Apple is about to run out of cash. This statement may sound lucrac is to most Apple stock (AAPL) investors, since the Cupertino company has been a cash-generating machine in the past many years. But even the management team knows this to be true.

Today, the Apple Maven talks about what has been happening to the iPhone maker’s once giant pile of cash, and what the declining balances may mean for shareholders.

Apple heading to net cash neutral

To be fair, “running out of cash” in this context does not mean that Apple’s checking accounts at the bank will dry out. It simply means that the company’s debt balances will roughly offset its cash position — i.e. Apple will become net cash neutral.

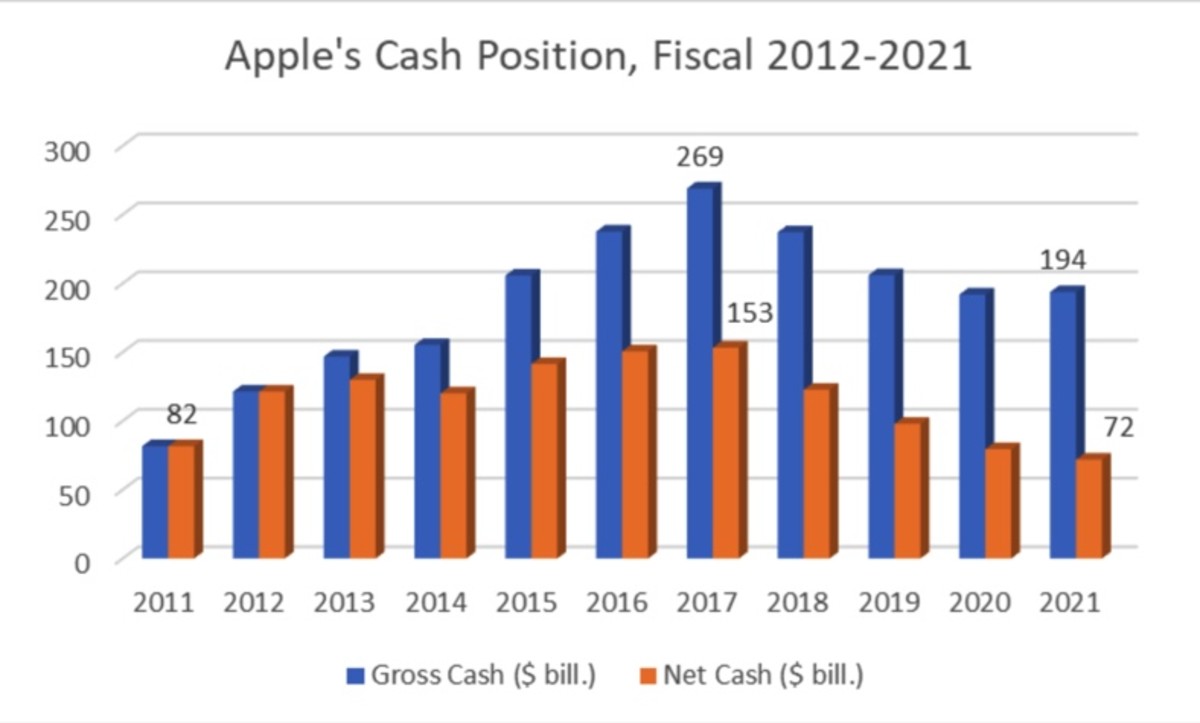

The chart below shows the evolution of Apple’s gross cash (blue bars) and net cash (orange bars) balances since 2011. Ten years ago was when then-CEO Steve Jobs stepped down and turned the control of the company over to then-COO Tim Cook.

Starting in 2012, Apple began issuing debt for the first time in its history. By 2017, the company boasted the largest gross and net-of-debt cash balances that it had ever seen in its books. But since then, both numbers have been dwindling. This year’s $72 billion in net cash is less than half the amount of about four years ago.

What happens when cash runs out?

