Apple stock could be a compelling long-term “buy and hold” play. However, the vicious rally of the past month may also mean that now is a good time to lock in some gains.

Apple stock’s recent run has been impressive. Shares traded at nearly $180 in after-hours on Friday, December 10. If the stock price reaches $181.68 soon, per my estimates, Apple will have become the first company ever to be valued at $3 trillion.

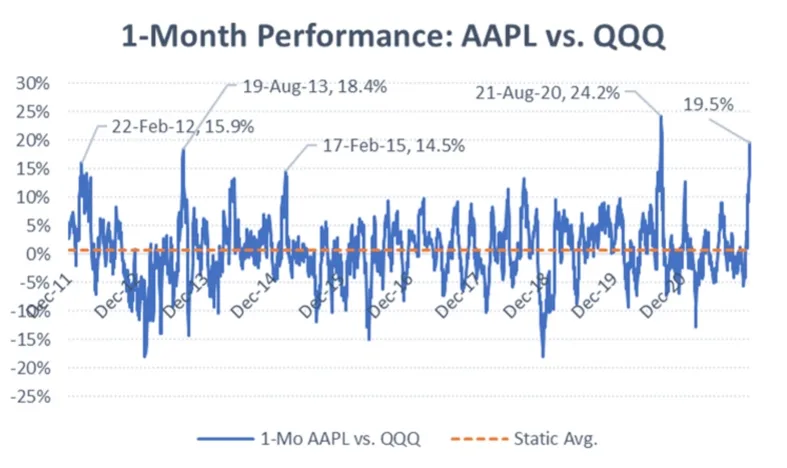

Amid investor enthusiasm, however, I fear that AAPL may have moved too fast since mid-November. With the stock having outperformed the tech-rich Nasdaq index by a whopping 19.5 percentage points in the past month, could now be a good time to trim the position and lock in some gains?

AAPL: impressive returns raise a flag

To start, I should make one thing very clear: in my opinion, Apple stock is a compelling long-term “buy and hold” play. In fact, I think that most growth-biased portfolios should be heavily exposed to shares of the Cupertino company, which I believe will outperform the rest of the market over the next, say, decade at least.

That said, I like to keep tabs on short term price behavior as well. After plugging in the numbers, I was astonished to see that AAPL has topped the performance of the Nasdaq (QQQ) over a one-month period by the most since late August 2020: outperformance of +19.5%. For the past decade, AAPL’s December 2021 rally vs. the benchmark has been the second strongest.

Looking into the rearview mirror, this is great news for Apple shareholders. However, one should invest looking into the future. And that’s when the argument for buying Apple stock at $180 apiece today becomes a bit less compelling.

The chart below shows the one-month performance of AAPL against QQQ over the past decade. Notice that the stock rarely beats the benchmark over such a short period of time by as much as it has in the past 4 to 5 weeks. The last time that it did, in August of last year, marked a peak in price of $134 that Apple stock still traded at until as recently as June 2021.

So, will AAPL tank next?

To be crystal clear, none of the above means that Apple stock will likely nosedive in the foreseeable future. But think of investing like a game of blackjack. A player will certainly want to stand at 20 if the dealer’s up card is a 5, for example. Does it mean that, by doing so, the player is guaranteed to win that hand? No, it only means that the odds favor him or her.

Likewise, buying Apple when the stock has handily outperformed the Nasdaq over the previous month has historically been disadvantageous. For example: over the past decade, AAPL has produced average one-year returns of +29%, assuming the stock is bought on any random day.

However, this number would have been much lower if shares were bought on strength against the Nasdaq: only +8%, on average, following one-month outperformance of 10% or more against the benchmark. On the other end of the spectrum, average one-year return in AAPL would have been a much better +39% following one-month underperformance of -10% or worse against QQQ.

The observations above are consistent with the strategy of buying a stock on weakness to take advantage of an eventual rebound; and selling it on strength to lock in gains, some of which could have been produced by irrational bullishness.

Panic and sell AAPL?

At this point, I should reemphasize that I remain an Apple bull. I would not sell all my stake in the company only because the share price climbed from $150 to $180 as quickly as it has.

However, I believe that now is a good time to think about rebalancing the portfolio. It seems prudent to me, following the recent rally, that some AAPL trimming and reallocation into other high-quality names would take place during this moment of strength in the stock.

精彩评论