Central bankers are set to begin talking about easing bond purchases as soaring prices test patience.

WASHINGTON—The recent inflation surge gives Federal Reserve officials further reason to begin discussing an eventual wind-down of their pandemic-driven easy-money policies at their meeting next week.

A growing number of economists are becoming concerned that the Fed could fall behind the curve on inflation as it seeks to aid the labor market’s recovery. If that happened, the central bank would have to tighten policy more abruptly than economists and market participants currently anticipate, dealing a potential blow to the economy and fueling market volatility.

“The intensity of the current inflation and the current bottlenecks in supply chains and labor markets is greater than I had anticipated,” said former Fed Vice Chairman Donald Kohn, adding that he still shares the central bank’s belief that the inflation pickup is temporary. “But it also could be that the underlying demand-supply balance will not correct as readily or as comfortably as the Fed and I had expected earlier. It’s got my inflation antenna quivering.”

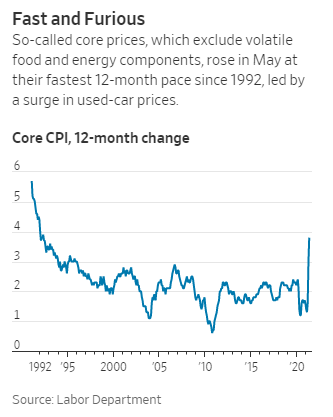

Consumerprices rose 5% in Mayfrom a year earlier, the Labor Department said Thursday. So-called core prices, which exclude volatile food and energy components, rose 3.8%, the largest annual jump since 1992. That followed strong price increases in April as well. The Fed seeks 2% inflation over the medium term, though it uses a different index as a gauge.

Central bankers note that the recent increase in inflation has been powered by an unusual combination of supply bottlenecks and pent-up demand from consumers emerging from their homes—pressures that should ease on their own later this year.

But Thursday’s data raise the stakes for the Fed as it begins to weigh pulling back on stimulative policies rolled out early in the pandemic.

Since last year, the Fed has held its key overnight interest rate near zero and has been buying at least $120 billion a month of Treasury and mortgage bonds. Its goal is to fuel the economy’s recovery by providing cheap credit.

Economists say the easy money is likely exacerbating some of the imbalances that are pushing up prices, since it fuels demand without directly boosting the supply of workers, cars or airplane tickets. A key risk is that price increases become large or persistent enough that consumers and businesses begin to expect and accept higher inflation. If that happens, the Fed would likely have to raise interest rates more than it currently anticipates to bring down those expectations.

For decades, the Fed relied on forecasts of inflation to guide its monetary policy, knowing that interest-rate increases or cuts can take months or years to filter through the economy. If the forecasts showed excessive inflation looming, the Fed tightened policy to prevent inflation from rising that much.

But last August, after more than a decade of below-target inflation, the Fed scrapped that strategy for one that prioritizes a strong labor market. Under the new strategy, if the economy is below full employment, the Fed will wait until it sees evidence of persistently above-target inflation before tightening policy.

Fed officials have said since December that they won’t raise interest rates until the labor market has returned to maximum employment and inflation has risen to 2% and is on track to rise moderately higher for some time.

They haven’t said how high they would be comfortable letting inflation go or for how long, but the sheer size of the recent price increases suggests it is on track to meet or exceed the Fed’s target sooner than was expected just a few months ago.

Central bankers have warned in recent remarks that they would act sooner if inflation becomes a problem.

Julia Coronado, a former Fed economist and president of MacroPolicy Perspectives LLC, said she doesn’t think recent inflation data call for the Fed to change course.

“These price pressures are very narrowly focused on things that seem like they will be obviously transitory,” Ms. Coronado said. “Think about this: We are at the most intense moment. It will not get more intense than this. We are reopening. We are blasting stimulus into the economy with a fire hose. We’ve got monetary policy at maximum stimulation.”

Mark Carney, a veteran central banker who led the Bank of England from 2013 to 2020 and the Bank of Canada from 2008 to 2013, said he sees growing evidence that the tightness in the U.S. labor market and related price pressures could extend beyond the short term.

“The prospect of inflation being above target for longer than the makeup of the past undershoot—I think the balance of risks is headed in that direction at this stage,” Mr. Carney said in a Brookings Institution event Monday.