Summary

- Short interest in Palantir dropped by 23.8% in the latest cycle.

- Even though Palantir continues to be surrounded by bearish narratives, market participants don't seem to be comfortable with shorting the stock.

- The stock could rally further.

Palantir's (PLTR) shares are up 20% in the last month alone but the rally could still continue. Latest data reveals that short interest in Palantir declined by 23.8% in the latest cycle alone. This suggests that a broad swath of market participants isn't buying into the bearish narratives surrounding the company, perceive its stock to be fairly valued and perhaps even anticipate it to rally going forward. This development should come across as an encouraging sign for the company's long-side investors. Let's take a closer look at it all.

The Data

I'd like to start by explaining the term "short interest" for the uninitiated. It's essentially the total number of short positions that are open against any given stock. A sharp rise in the metric indicates that traders grew bearish on the concerned company, and actively initiated short positions against it. Conversely, a sharp decline in the metric indicates that traders actively wound up their short positions either perhaps because they anticipate the stock to bottom out and/or rally going forward. So, the short interest is a useful tool to gauge the Street's ever-evolving market sentiment.

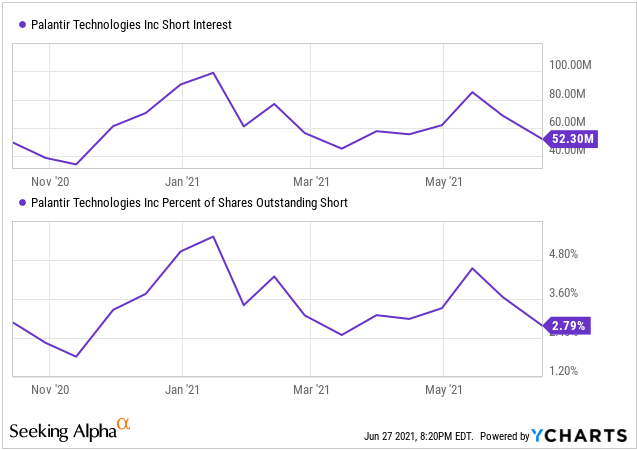

In Palantir's case, its short interest at the end of the latest data cycle stood at 52.3 million, sharply down by 23.8% on a sequential basis. Although Palantir's short interest figure isn't at its all-time low yet, the pace of its recent decline, however, is certainly one of the fastest in the company's brief history since its direct listing last year. For the record, Palantir has over 1.8 billion shares outstanding which means that about 2.8% of its entire share total had been shorted. Also, the short interest data is for the cycle spanning from early June to mid-June, and the data wasreleasedon Thursday.

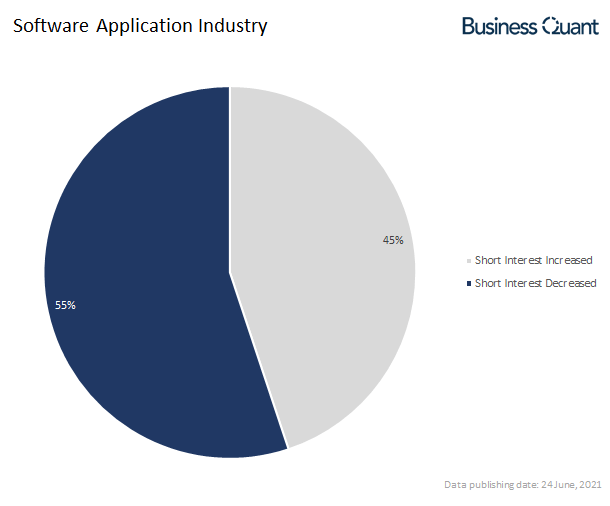

Next, I wanted to confirm if other software application companies also registered a sharp reduction in their short interest figures, or was Palantir an anomaly in its peer group. So, to get a broader perspective on its industry, I pulled the short interest figures for about 100 software application stocks listed in the US. Interestingly, 55% of these stocks registered a net reduction in their short interest figures, of varying magnitudes of course, which points to an industry-wide short unwinding.

Moreover, the median short interest decline was 1.9%, whereas Palantir's short interest declined by a far more significant 23.8% during the same data cycle. In fact, there were just 6 other stocks in our study group, which saw their short interest decline in excess of 23.8%. This conclusively shows that market participants were far too active with unwinding their short positions in Palantir.

But this leads us to an important question - why are market participants so cautious with shorting Palantir in the first place?

