Shares of the videoconferencing platform gained last month on a solid earnings report and other tailwinds.

What happened

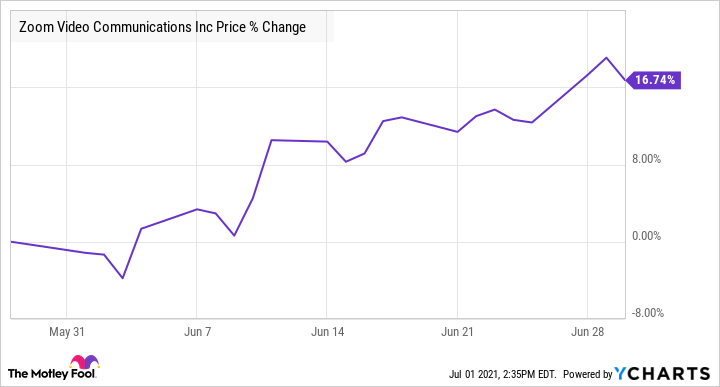

Shares of Zoom Video Communications(NASDAQ:ZM)jumped 17% last month, according to data from S&P Global Market Intelligence.

The videoconferencing leader benefited from a strong first-quarter earnings report, some bullish analyst notes, an acquisition, and concerns about the spreading COVID-19 Delta variant.

As you can see from the chart below, the cloud stock gained steadily over the course of the month, riding a broader trend in growth and tech stocks.

So what

Zoom kicked off the month with another round of smashing growth as revenue rose 191% to $956.2 million in its first-quarter earnings report, easily beating estimates at $906.3 million. Customers with more than 10 employees nearly doubled to 497,000.

Its bottom-line performance was also impressive as adjusted operating income jumped more than seven times from the year-ago quarter to $400.9 million, equal to a 41.9% adjusted operating profit margin. Adjusted earnings per share reached $1.32, topping the consensus at $0.99.

Despite the strong results, investors shrugged off the results as the stock was mostly unchanged on the news. However, it jumped at the end of the month's first week on news that Cathie Wood's ARK Invest bought 96,100 shares.

The following week, the stock gained on a pair of bullish analyst notes as it was upgraded to buy at Argus, and RBC Capital analyst Rishi Jaluria rated Zoom outperform and called it a top pick.

Lastly, Zoom jumped at the end of the month after saying it would acquire Kites, a real-time machine translation start-up to help Zoom with its machine translation, a valuable add-on service for videoconferencing.

Now what

Zoom will face difficult comparisons over the rest of the year as the company laps its blowout performance during the pandemic. But it hiked its guidance for the full year in the first-quarter report, calling for revenue of $3.975 billion to $3.99 billion, above its prior range of $3.76 billion to $3.78 billion. It also expects adjusted earnings per share of $4.56 to $4.61, up from an earlier forecast of $3.59 to $3.65.

With that forecast, Zoom doesn't even look that expensive at a price-to-earnings ratio of less than 90, especially compared to some of its software-as-a-service peers that aren't even profitable. Though last year's growth was certainly an anomaly, the future still looks bright for Zoom.