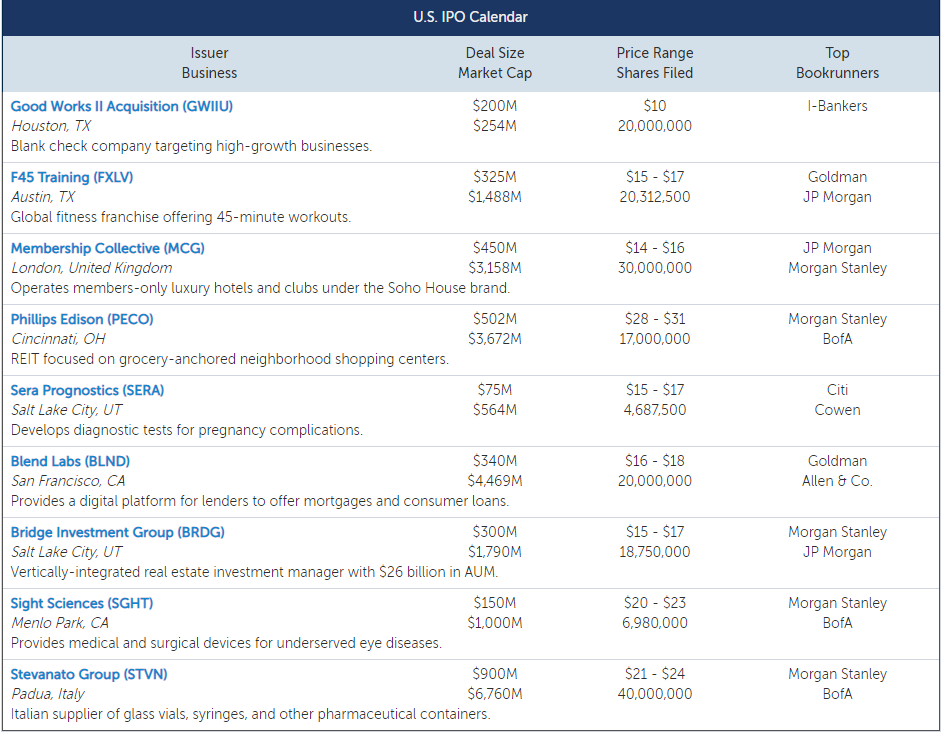

After a slow holiday week, nine IPOs are scheduled to raise over $3 billion in the week ahead.

Italian drug container supplier Stevanato Group(STVN) plans to raise $900 million at a $6.8 billion market cap. Controlled by its founding family, the profitable company supplies glass vials, syringes, and other medical-grade containers to more than 700 customers, including 41 of the top 50 pharmaceutical companies.

Shopping center REIT Phillips Edison & Company(PECO) plans to raise $502 million at a $3.7 billion market cap. This REIT owns equity interests in 300 shopping centers across the US, focusing on locations that are anchored by grocers like Kroger and Public. It targets a 3.5% annualized yield at the midpoint.

Known for its member-only luxury hotel brand Soho House,Membership Collective Group(MCG) plans to raise $450 at a $3.2 billion market cap. The company boasts a large and loyal member base, though it has no track record of profitability and saw revenue fall by almost half in the 1Q21.

Mark Wahlberg-backed fitness franchise F45 Training(FXLV) plans to raise $325 million at a $1.5 billion market cap. Specializing in 45-minute workouts, F45 has over 1,500 studios worldwide. The company managed a 37% EBITDA in the trailing 12 months, though the company’s expected post-pandemic growth has yet to show through in the numbers.

Mortgage software provider Blend Labs(BLND) plans to raise $340 million at a $4.5 billion market cap. Blend Labs provides a digital platform to financial services firms that improves the consumer experience when applying for mortgages and loans. Despite doubling revenue in 2020, the core software business is highly unprofitable due to R&D and S&M spend.

Bridge Investment Group(BRDG) plans to raise $300 million at a $1.8 billion market cap. This investment manager specializes in real estate equity and debt across multiple sectors. As of 3/31/2021, Bridge Investment Group has approximately $26 billion of AUM with more than 6,500 individual investors across 25 investment vehicles.

Ocular medical device provider Sight Sciences(SGHT) plans to raise $150 million at a $1 billion market cap. The company develops and sells medical and surgical devices that present new treatment options for eye diseases. The highly unprofitable company showed signs of re-accelerating growth in the 1Q21 (+32%) after the pandemic delayed elective procedures in 2020.

Pregnancy diagnostics company Sera Prognostics(SERA) plans to raise $75 million at a $564 million market cap. The company uses its proteomics and bioinformatics platform to develop biomarker tests aimed at improving pregnancy outcomes. Sera Prognostics’ sole commercial product, the PreTRM test, predicts the risk of a premature delivery, though it has yet to generate meaningful revenue.

A hold-over from last week, early-stage kidney disease biotech Unicycive Therapeutics(UNCY) plans to raise $25 million at a $79 million market cap.

IPO Market Snapshot

The Renaissance IPO Indices are market cap weighted baskets of newly public companies. As of 7/8/21, the Renaissance IPO Index was down 0.8% year-to-date, while the S&P 500 was up 15.0%. Renaissance Capital's IPO ETF (NYSE: IPO) tracks the index, and top ETF holdings include Snowflake (SNOW) and Palantir Technologies (PLTR). The Renaissance International IPO Index was down 5.2% year-to-date, while the ACWX was up 7.3%. Renaissance Capital’s International IPO ETF (NYSE: IPOS) tracks the index, and top ETF holdings include Smoore International and EQT Partners.

精彩评论