Summary

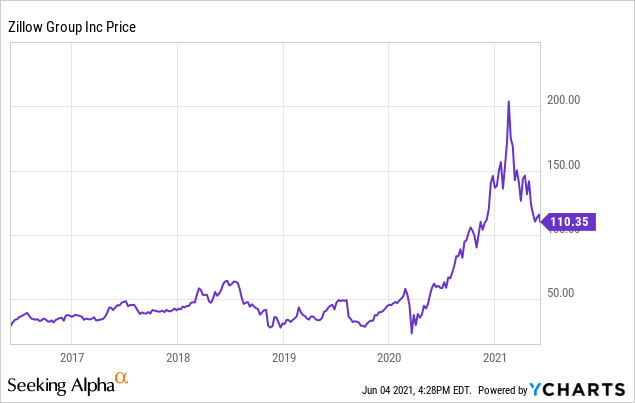

- Shares of Zillow Group have come down some 30% since my "Take Profits" article was published on Seeking Alpha.

- However, and despite a definite improvement in the latest Q1 EPS report, the stock looks to have a further downside to come.

- That is because margins are dismal, forward adjusted EBITDA guidance for Q2 was weak (lower than Q1), and the outstanding share count continues to grow.

- Yet, the stock still trades with a forward P/E of nearly 100x.

The Zillow Group (ZG) has, without a doubt, established itself as the #1 online real estate website and as one-stop shop for home-buying consumers. The company's recent pivot to what I'll call the iHome business (purchasing homes directly from consumers and then selling them on the open market) has been a positive catalyst of late in terms of revenue growth, and that business blends well with ZG's Mortgage Segment and Internet, Media, and Technology Segment. However, despite the recent and significant drop in the price of the shares, ZG still seem substantially overvalued in my opinion. That is because margins are - in a word - pathetic. In addition, Q2 guidance was weak and the company plans to hire an additional 2,000 employees this year. In my opinion, that will pressure margins even further through the remainder of the year.

Investment Rationale

Like many Americans, Zillow has become one of my favorite websites. I am surely not alone when it comes to frequently checking Zillow.com to see what the current "Zestimate" is for my home as well as for the homes I have owned in the past, and those of my friends and family.

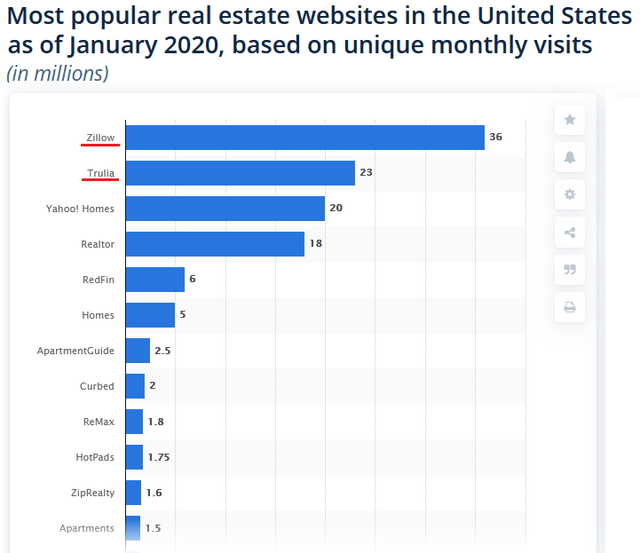

Indeed, marketing share data from Statista shows that Zillow is #1 in unique monthly visits, and Trulia - which the Zillow Group bought in 2014 - is #2. In aggregate that gives the Zillow group a stranglehold on the real estate website market (at least by the unique visits metric) at more than 3x the share as compared to what was once a highly competitive race with Realtor.com for consumers' eye-balls:

But of course there are other metrics to judge the popularity and use of real estate websites. Here is more recent data (April 1, 2021) from SimilarWeb.com:

When it comes to average visit duration, pages viewed per visit, and bounce rate (the % of consumers that only view one-page then leave the site), Zillow and Trulia again show impressive comps. That said, note there must be other metrics that figure into the SimilarWeb ratings shown above because - from these metrics alone - one could argue rightmove.co.uk has the best stats as shown. Regardless, this graphic is another indicator that the Zillow/Trulia brand is very strong and the market leader.

However, eye-balls aren't enough ... the views and activity need to be converted into profits, and that is where the Zillow Group is struggling in comparison to its rather lofty valuation.

Q1 Earnings

Zillow released its Q1 EPS report on May 4th. It was a strong report. GAAP net-income of $0.20/share beat estimates by a whopping $0.13. Revenue of $1.22 billion was a $120 million beat and was up 8% yoy. The company reported strong traffic on its website and mobile apps, with 221 million average monthly users (up 15% yoy) driving 2.5 billion visits during Q1 (up 19% yoy).

