Bargain hunters may start to consider buying Apple stock on the dip, following the December selloff. Here is what they should know first.

Apple stock remains in a funk. Only one week to the dayafter I tossed around the ideaof trimming the position, shares of the Cupertino company dipped 7% from the $180 peak against the Nasdaq’s 4% decline, nearly entering correction territory.

A few brave investors and traders must be taking this opportunity to start buying the dip. The Apple Maven highlights three facts that these bargain hunters should keep in mind.

#1. Valuations are looking more attractive

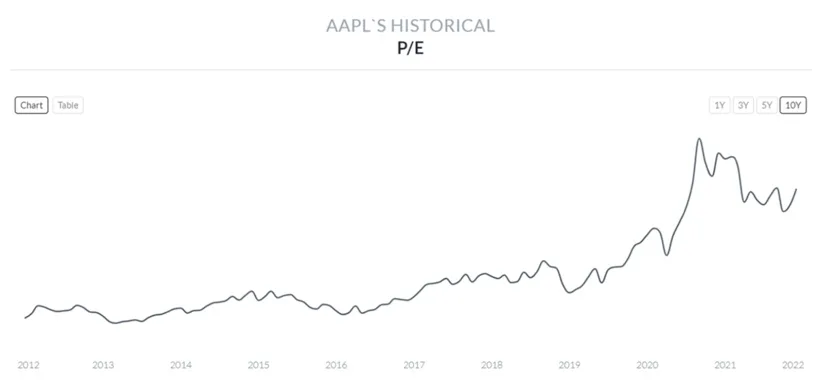

AAPL is far from being a dirt cheap stock. The price-to-earnings ratio today is still higher than it had been for at least the full decade prior to the start of the pandemic (see chart below). However, with the recent decline in share price but still resilient business fundamentals, valuations are starting to look more compelling.

The last read on the graph above shows a P/E of 29.0 times as of November 30. As of last check, on December 20, the fiscal 2022 multiple had dropped to 27.5 times. These are roughly the same levels of June 2020, after which Apple stock moved 85% higher in a year and a half.

#2. The deeper the hole, the higher the gains

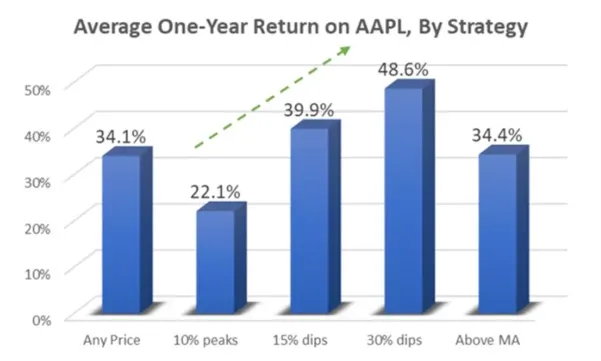

“Buy low, sell high”. The mantra may seem overly simplistic, but the strategy has worked wonders in the case of AAPL.

We have often mentioned here, on the Apple Maven channel, that shares of the Cupertino company do best when bought after a selloff. Historically, the one-year gains have been 22% when the stock is bought near a peak, but nearly 40% when bought after a 15% drawdown.

Could this time be different for dip buyers? I think not. To be clear, I do not believe that every stock is worth owning on weakness, as “40% of all stocks have suffered a permanent 70%-plus decline from their peak value”.

But in the case of Apple, it is highly likely that share price will eventually head higher again, shaking off short-term bearishness and chasing the strong business fundamentals. Having the patience to wait for the next rally is crucial.

#3. Don’t underestimate volatility

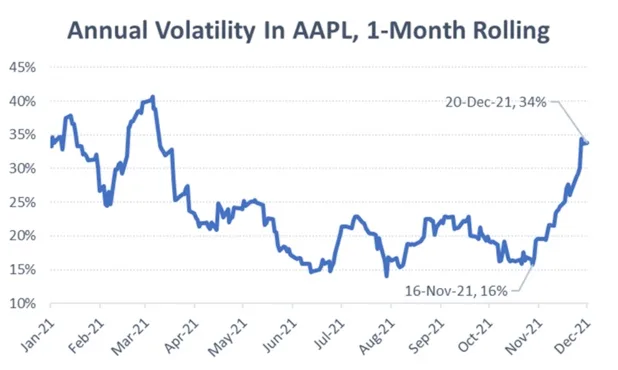

All the above sounds bullish at first glance, and an incentive to buy Apple at the current share price of around $168. But if doing so, I urge traders and investors to pay attention to volatility.

The emotional and psychological aspects of investing can be as important as the quantitative considerations, in my view. Those who buy dips must be willing to endure higher volatility, which has increased sharply for AAPL in the past few weeks — see below.

Because Apple stock price is likely to ricochet in the short term, some might be tempted to sell their shares prematurely, should they drop well below current levels. If buying AAPL, be sure to have a clear exit strategy to avoid falling victim to spur-of-the-moment decisions.