Summary

- Investors and analysts pushed their way through Micron's FQ4 report to take in FQ1's guidance.

- The headlines saw sequentially lower and consensus missing revenue and earnings per share.

- However, I found four specific pieces of the guide that tell an utterly bullish story.

- The narrative Micron is entering a downcycle is not apparent to management as it forecasts record yearly revenue with corroborating numbers.

- The FQ1 guide marks the end of the stock's drop and the beginning of the recovery, all before contract DRAM pricing even moves.

The focus on Micron's (MU) FQ4 earnings has been its FQ1 guidance. And for good reason, too, as everyone wanted to understand if calendar Q4 would have softer DRAM pricing, leading to weakness at the company. In the end, all the market saw was the sequentially lower guide in terms of revenue and earnings per share, seemingly confirming the bearish fear. But, have you noticed the market didn't crater on earnings - I mean actually crater, not drop a mere 3%? That's because under the covers of the conference call and guide were bullish headlines, more than if the company guided at or above consensus numbers. FQ1's guide marks the bottom in the stock as the call contained the most bullish numbers and forecasting I've ever heard Micron management utter. Therefore, don't look past Micron's FQ1 guidance; embrace it because it tells a very, very bullish future.

More Bullish Than Sequential Growth

The focus of this article is not FQ4. It's apparent the company cleared the bar on revenue, produced outsized return in terms of EPS, and met the top end of guidance on gross margins. The fact is the quarter was expected to be robust, and it delivered. Over the last few months, the market turmoil has been around expectations for FQ1 - and beyond - and if DRAM pricing would soften. A softening DRAM (and NAND) pricing market hurts Micron's ability to produce outsized revenue and net income.

To this end, conferences leading up to the earnings report were structured to portray PC and consumer DRAM as seeing "some pockets" of inventory above normal levels as component shortages in certain areas held up final assembly of products on the OEM side. As a result, this was one reason to expect things to be weaker leading up to the FQ4 report than what consensus was portraying with sequentially higher revenue and earnings.

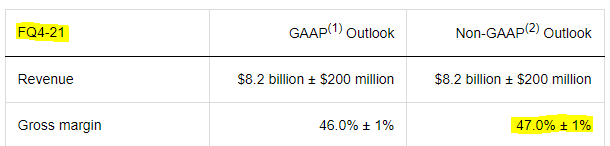

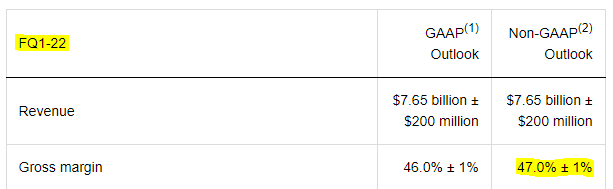

That being said, the perceived weakness via a lower sequential guide quarter-to-quarter in revenue and earnings masked the bullishness management indicated not just by words but by numbers in the guide below the surface. As a refresher, the company guided FQ1 for $7.65B in revenue at the midpoint compared to FQ4's $8.27B along with $2.10 in EPS compared to the $2.42 it just reported. It also guided for gross margins of 47% +/- 1% versus 47.9% in FQ4.

Saying things like "we expect record revenue in FY22" doesn't jive with a downturn in the memory cycle. But one must dig deeper than the headlines to understand there are four specific reasons why this quarter is not a foreshadowing of more weakness and an end to an up-cycle that never got wind in its sails. Those reasons are:

- Days of inventory (DOI) will remain under optimal levels

- CapEx foreshadows greater revenue

- "Record" FY22 revenue

- Gross margins were guided the same as FQ4

These four pillars set investors up to buy shares while the beating is at its worst for a very lucrative investment just six months from now. Join me in detailing each tenant of this bullishness.

Micron's Days Of Inventory

There are a few key metrics to always look at to see how the memory supply and demand dynamic is playing out in as close to real-time as you can get. One of the biggest is days of inventory and overall producer inventory across the industry. CFO Dave Zinsner said the company exited FQ4 with 94 DOI, below the optimal level of 100 days. This means Micron has very few finished goods to supply the market; there isn't any excess to sell, and everything depends on the manufacturing line. But the key part here is the company doesn't expect to get to the optimal level untilthe end of FY22.

