The active ETF manager got a big break from Wall Street.

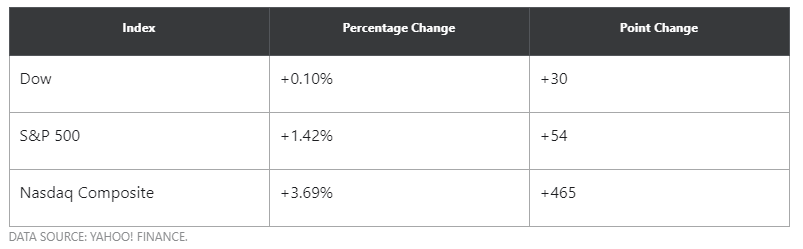

The stock market soared on Tuesday, making back lost ground from what's been a tough couple of weeks for many investors, especially those focusing on the high-growth stocks in theNasdaq Composite(NASDAQINDEX:^IXIC). The Nasdaq managed to outpace both theS&P 500(SNPINDEX:^GSPC)and theDow Jones Industrial Average(DJINDICES:^DJI), but all three finished higher, and the Dow set a new intraday record high before falling back from its best levels of the session.

Squaring up

Square(NYSE:SQ)is Wood's largest holding in herARK Fintech Innovation ETF(NYSEMKT:ARKF). Square had been down more than 25% from its recent highs just last month, but the stock picked up ground with an 12% rise on Tuesday.

The case for Square's core electronic payments network is sound and easy to understand. The company has worked hard to bring key financial services to businesses of all sizes. Wood also likes how Square has embraced cryptocurrencies rather than shying away from their potential application as disruptors to traditional payment systems.

Strategic moves likeSquare's recent purchase of Tidal, however, take a little more explanation. Square CEO Jack Dorsey believes there's growth potential in creating an ecosystem that resonates with the artist community. It's unclear how that'll play out, but it shows the company's willingness to take risks in surprising directions.

Looking healthier

Meanwhile, in theARK Genomic Revolution ETF(NYSEMKT:ARKG), you'll findTeladoc Health(NYSE:TDOC)as the biggest holding. Teladoc had taken an even bigger hit, falling about 40% from its highs last month. But Tuesday brought relief in the form of a 9% gain to make back some of those losses.

Investors have been increasingly wary about stocks that benefited from the stay-at-home mandates of the COVID-19 pandemic. Teladoc went from being a convenience to a necessity during the pandemic, and patients got their first look at what remote medicine might actually look like. Some fear that when the coronavirus crisis is under control, people will simply go back to the old way of doing things andhurt Teladoc's growth.

That's certainly possible, but the counterargument is that having seen how good remote health services can be, patients might choose to keep using them even when they don't absolutely have to. That makes a share price that's well off its highs look much more attractive, offering a margin of safety for the bull case for Teladoc.

Revving its engines

Finally, Tesla(NASDAQ:TSLA) is by far Wood's favorite stock, as it's the top holding in three different ARK Invest funds.ARK Next Generation Internet ETF(NYSEMKT:ARKW),ARK Autonomous Technology & Robotics ETF(NYSEMKT:ARKQ), and the landmarkARK Innovation ETF(NYSEMKT:ARKK)all have Tesla prominently featured, with as much as 10% of fund assets in the electric automaker's stock. Tesla shares had been down roughly 35% at their worst levels, but a nearly 20% rise on Tuesday added a full $110 back to the stock price.

One source of optimism about Teslacame from Wall Street analysts. Wedbush issued a new price target of $950 per share, which represented a nearly 70% rise from Monday's closing price of $563. Analyst company New Street upgraded the stock to buy from neutral, setting a $900 price target. Both see good things for the automaker in the next few years, including higher deliveries and opportunities in big markets like China.

Tesla promises to remain volatile for the foreseeable future. Yet Wood sees Tesla at the forefront of key technological advances in autonomous driving and energy storage, and that could keep interest in the automaker's stock high for a long time.

Getting back on track

Obviously, one day doesn't say anything about the long-term direction of any investment, and today's gains didn't claw back all the losses that these three stocks have suffered in recent weeks. Nevertheless, Tuesday's bounce does show that investors still have confidence in the companies that made it into Wood's portfolio, and many fully expect further increases in share prices for Square, Teladoc, and Tesla far into the future.

精彩评论