Apple is one of the most unlikely meme stock candidates. However, the Apple Maven thinks that AAPL behaved like one in the third quarter of 2020. Here is what happened.

Apple (AAPL) is nothing likea meme stock. The sheer size of the company, trading volume, institutional ownership and multi trillion-dollar market cap make it nearly impossible for a relatively small number of retail traders to sway the stock price in any meaningful way. But there are often exceptions to the rule.

Today, the Apple Maven goes back to third calendar quarter of 2020 and revisits the few weeks when Apple stock traded like meme: up sharply and quickly, on heavy volume and arguably decoupled from business or macroeconomic fundamentals, followed by a sudden drop from the peak.

AAPL stock: to the moon!

Apple’s fiscal third quarter, reported in late July 2020, was quite impressive given the COVID-19 disruptions. The company managed to post revenue growth of nearly 11% and EPS of $2.58 that topped consensus by around 50 cents.

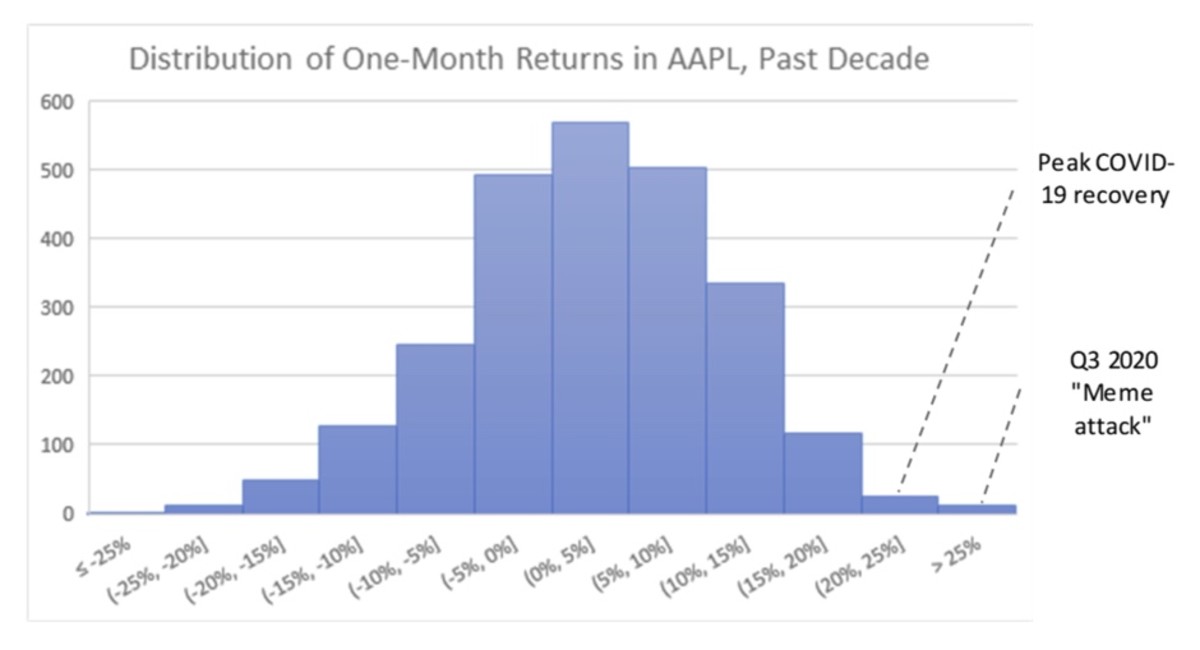

But, despite the strong performance, it is still not easy to justify what happened to Apple stock in the month or so that followed the earnings release. Between July 31 and September 1, AAPL climbed a staggering 40%, the most in such a short period of time in the past ten years at least.

Not even the recovery from the bottom of the COVID-19 bear was so fast and so furious. See chart below: a histogram of the one-month returns in Apple stock on any given day over the past decade.

The roots of the meme attack

In my view, there is one key factor that explains the bullish reaction of August 2020. Along with financial results, Apple also announced its first stock split since 2014. One share of AAPL would become four on Monday, August 31. CEO Tim Cook explained the company’s decision:

“We are announcing a four for one split of Apple common stock to make our stock more accessible to a broader base of investors.”

While accessibility to retail investors is probably the main reason for splitting a stock, the rationale does not work as well in today’s trading environment. Nearly all major brokerage firms allow for fractional ownership, which means an investor can buy or sell less than one share of Apple stock.

The only way that a stock split matters nowadays, in my view, is by catching the attention of investors who believe that the event unveils “a good deal”: two, or four, or ten shares for the price of one. This was probably the key factor driving AAPL share price to $134 from $106 in less than five weeks.

The morning-after hangover

Like any good “meme attack”, AAPL share price spike was followed by a sudden pullback.

After reaching a peak of $134 in early September, the stock dropped below $107 only 12 trading days later. It entered correction territory, defined as a 10%-plus pullback from the peak, in a record four trading days. In fact, Apple was still priced below September 1 levels as recently as a couple of days ago.

It is probably not a coincidence that Apple’s sharp fall from the top started to unfold within one or two days of the stock split finally being executed, when the “buzz” finally wore off – the telltale sign of a meme stock-like frenzy running its course.