Pause. Think about that for a second.

If the company can't replenish its inventory for three or four more quarters, it means there isn't any supply able to be allocated to it for quite a while.

But allow me to go a level deeper.

What's in the calculation for DOI? Well, at the second level, it's the cost of goods sold. There are two ways DOIs are pressured or go down. If the cost of inventory on the balance sheet decreases, DOI will - obviously - go down, COGS remaining equal. If COGS go up, DOI will also go down. In either situation, there are bullish underpinnings causing it.

If the company expects DOI to remain steady, it means one of two things. Either inventory on the balance sheet will remain the same and COGS will remain the same, or inventory will increase proportionally to COGS. And since the company expects an even better year than FY21, we can conclude inventory and COGS will be rising together. And from that, COGS only rises when revenue rises or when costs increase disproportionately. So, considering management expects costs to come down by a few percentage points each quarter, revenue has to be growing quite a lot to bring the absolute dollar amount of COGS higher.

Therefore, the company cannot increase its inventory faster than its revenue growth (increasing COGS), which means it does not expect the market to slow down for it to catch up. And even then, it sounds like COGS will inch lower toward the end of the year more disproportionately from revenue growth when some headwinds from COVID-19 on the back-end packaging and testing ease and when front-end cost-downs from node transitions fully mature.

So, analyzing DOI touches on two significant facets of Micron's business: inventory and revenue. Remember, inventory rises in down parts of cycles. But, inventory is expected to be under pressure for the majority of the fiscal year, and even after that, only expected to be at "normal" levels (around 100 days).

CapEx Guides FY22 Revenue

The first thing the market likely saw was the "dramatic" increase in CapEx for FY22 over FY21. FY21 saw $9.7B in CapEx, and the company is guiding for $11-$12B in CapEx for FY22. And just when everyone is thinking demand is going to wane, Micron is poised to push CapEx higher by 18.5% this fiscal year.

Sound the alarms!

But, put it into context. Remember when Micron's CFO Dave Zinsner said CapEx would generally be 30-35% of revenue each fiscal year?

...what we're trying to do from a CapEx intensity is invest somewhere between 30% and 35% of revenue.

- Barclays Americas Select Franchise Virtual Conference, May 19th, 2021

Simply taking $11.5B and backing into revenue figures gives us a high-level guide for FY22. That exercise gets us $32.86B for 35% of revenue and $38.35B for 30%. Let's take the low end of revenue and compare it to the year we just had. FY21 finished with $27.71B in revenue, so we're looking at an 18.5% revenue increase, the same amount CapEx is being raised - which was evident based on algebra - so, at the very least, we're expecting over $32B in revenue for FY22.

That amount of revenue doesn't foreshadow a downturn.

But allow me to drill down further to prove a repeated point I've made about not all CapEx being bearish. The increase is primarily set to be in NAND as NAND has been purposely underinvested as it transitioned to replacement gate in FY20. In FY21, it was bumped a bit, but now management is saying NAND will be back at full investment. At the same time, DRAM equipment manufacturing CapEx will bedownyear-over-year.

Furthermore, we continue to hear no new wafer starts. The company believes it's still several years away from needing additional wafer starts to supply the demand environment of the future. So with higher CapEx going toward more expensive equipment like EUV and more pilot programs and not much toward increases in bit supply beyond node transitions, the disciplined supply program rages on.

Therefore, it's hard to argue an increase in CapEx absolutely means throwing off the supply and demand balance in the memory market. Not only is the key the link between revenue and CapEx, but additional investments in back-end packaging and testing only provide upside to the company's margins later on. Add in equipment, like EUV, being very expensive, and it's easy to see higher CapEx isn't what it used to mean. In fact, it likely means abetteryear ahead.

