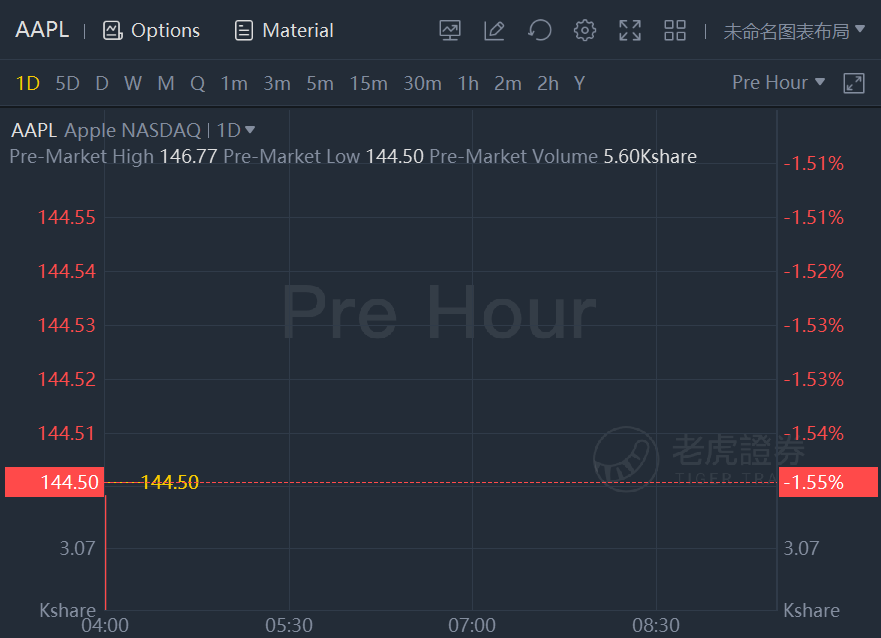

Apple shares fell 1.5% in premarket trading.

CFO suggests that sales growth will slow overall and in the hot services sector, sending shares lower in after-hours trading despite stunning beat in earnings and iPhone sales

Apple Inc.’s whopping fiscal third quarter was overshadowed by the company’s forecast for slowing growth Tuesday, putting a damper on its record results and sending shares south.

Apple reported its strongest June quarter ever on Tuesday, with a near doubling of its profits and a whopping iPhone beat— iPhone revenue surpassed Wall Street’s expectations by a stunning $5 billion. But the celebration came to a crashing halt when Apple Chief Financial Officer Luca Maestri said in a conference call that the company’s revenue growth would slow in the current quarter due to foreign exchange rates, the semiconductor shortage and tougher comparisons with the previous year.

“We expect very strong double-digit year-over-year revenue growth during the September quarter,” Maestri said, while continuing to avoid exact revenue guidance due to uncertainty related to the COVID-19 pandemic. “We expect revenue growth to be lower than our June quarter year-over-year growth of 36%.”

Apple’s shares had gained in after-hours trading to that point, but immediately fell back and ultimately ended the extended trading session with a 2% decline.

Beyond overall revenue, Maestri also warned about one of Apple’s hottest businesses and declined to give any hints about prolonged declines in sales growth.

“We expect our services growth rate to return to a more typical level,” Maestri said, referring to Apple’s services business, which reached record-high revenue in the quarter by growing 33% to $17.5 billion.

That growth rate also benefited from a favorable comparison as certain services were significantly impacted by the very beginning of the COVID-19 lockdowns a year ago, he added.

“We expect significant growth in services, but not to the level that we’ve seen in June,” he said in response to a question about the company’s guidance.

When asked about the upcoming holiday period, and whether the semiconductor and component shortage would have an impact on what is typically Apple’s biggest quarter, Maestri said he only wanted to talk about one quarter at a time. Some analysts have already been wondering if the second half of this year is going to be as strong as the first half among tech companies, especially the tech giants, and Apple’s June quarter seemed to be reflective of those fears.

While it seems ridiculous to see shares decline after reporting such a mind-blowing quarter — iPhone total revenue alone was nearly $40 billion and Chief Executive Tim Cook said that 5G penetration is still “very very low, and so we feel really good about the future of the iPhone” — concerns that we are at a peak for tech are valid. And as the delta variant continues to create uncertainty about the path of the COVID-19 pandemic, there is even more uncertainty ahead

As Cook phrased it Tuesday, “the road to recovery will be a winding one.”

精彩评论