Tech, consumer discretionary and cyclical sectors historically outperform: Raymond James

Rising Treasury yields are sending shivers through the stock market, particularly for highflying tech-related stocks. But history shows that when yields are rising “for the right reasons,” tech shares and cyclically sensitive stocks tend to thrive, according to Raymond James.

The right reasons are “improving economic growth and a ‘healthy’ rise in inflation,” said Larry Adam, chief investment officer for the private client group at Raymond James, in a weekend note. And those reasons have driven the yield on the 10-year Treasury note to just shy of 1.4%, or about their highest in a year. Yields also are coming off their largest weekly rise in six weeks.

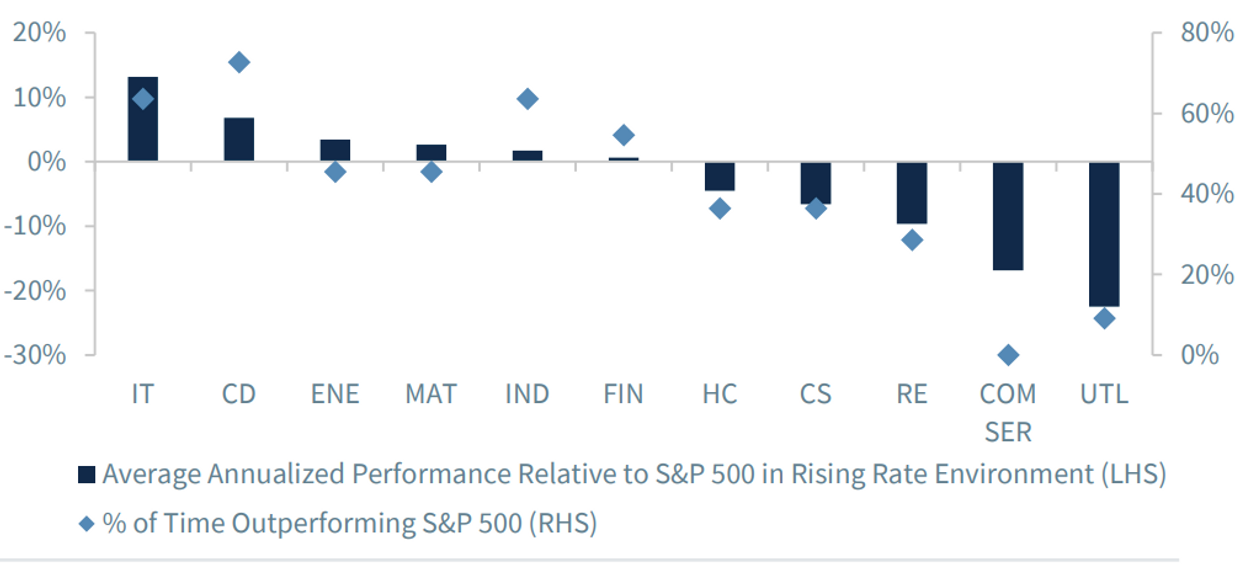

Adam highlighted the chart below, which breaks down the average annualized performance of each of the S&P 500’s 11 sectors and the percentage of time each sector outperforms the S&P 500 in a rising rate environment.

“Since 1990, during rising rate environments, the more cyclical sectors have outperformed,” Adam noted. “The average annualized outperformance relative to the S&P 500 and the percentage of time it outperforms the S&P 500 is largest for the tech, consumer discretionary and industrials sectors — three of our preferred sectors,” while higher dividend-yielding sectors like utilities, real estate and consumer staples tend to underperform.

Stocks wereputting in a mixed performanceon Monday, with the Nasdaq-100,down 2.6%, and the Nasdaq Composite,down 2.5%, suffering the steepest declines. Both are tilted toward large-cap, tech-oriented stocks.

The Dow Jones Industrial Average was positive, while the S&P 500 was off 0.8%.

The rise in yields is being blamed in large part on expectations for a potential surge in inflation thanks to ramped up government spending and ultraloose monetary policy. Fears that the Federal Reserve could move to begin withdrawing some liquidity sooner than anticipated is seen helping to unsettle stocks, analysts said.

But Adam argued that inflation not only is unlikely to “short circuit” the rally, it may be a welcome development for stock-market bulls.

“When analyzing how the S&P 500 performed under varying levels of core inflation, equities performed above-average in an environment where core inflation was between 1-4%,” he wrote.

Inflation at those levels is generally considered healthy when it coincides with improving economic activity, Adam said. The reason is because companies have pricing power, allowing them to lift prices, while also reaping the benefits from productivity gains, which helps to boost earnings growth.

Raymond James expects core inflation to be around 2%. Adam said that when core inflation runs between 1% and 3%, the average performance relative to the S&P 500 on a year-over-year basis has been strongest for the technology (+6.8%), healthcare (+2.3%) and consumer discretionary sectors (+2%).