Micron Forecasts Record FY22 Revenue

When a company discusses record numbers, it means higher numbers - higher than ever. Micron is giving full-year guidance by saying it sees record revenue in FY22. This is not something I've ever heard this management team say before. Who flipped the confidence button in the board room?

Bit shipping growth will resume in the second half of the fiscal year, and we're planning to deliver record revenue with solid profitability in fiscal 2022.

- Sanjay Mehrotra, Micron CEO, FQ4 '21 Earnings Call

Record revenue would mean exceeding the last upcycle in FY18, where the company did $30.39B in revenue. This agrees with my expectations from the CapEx calculations, where the company is shooting for ~$32B in revenue. This would also mean a prolonged decline in pricing is not possible as pricing is a significant factor in Micron's revenue and profitability. If customer inventories remained high past the 2021 calendar year, pricing declines would set in enough that FQ1 would be the highest revenue quarter for FY22 at $7.65B. Even if FQ1 were annualized, it would only amount to $30.6B. Yes, enough to qualify as record revenue, but not if pricing declines have yet to set in. If DRAM pricing is set to collapse, $7.65B would be the high watermark and likely see revenue closer to $7B and $6.5B in quarters as the year goes on. This wouldn't even amount to $27.65B and would come in under what FY21 just amounted to ($27.71B).

Considering the confidence to provide full-year guidance (unheard of) along with a dividend, I'd say management has some decent visibility into the demand picture for this new year. What it says about "smallpockets" of higher customer inventory must be accurate if this is the case.

Micron's Gross Margins, The Pièce De Résistance

The best news to come out of the guide was the gross margin guidance. In what I find to be the most impressive part of FQ1's guidance, the gross margin guide exactly mirrors what the FQ4 guide was: 47.0% +/- 1%. With revenue set to be sequentially down 7.5% and EPS down ~13%, gross margins coming in the same was not expected but was very bullish.

How is that possible? I wondered the same thing.

Clearly, pricing isn't going to be coming down much in FQ1 for many of its products, if at all.

While we will benefit from our node transitions on both DRAM and NAND, we will continue to see near-term headwinds from COVID-related expenses in assembly and packaging. As a result, we expect the gross margins in FQ1 to be largely a function of the mix .

- Dave Zinsner

If it's dependent on the mix and the gross margins will be identical, well, there must be some product reason. More specifically, the mix must be shifting toward DRAM and more so toward server and cloud, where margins are inherently higher. Having less PC and consumer DRAM can be a blessing in disguise as it doesn't weigh on gross margins due to the thinner margins they tend to carry.

I can't stress enough how vital the gross margin guide is here as normal circumstances contend a decline in bits shipped and/or average selling prices (ASPs) reduces gross margins with it. However, the mix is working in its favor and reveals many diverse end markets with solid demand remaining elsewhere for CQ4.

Remember, the market has been hammering the stock due toPC DRAMpricing weakening. The focus on PC DRAM is causing a red herring for investors. Micron is proving weak PC DRAM might take away some revenue with this guide, but other end markets are staying solid and keeping things afloat. Read as: the theory of dependency on PC DRAM has overstayed its welcome.

MU Stock - Not So Bad After All

We wouldn't have been able to glean some of these bullish tenants if Micron guided sequentially higher for FQ1. The diversification away from PC and the robustness of other end markets would have been masked if things went status quo. But because of the weakness in one end market, it opened the window to see how well and how diversified Micron's business has become. When PC is showing weakness, it no longer means everything else must be weak also.

This is probably the most bullish downgrade I've seen with Micron over the last several years, if not the most bullish. The tone of Mehrotra and Zinsner was very upbeat, not usual for a team that has guided down before. I remember hearing despair and shakiness in their tone in prior similar situations, but not this time. The team truly believes the coming weakness in pricing, albeit small, will be a short-lived event where the continued strength in demand will continue on the other side.

I'm inclined to build my Micron position here, given that in just a few short months, the market will start bringing in to view the other side of this PC DRAM pricing blip. And when it does, the stock price will rise in anticipation of it coming to fruition, just like it did for this expected weakness in calendar Q4.