Summary

- The eCommerce industry has been one of the industries that has suffered the most in the recent tech market sell-off.

- Both Shopify and Etsy have fallen victim to this, now standing down significantly from all-time highs.

- Both companies operate extremely lucrative business models with large Total Addressable Markets.

- I am taking a piece of both of these successful businesses at current valuations for the long-term.

eCommerce is undeniably one of the biggest market opportunities for the coming years and any company that takes a piece of this pie will set itself up for huge growth over the long run. Both Shopify (SHOP) and Etsy (ETSY) have had tremendous success in occupying those positions.

Many investors like to draw competition between the two companies, but I believe there is enormous potential and value in holding both of them. In this article, I am going to discuss why I am buying stock in both Etsy and Shopify.

The competitive edge - different focuses

In many ways, it's easy to see the argument that Shopify and Etsy are direct competitors. Both offer solutions for merchants to set up their own shops. Shopify does this by providing powerful sales tools and a complete system that allows sellers to set up their own websites with their payment systems. While Etsy provides sellers with the tools to join their expansive marketplace and the traction that comes with that.

While the solutions and offerings provided are similar, I believe both are meeting significant needs within the eCommerce industry. Etsy provides an immediate easy way to set up shop on the website with a small listing fee and gives sellers immediate access to 96 million active buyers on its platform. For someone who is looking to gain immediate buyer attention, this is really appealing. A risk that many investors discuss that faces Etsy is that when sellers scale on the platform, they can just transfer off to Shopify. However, when sellers grow their business on the platform, utilizing Etsy's name and seller features to get started, it's then very hard to transfer this off the platform. Add to this the fact doing so would remove numerous potential buyers who use Etsy every day - the platform becomes very 'sticky'.

Whilst Etsy saw active buyers start to flatline over the last few quarters, spend per buyer continued to accelerate, proving the marketplace's ability to retain its most valuable customer cohort. These buyers are incredibly valuable when the marketplace faces headwinds related to mass reopenings across the world.

Shopify, on the other hand, provides scale for businesses and empowers them to develop and create their own online store. The benefits of Shopify are the recurring revenue they attain from the subscription-based model, and the relatively lower fees paid in comparison to Etsy. Shopify also offers a broader range of services for merchants on the whole, creating numerous revenue pipeline opportunities.

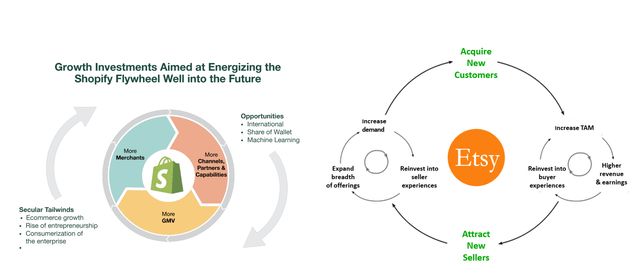

Both Etsy and Shopify have flywheel effects that are significant contributing factors in their success:

This is where the real benefits of the pandemic come into play, the double-sided nature of both businesses means the huge amount of traction they have received through this pandemic has really kickstarted the flywheel effect and will benefit both companies for years to come. It's this aspect of the business that underlines why the market has historically charged a premium to these names - operating models like these are very lucrative.

The competitive edge of both businesses was shown not only through the number delivered over the last two years but also through their ability to grow at a faster pace than the broader eCommerce market. This reinforces the thesis that when you are buying these businesses, you are buying a stake in some of the best that eCommerce has to offer.

Strong prospects

The asset-light model of both of these businesses also makes them attractive in the current economic environment. This may sound surprising considering how badly hit they have been over the last three months directly as a result of the macro environment and prospects of rising interest rates. I, however, believe they can mitigate the effects that many other tech plays may struggle with. Issues such as wage-related inflation won't trouble Etsy or Shopify. As we come through this initial turmoil, I believe the market is going to look for high-quality businesses with a history of operating excellence, the pair have this.

In many ways, I foresee a 'tech divergence' coming, where the highest quality tech names start to outperform peers. For the last two years, pretty much all of tech has had huge success, even though many have performed better than others. This symmetry has also occurred during this tech crash, where pretty much all tech firms have fallen victim. Looking forward, companies can't just rely on broader market sentiment as a tailwind, they have to deliver and I believe will be rewarded for doing so - Etsy and Shopify have the ability to be these businesses.

Valuation analysis

I have tabled some key comparison metrics below:

| Comparison metric | Shopify | Etsy |

| NTM EV/EBITDA | 128 | 25 |

| NTM P/E | 172 | 40 |

| NTM P/S | 18 | 8 |

| NTM Revenue Growth | 31.7% | 20.9% |

| NTM EV/Revenue | 14.38 | 11.9 |

| Return on Equity | 72% | 9.3% |

| Price/Free Cash Flow | 1256 | 21.22 |

| Debt/equity % | 8.2% | 150.6% |

Table compiled by Author using Refinitiv data

Etsy sits on far more attractive forward metrics such as EV/EBITDA and Fwd P/E ratio, however, also sits on more uncomfortable debt levels as a result of the acquisition of both Depop and Elo7 that was fueled bydebt. Shopify, on the other hand, has greater growth prospects and arguably stronger prospects to scale quickly from its current position. On the whole, from a financial standpoint, I find Etsy more attractive but the growth runway ahead for both companies cannot be understated and Shopify has the ability to deliver strong operating margins when it does move closer to maturity - which at this time is a long way off.

Conclusion - I am buying both

This has undeniably been an incredibly difficult period for the markets and tech investors in particular. The declines seen in eCommerce names are hard to stomach and it's difficult not to get caught up in all the negative sentiment.

However, it's important in this to take a step back and see the opportunity that has emerged at these prices for both Shopify and Etsy. Both businesses operate incredibly viable and profitable business models in a fast-growing space. The pandemic has provided a material inflection point for both companies that will set them up for significant growth over the coming years. The effect of the pandemic-related 'eCommerce transition' will not simply fade away. I see both stocks, sitting significantly down from all-time highs, as a 'buy'.