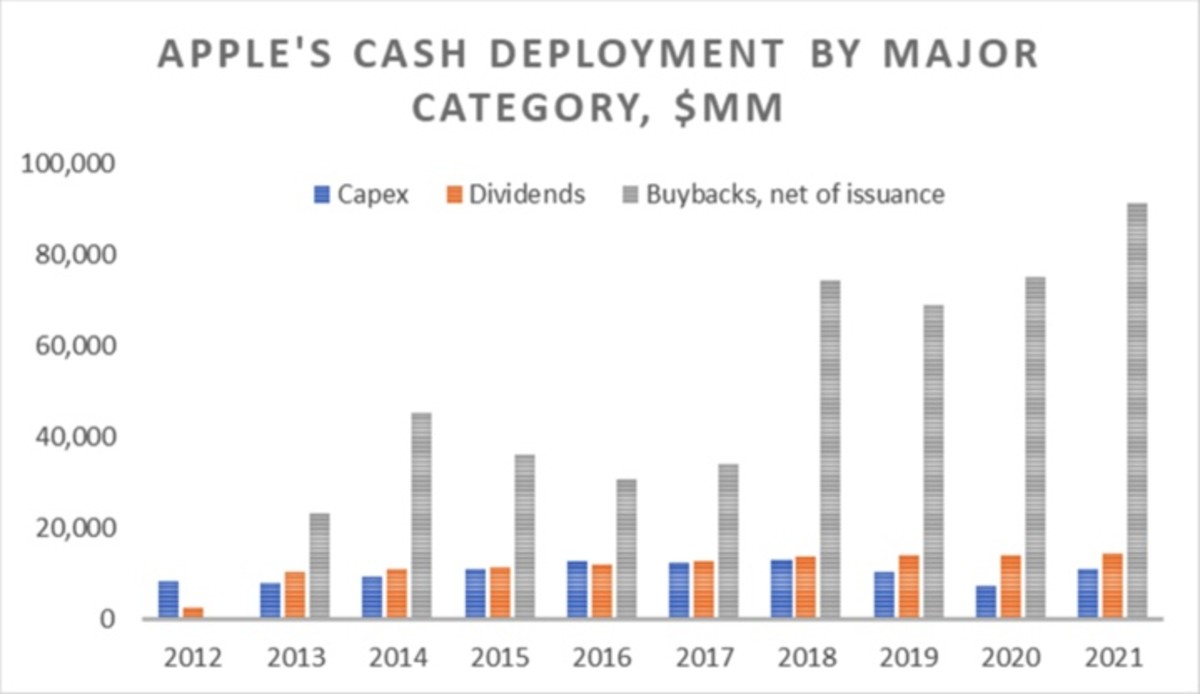

The chart below shows that, prior to Tim Cook as CEO, Apple was very timid at deploying its cash reserves. While capex and dividend payments increased quickly (large M&A has never been a thing for Apple), buybacks skyrocketed. Apple has spent more than three times as much in share repurchases since 2018 than it did in capex and dividends combined.

As Apple’s cash balance continues to dip, it is reasonable to expect the pace of share retirement to decline as well. This is true not only because of a leaner balance sheet, but because AAPL stock trades at a much richer price today — thus, it costs Apple more to buy back each share of its own equity.

Why is this relevant for investors? Over the past decade, Apple’s shares outstanding have declined by 10 billion units to 16.7 billion. Share count is the denominator in EPS (earnings per share) and EPS is the denominator in price-to-earnings. Therefore, buybacks alone have probably been responsible for a good chunk of Apple stock’s climb in the past several years.

At the current stock price of $165 apiece, Apple can afford to retire around 435 million more shares with its current net cash balance, or barely 3% of the float. After that point, the Cupertino company might need to scale back on repurchases or borrow in order to keep buying its stock.

Should investors worry?

I think that Apple stock could suffer, at least from deteriorated investor sentiment, if or once it begins to slow down the pace of its share buyback efforts. However, I also believe that this is only one aspect of the investment thesis that people should consider.

I remain optimistic about Apple stock from a business fundamentals perspective. The Cupertino company seems to have found the sweet spot in demand for its products and services, which I believe bodes very well for AAPL in the foreseeable future.