Rosenblatt's Horgan is bullish on long-term upside, but is more cautious near-term give risk of pullback in cryptocurrency prices

Coinbase Global Inc. received yet another bullish endorsement from a Wall Street analyst on Wednesday, with Rosenblatt Securities analyst Sean Horgan expects the cryptocurrency exchange stands to be a "long-term category leader."

Horgan initiated coverage of Coinbase with a buy rating and a stock price target of $450, which is about 46% above current levels.

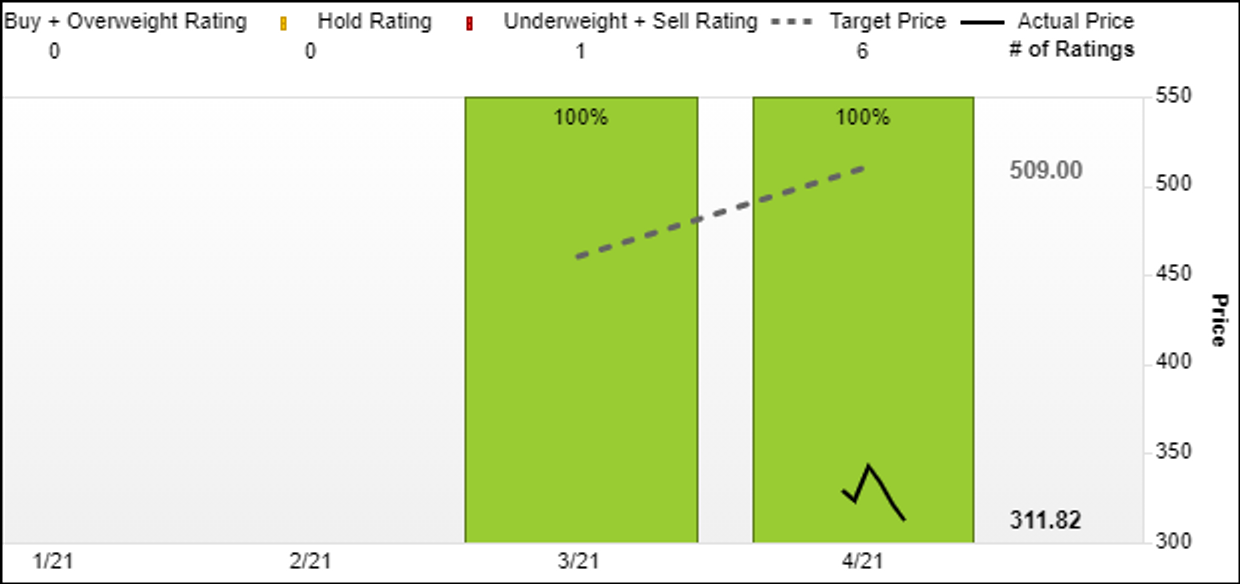

That keeps it unanimous, as all six analysts surveyed by FactSet have the equivalent of buy ratings on Coinbase. The average price target is $509.00, which is more than double the $250 reference price established when the stock went public last week.

The stock dropped 3.7% in morning trading Wednesday, to trade 5.9% below where it closed on its first day of trading on April 14 .

Horgan said he was bullish on the long-term upside of Coinbase, as it is set to benefit from the growing adoption and acceptance of cryptocurrencies. He said he was more cautious for the short-term, however, as "the stock faces downside risk from the drawdown in the price of crypto."

Bitcoin was down 1.4% in morning trading Wednesday, and has shed 12.4% since closing at a record $63,434.45 on April 13, according to FactSet data. Despite the recent pullback, bitcoin has still climbed 91.6% year to date and soared 712.7% over the past 12 months. In comparison, the S&P 500 index has gained 10.4% this year and rallied 51.5% over the past year.

Last week, BTIG analyst Mark Palmer initiated coverage of Coinbase with a buy rating and $500 stock price target, saying he believed the crypto exchange will be the "primary beneficiary" of the increased adoption of bitcoin and other digital assets, especially be institutional investors.

"We believe [Coinbase] should be regarded as the market leader in a category characterized by rapid and apparently sustainable growth driven by significant changes in consumers' behaviors and their adoption of new technology," Palmer wrote in a research note.

Rosenblatt's Horgan said he believes it's "reasonable" to assume the potential for cryptocurrency market value to increase by about fivefold to the approximately $11 trillion market value of gold over the next years. He said Coinbase's current 11% share of the crypto market leaves it in "pole position" to capitalize on that growth.

"Crypto has reached an inflection point on its road to legitimacy, and we see this as a long-term disruptive trend that is only in its early innings," Horgan wrote in a note to clients. "Net/net, we are buyers of [Coinbase's stock] as a long-term category leader and pure-play cryptocurrency stock."

精彩评论