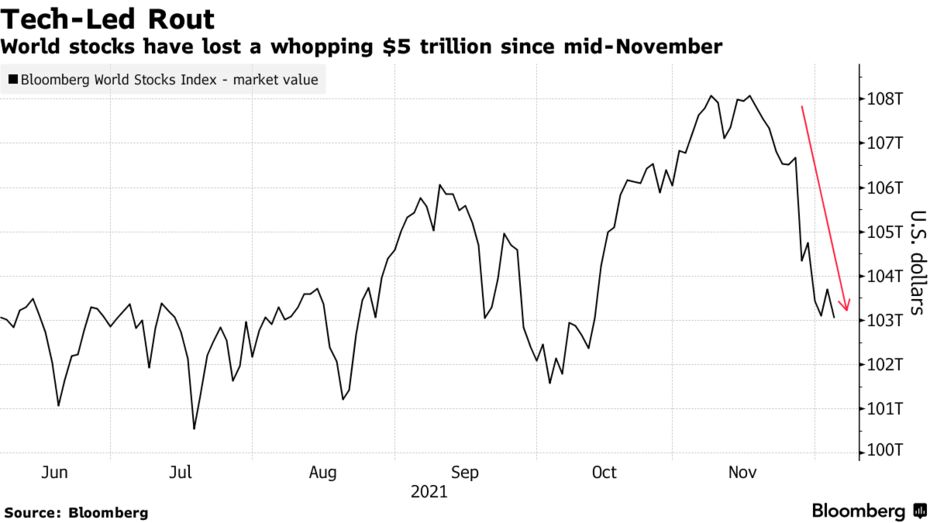

(Bloomberg) -- A whopping $1.7 trillion wipe-out from the Nasdaq Composite Index is starting to look like it has farther to run.

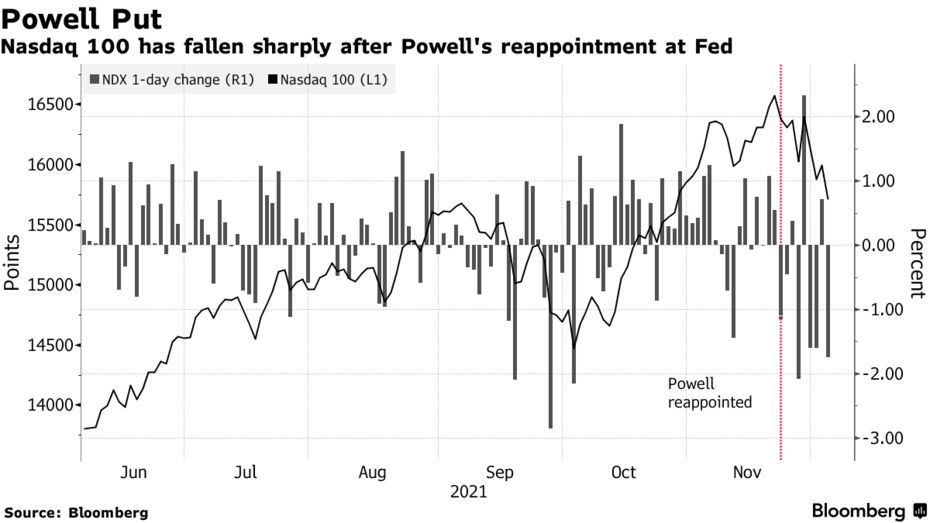

The two-week rout followed the re-appointment of Jerome Powell as chair of the Federal Reserve and his comments on quickening the rollback of pandemic stimulus. Those hawkish signals are leaving investors bracing for rising interest rates that will hurt some of the most highly valued stocks, such as Zoom Video Communications Inc., Adobe Inc. and Tesla Inc. Borrowing costs are likely to go higher even as the new omicron variant of the coronavirus raises the risk of an economic slowdown.

“A new Covid variant started the ruckus for markets, but we view that as secondary to the real culprit,” Morgan Stanley equity strategist Michael J. Wilson wrote in a report Monday, referring to the Fed.

The jolt will be felt more by the Nasdaq Composite, home to some of the world’s most expensive stocks. They include electric-vehicle maker Rivian Automotive Inc., which hasn’t recorded any meaningful revenue, yet has a $93 billion market value, or software companies Datadog Inc. and Zscaler Inc. trading at more than 50 times sales. The average S&P 500 stock trades at 3 times sales.

“Some of these future tech stocks could go down another 5% to 8%,” Phil Blancato, chief executive officer of Ladenburg Thalmann Asset Management, said Friday. “If you listen to the Fed speak it seems somewhat inevitable.”

One of the biggest beneficiaries of the bull market in fast-growing companies, Cathie Wood, is suffering. Her flagship ARK Innovation ETF has lost 40% of its value from its February peak, sinking 13% last week alone. Many of the stocks in the fund are expensive and barely unprofitable.

“There’s been a flight to quality,” said Mike Mullaney, director of global market research at Boston Partners. “Both in tech and in communications services is where you have a lot of those high-flying stocks with enormous price-to-sales multiples and not much in earnings, and that’s what’s really getting thrown out with the bath water right now.”

Mullaney said Friday he sees old-school tech companies such as Seagate Technology Holdings Inc., HP Inc. and NXP Semiconductors NV -- all profitable, and selling for about the market’s multiple or less -- doing well.

The biggest tech companies also are feeling the pain. The world’s top largest, including Apple Inc. and Microsoft Corp., lost $200 billion in value on Friday alone. It could get worse.

The Nasdaq Composite has fallen 6.2% from its Nov. 19 peak, while the S&P 500 is down 3.5% in the same period.

But some investors say it’s time to buy on market declines, given the long-term prospects for some technology companies.

“I am a dip buyer because of the types of stocks I am buying,” said Kim Forrest, chief investment officer at Bokeh Capital Partners, pointing to semiconductor companies such as Xilinx Inc., Micron Technology Inc. and Intel Corp., which she sees benefiting from the worldwide rollout of 5G phone networks.

Tech Chart of the Day

精彩评论