There is a new bear roaming the Apple orchard. Could Apple stock dip about 30% from current levels, as one Wall Street analyst argues?

Anew bear has emerged from its cave. New Street’s Pierre Ferragu believes that Apple stock is now a sell, downgraded from his previous neutral stance, and that shares could sink by nearly 30% from current levels to only $90.

The Apple Maven gets inside the mind of this Wall Street skeptic to better understand the potential risks of investing in Apple stock today.

“12S cycle” coming up?

New Street is effectively the only true Apple bear on Wall Street today. Famed skeptic Rod Hall, at Goldman Sachs, finally threw in the towel after the Cupertino company delivered a record-breaking fiscal second quarter. Wolfe Research’s Jeff Kvaal maintains his sell rating, but at a high price target of $125 that suggests minimal downside risk.

Pierre Ferragu goes deeper. In his view, the best of Apple’s iPhone upgrade wave, the so-called 5G super cycle, has been left in the rearview mirror. The point was reinforced by the analyst’s views that the Cupertino company’s upcoming smartphone will probably be a “12S model” with limited updates.

In addition to an underwhelming 2021 iPhone model in the pipeline, Mr. Ferragu’s bearish thesis is further illustrated by his quote below:

“The key question is how things shape up for next year, as the current super cycle has brought forward demand […] and consumers spend less on consumer electronics as the economy re-opens.”

Plugging some numbers

New Street offered some figures to back up the 30% downside risk. According to the analyst, 2022 iPhone shipments would land at 190 million units, at the mid-point of the guidance range.

If ASPs (average selling prices) remain elevated, as they have been in the first two quarters of fiscal 2021, the bear case points at next-year iPhone revenues of around $150 billion. At these levels, iPhone sales would have increased by a modest 5% per year through the COVID-19 crisis and pandemic recovery, against what I estimate to be nearly 20% consensus growth.

Considering how relevant the iPhone still is to Apple’s financial performance (50% of total company sales in fiscal 2020), low growth prospects would likely lead to valuation compression. The double whammy would come in the form of consensus-lagging EPS, a combination of which would be needed to support New Street’s $90 share price target.

The Apple Maven’s opinion

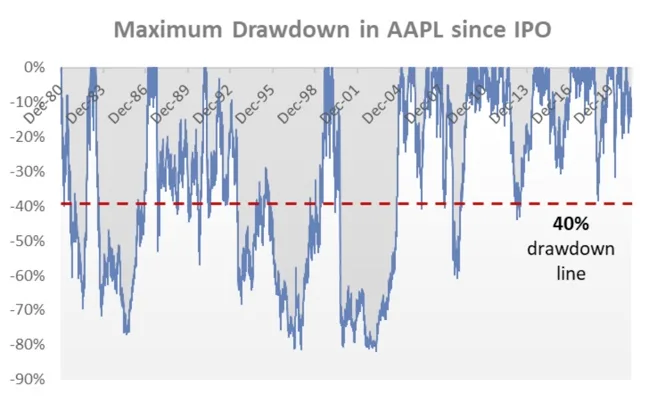

One thing is clear: stock prices can swing wildly and correct sharply. Apple stock is no stranger to painful pullbacks. Shares have dipped by 40% or more from the peak (12% currently, plus the nearly 30% decline expected by New Street) several times before, as the chart below suggests.

But quite a bit would have to go wrong, in my opinion, for AAPL to return to $90 – levels not seen since the thick of the pandemic. From higher ASPs in 2021 to increased sales well past the peak of the stay-at-home buying spree, the iPhone seems to be experiencing a secular, not temporary increase in demand.

Weakness in iPhone would likely need to come along muted results in other segments as well. In other words, Apple’s troubles would have to be broader, rather than product specific. To me, this would only be possible under two key assumptions:

- The post-pandemic “return to normal” will, indeed, cause discretionary spending to shift meaningfully away from tech devices and services – which I am skeptical about;

- The economy will endure a double-dip recession that cannot be remedied as well by fiscal and monetary stimuli –something that I also believe to be of low probability.

At the end of the day, AAPL $90 is possible – just not highly likely, in my view.