The Mac and the iPad are back.Apple Inc. reported an extraordinary second quarter on Wednesday, with record results in every product category, including the biggest growth seen by the Mac and iPad in years. But investors are wondering how long it will last.

Apple reported fiscal second-quarter results that soared past expectations, with revenue coming in a whopping $12.5 billion above Wall Street’s estimates. Apple reported quarterly revenue of $89.6 billion, while analysts had been expecting $77.1 billion. Dan Ives, an analyst with Wedbush Securities, called it a “drop the mic” quarter for the company.

“We are extremely pleased to report record results for our March quarter despite continued uncertainty in the macro environment,” Apple Chief Executive Tim Cook told analysts on the company’s conference call.

In a bit of a surprise, Apple’s computing hardware sales grew at rates slightly faster than the iPhone, Apple’s biggest-selling product, as more people continued to purchase or upgrade computers to work from home. The iPad was hugely popular among students who are still stuck in remote-learnings classes.

Both the Mac and the iPad saw growth rates that have been unprecedented in recent years. Apple said the Mac had total revenue of $9.0 billion, up 70%, while the iPad came in at $7.8 billion, up 79%. The iPhone, in contrast, still remained king with the biggest chunk of revenue, $47.9 billion, up 65%, boosted by sales of Apple’s new 5G iPhone 12. It was Apple’s first full quarter with its newest iPhone.

Revenue for the Mac was an all-time record, and was an important boost after fiscal 2020 saw Mac sales decline in the first two quarters of that year.

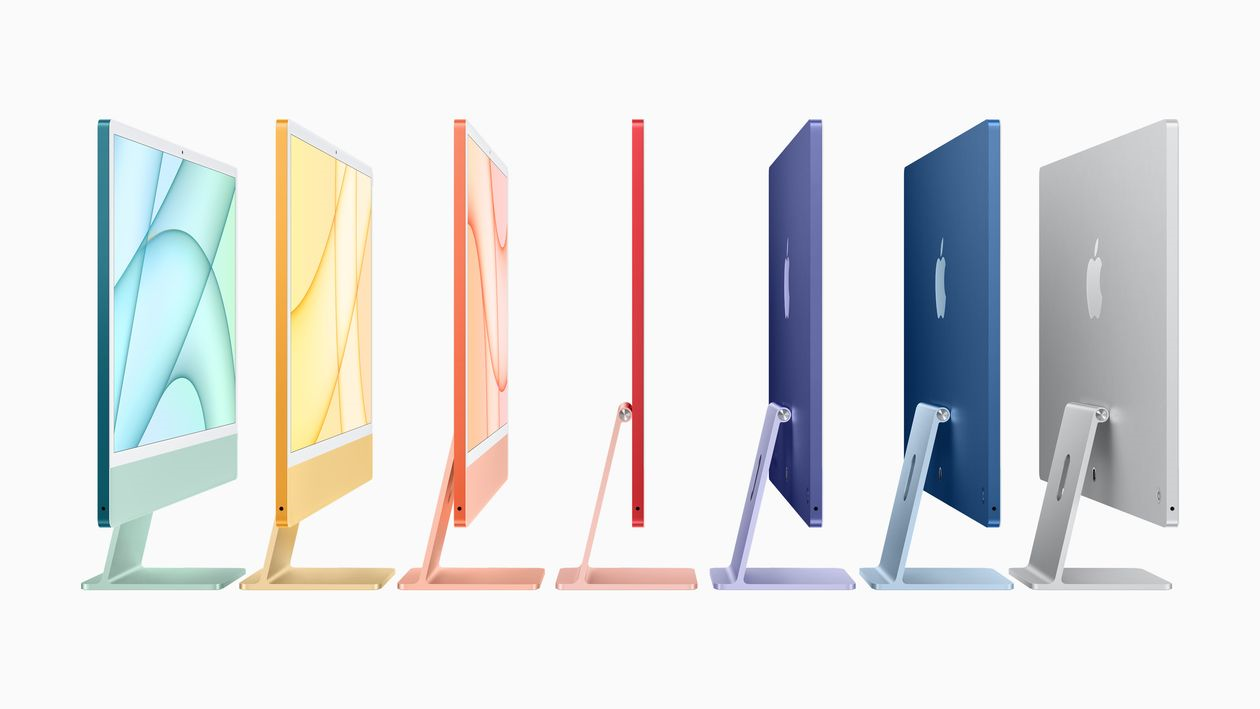

“This amazing performance was driven by the very enthusiastic customer response to our new Macs powered by the M1 chip,” Chief Financial Officer Luca Maestri told analysts. “IPad performance was also expanding with revenue of $7.8 billion, up 79%. We grew very strongly in every geographic segment, with an all-time record in Japan and a March-quarter record in the rest of Asia-Pacific.”

But the big question on everyone’s mind was: How long can the company sustain this kind of growth? Apple, for its part, declined to give any revenue forecast for the rest of the year, citing uncertainties related to the ongoing pandemic. Maestri did say that the company expects revenue to grow by strong double-digit amounts, year over year, but he also noted the traditional sequential decline in the June quarter from the March quarter will be greater than in prior years.

“This was a pretty unbelievable quarter, and investors are going to ask about the sustainability of current demand trends, especially as you lap some of the benefits from COVID, in areas like services and Macs later this year,” said Morgan Stanley analyst Katy Huberty during the call. “Which segments do you see the opportunity to maintain strong revenue growth, versus where is it reasonable to assume there will be some digestion as consumers shift their spending priorities?”

Cook said the company was seeing strong continued momentum with the iPhone, that it’s early innings for the Apple Watch, and its services segment is accelerating. He did point out though, that the component or chip-supply issues that are widespread across the industry would affect the Mac and iPad the most. “We’ll have some challenges in there, and challenges meeting the demand we have got,” Cook said.

The chip shortages are expected to hit Apple’s anticipated revenue in the coming quarter by between $3 billion and $4 billion, Maestri said.

Apple investors were clearly nervous about how the tech giant can outdo itself, and keep up with these huge numbers going forward. Shares in after-hours trading were up only 2.5%.

Investors are likely going to have to look to the iPhone for the big growth in the rest of the year, Ives wrote: “With 5G now in the cards and roughly 40% of its ‘golden jewel’ iPhone-installed base not upgrading their phones in the last 3.5 years, Cook & Co. have the stage set for a renaissance of growth in Cupertino.”

Whether that expected growth will match this quarter’s is another question.