Cautious for Good Reason

As I've explained in my prior articles, Palantir has several initiatives at play which could collectively catapult its growth in 2021-22. These initiatives include itstransitionto a customer-friendly payment model to boost commercial sales, offeringfree trialsto major companies to expand its sales funnel and expanding itssales teamto revamp its outbound marketing function. We won't be discussing the same points again to avoid being repetitive, but the takeaway here is that since Palantir is undertaking several growth initiatives, it makes for a risky short bet for the time being at least.

But don't take my word for it.

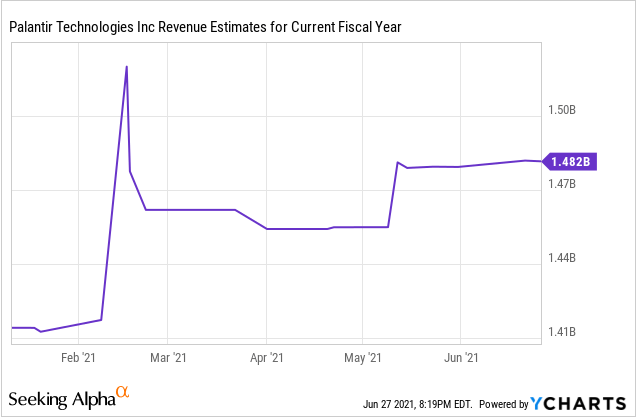

The community of professional analysts is realizing Palantir's growth potential and raising their revenue estimates for its current fiscal year. They've raised their FY21 revenue estimates by about 5% so far since mid-January and there's no telling how many of such upward revenue revisions are still in store for the remainder of Palantir's FY21. This bullish uncertainty presents an unfavorable risk-reward ratio for short-side market participants and explains why short interest in Palantir continues to decline.

There's another point to consider here, that nobody seems to be talking about. Palantir has won several COVID-19 tracking-related contracts (such ashere,here,here,hereandhere) over the last 12 - 15 months as government agencies across the globe grappled to control the spread and tried to better manage their resources. With COVID-19 said to be making a fierce comeback with thedelta variant, I contend that Palantir could experience a similar order windfall this year, from proactive government agencies, which could boost the company's government sales along the way.

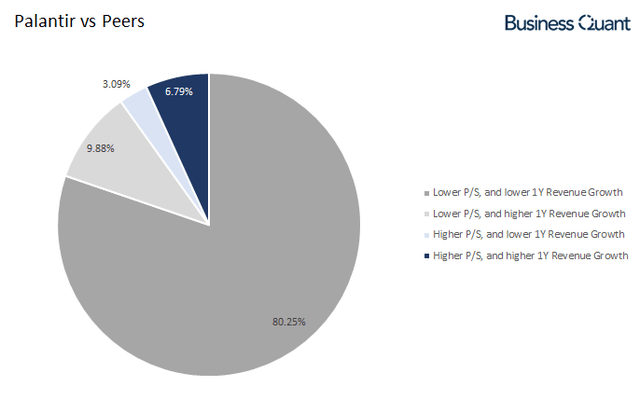

Lastly, several commenters argue that Palantir's shares are trading at a premium and are due for a sharp correction. Its shares are trading at about 34-times trailing twelve-month sales so it's understandable why many might think that the stock is overvalued. But I believe the problem with this approach is that we're not factoring in industry-wide trading multiples or Palantir's revenue growth rate, compared to its peers.

So, to put things in perspective, I compiled the revenue growth rates and price-to-sales (or P/S) multiples for over 320 software infrastructure and software application stocks that are currently listed on US exchanges. Next, I benchmarked these industry groups based on Palantir's revenue growth rate and its P/S multiple. As it turns out, over 90% of Palantir's peers have a slower revenue growth and/or are trading at higher trading multiples. This suggests that Palantir's higher pace of growth justifies its price premium and that the bearish concerns regarding its valuations, are exaggerated.

Final Thoughts

I'd like to point to readers that fluctuations in short interest figures don't always impact the underlying stock prices. This data is based on short positions that were open at a prior cut-off date and investors with a long-term time horizon should, at best, use it to corroborate their bull or bear thesis.

Having said that, if the bearish narratives surrounding Palantir held any merit, or posed a legitimate risk to its share price, a broad swath of market participants would've actively shorted the stock to profit off of this near-certain eventuality. But that didn't happen and its short interest declined instead, that too by a significant amount.

This active short unwinding indicates that market participants are uncomfortable in shorting the stock at current levels. This should come across as a reassuring sign for the company's long-side shareholders. The stock seems to be fairly valued and has the potential to rally further. Good Luck!