Summary

- Sea Limited is a growing company in a growing economy.

- At this stage, the company should be judged on its growth, not earnings.

- The recent fall in price makes the stock look attractive when compared to similar growth stories.

Thesis Summary

Sea Limited (SE) is one of those companies that divide the room. The stock was one of the best performing of 2020/2021 but has now fallen over 30% from its all-time high following a general sell-off which has been most felt in growth stocks.

However, Sea's fundamental growth story remains strong, and the fact that it is running at a loss should not bother investors at this point. If we look at each segment individually, there's a lot to like, and an argument could be made for a much higher price than today. On a final note, Sea should also be aided by the recent policy change coming from China's Central bank, the PBOC, and overall macroeconomic trends.

A Quick Recap

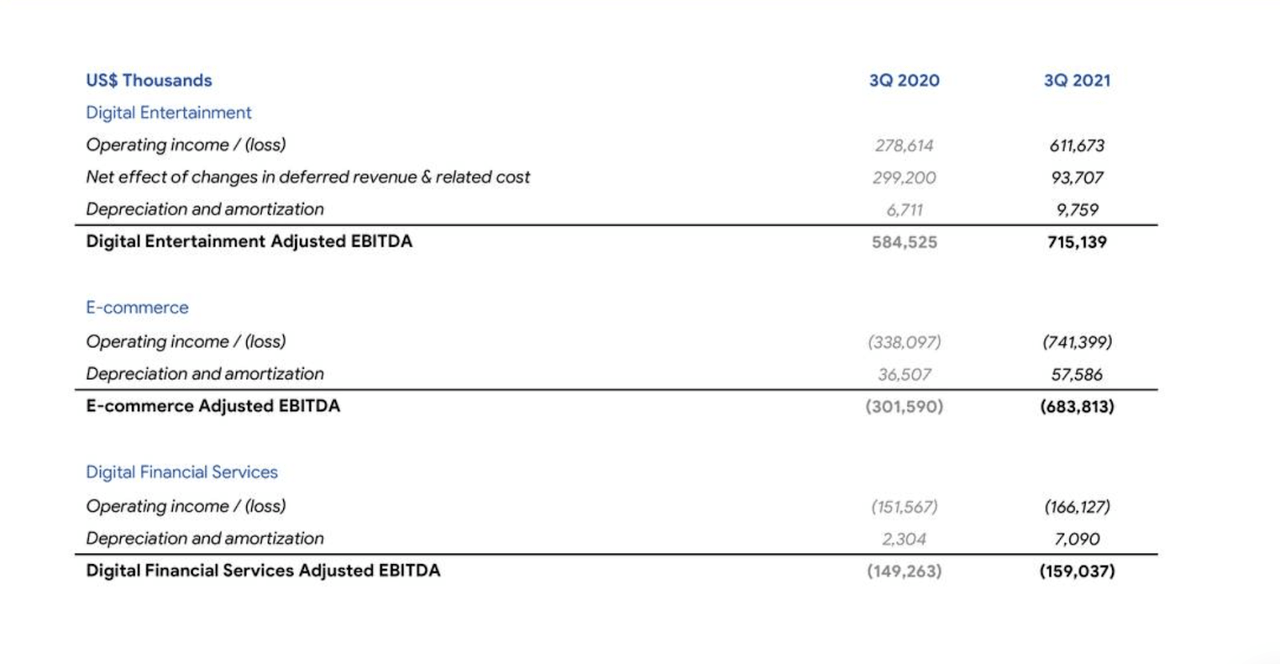

Sea Limited has three main segments; Digital Entertainment (Garena), Financial Services (SeaMoney) and E-commerce (Shopee). This is how they performed in the last quarter.

As we can see, Digital Entertainment is the only segment bringing in operating income. Meanwhile, eCommerce and Digital Finance are running at a loss. However, the growth rates at this point justify the investment. GMV for Shopee was up 81% YoY, and TPV processed through SeaMoney is up 111% YoY.

Despite strong growth across the board, Sea Limited has come down significantly in the last few weeks, providing us with a perfect opportunity to buy a stock with an incredibly appealing fundamental growth story.

Growth And Profitability Prospects

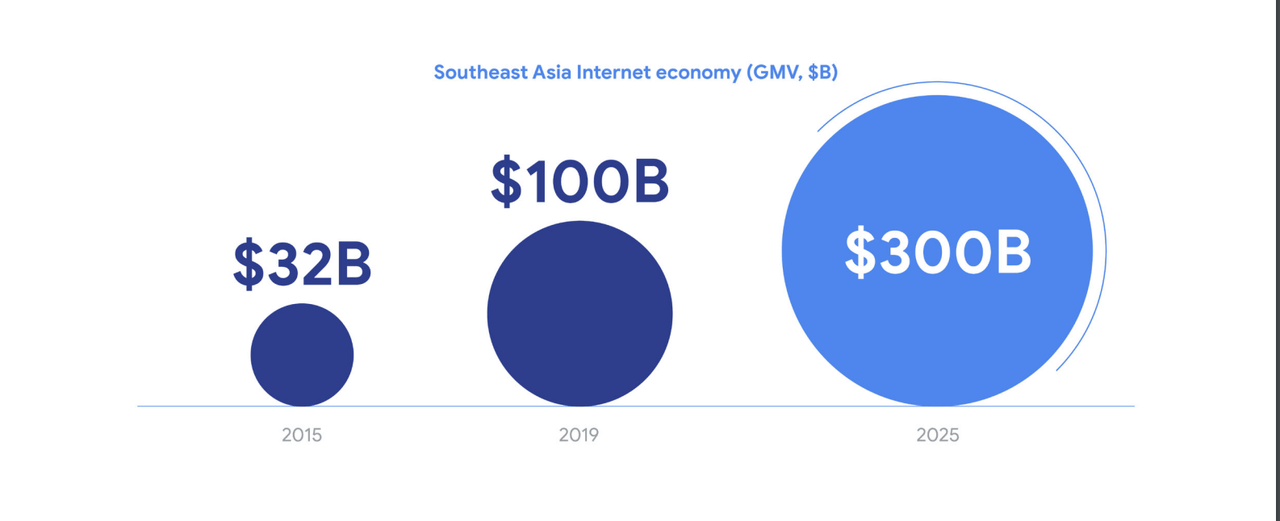

Firstly, let's talk about Sea's main geographical market; Southeast Asia. SEA economies are experiencing not just a fast level of growth, but also digitalization, which bodes incredibly well for SE.

By 2025, the Internet economy is poised to reach over $300 billion in GMV. Indonesia, Vietnam and Thailand will be amongst the fastest growing Internet economies, and these are all areas where the company has a strong presence. On top of that, Sea is also expanding into Latin America, where it has challenged and surpassed MercadoLibre (MELI) in some countries like Brazil.

Shopee and SeaMoney will grow hand in hand. As Shopee grows, more merchants and consumers will be pulled into the SeaMoney ecosystem, which not only allows digital payments but also helps merchants and consumers get financing. Of course, at the moment the company is focusing on expansion, but we know full well that both eCommerce and Digital Finance can be lucrative segments.

Garena, which is responsible for creating Free Fire, is on another path. User growth is slowing down, this is true, but there is still plenty of room for monetization. The company has made moves in the right direction here by releasing Free Fire MAX, a premium version of the game. In a recent article on Seeking Alpha,JR Research pointed out that Garena continues to increase the proportion of paying users to active users, which are also growing, albeit at a slower rate.

Comparative Valuation

With all that said, I do feel like sometimes Sea Limited gets judged unfairly, precisely because it has such a successful and profitable segment thanks to Free Fire. Investors often look at Sea's earnings and complain that they aren't growing fast enough, but this is not the company's objective. If Shopee or SeaMoney traded separately as "exciting and fast-growing start-ups" investors would be much less harsh with the valuation.

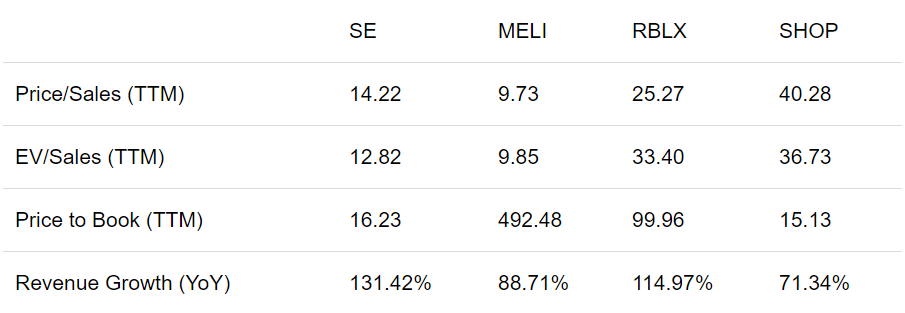

Sea Limited is a growth company in a growth economy, and it should be judged on its growth and revenue, not on its earnings:

Above we can see valuation ratios for Sea and what I consider to be some similar companies, though I am sure this will be a contentious point. Meli competes head-on with Sea in the eCommerce and fulfilment space. Roblox (RBLX) is an up and coming game/platform, and it is comparable to Free Fire. Shopify Inc.(NYSE:SHOP)has some unique characteristics, but it is also similar in many ways to Sea. It offers an eCommerce platform and helps merchants sell their products, and Shopify Pay is comparable to SeaMoney. Also, all of these companies are high growth companies through Sea is the best in this regard.

In terms of P/S and EV/Sales though, Sea is cheaper than the rest of these companies, except for Meli. Also, I like the fact that Sea has a Price/Book in line with that of Shopify. Arguably these other companies could be said to be overvalued, but the idea here is to compare these companies amongst each other.

Ultimately, Sea is growing incredibly fast, and though it isn't "profitable", we know that it's building a business model that will be. A P/S of 14 seems attractive given all of this and the ratio is below the more recent average of around 20.

Other Considerations

Some investors might think that, with the Federal Reserve tightening monetary policy, this is not a good time. The first issue here would be; how long can the Fed tighten? We've seen this play out before in 2018, and we know how it ends. More importantly though, while the Fed tightens, the PBOC is loosening monetary policy, as we saw the key benchmark lending rate cut last week.

What does this mean for Sea? The effects are unclear. Easy credit in the area will help the company and its customers, but what about exchange rates? Some of these countries try to keep pegs to major currencies, so this might not change. This would suggest that South Eastern economies might have to follow the Fed in tightening monetary policy to defend this exchange rate.

And lastly, what if COVID returns in full force? Again, the effects would be unclear. In many ways, Sea's business could be improved by this, even if the economy suffers overall.

Takeaway

Nothing much has changed for Sea Limited in recent months, except for its share price, and I'd be remiss if I didn't point out this buying opportunity. The company is expanding in all areas, and even increasing its profitability, though that is less important. I'm excited to see what 2022 holds for this stock.