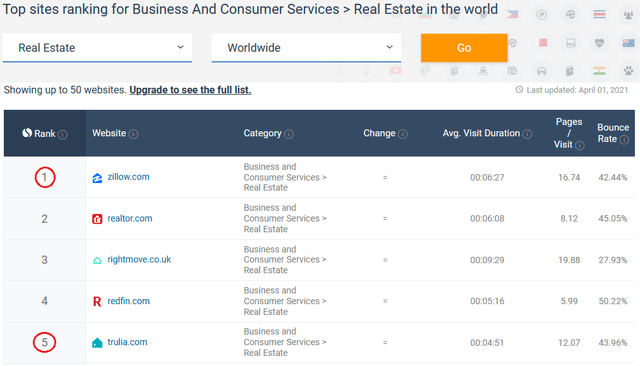

The most interesting segment in Q1 was the iHome (or what ZG calls "Zillow Offers") because it accounted for ~57% of revenue and is the segment Zillow is counting on to be is profitable growth engine.

However, as can be seen in the graphic below, the margins are - so far - quite puny:

As can be seen, the all-in return (after operating costs and interest expense) on the home buying/selling (flipping might be a better word) is a scant 4.94% of the average per-home revenue. That is despite what is generally considered to be a very hot-market real estate market across the nation. In addition, note the iHome business is a threat to the company's future growth aspirations because the pivot to iHome has pretty much cratered the company's Premier Agent business. The pivot also likely means more pressure on Zillow's advertising revenue which generally comes from the agents its iHome segment is now stealing away homes from. And all that for only 4.9% margins?

Going Forward

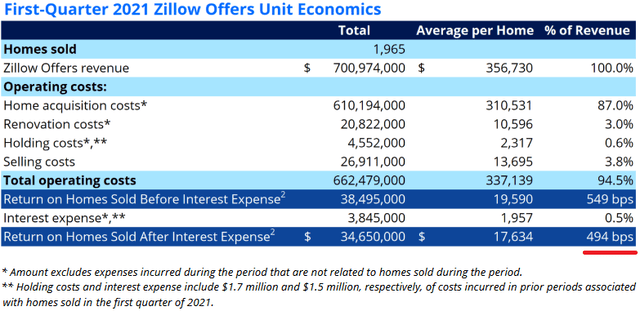

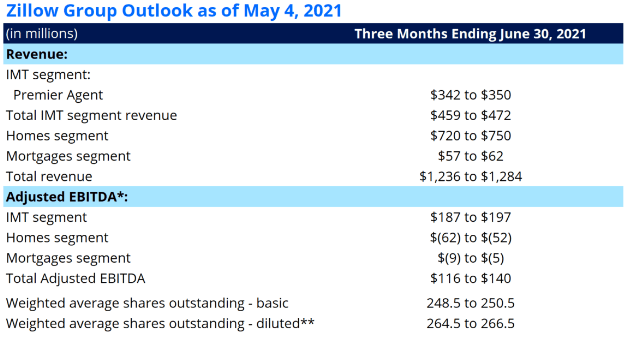

The chart below is the company's guidance for Q2:

At the midpoint of guidance total adjusted EBITDA ($128 million), note that will be down considerably from the $181 million in total adjusted EBITDA delivered in Q1.

In addition, note the weighted average share-count at the end of Q1 (it was not included in the Q1 EPS report, but can be found in the SEC 10-Q filing) was 259,346,000 shares (up a whopping 23% yoy). And that share-count is expected to continue growing to an estimated 265.5 million shares at the end of Q2 (based on the guidance shown above).

Valuation

So we have weak margins, falling adjusted EBITDA and a significantly rising number of fully diluted shares. Hmmmm.

Yet, despite the recent correction in the stock (note the stock is down ~30% since my Seeking Alpha article in March Zillow: Take Profits), the stock is still trading at a lofty valuation given the analysis of Q1 and Q2 guidance just presented. The Seeking Alpha forward P/E=97.7x.

That is obviously a rich comparison in terms of Zillow's growth prospects (or non-growth...) considering the weak Q2 guidance. In addition, it is not clear to me what the catalyst will be to improve the company's awfully small margins going forward. That is especially the case considering Zillow plans to hire an additional 2,000 employees this year, increasing its headcount by some 40%. In my opinion, this headcount growth will be a significant headwind when it comes to increasing margins. That is, Zillow is not able to demonstrate increasing margins as it tries to scale-up its operations.

Meantime, the pivot to iHome also means that ZG now has significantly more macro-level risks as it will be increasingly dependent on the ups (now..) and downs (coming...) of the housing market.

Risks

The risk of buying Zillow Group today is - in my opinion, a priced-to-near-perfection valuation level. I say "near perfection" because it was priced to perfection when I wrote my "Take Profits" article on ZG, and since it is down 30% since that piece was published, now I will simply call ZG a "rich valuation" proposition.

The goods news is that Zillow has a relatively strong balance sheet: it ended the quarter with $4.7 billion in cash (up from $3.9 billion at the end of 2020) after completing a $551 million stock offering during the quarter.

That compares to $2.259 billion in debt, which was down slightly from year-end. As a result, the company has an estimated $9.19/share in net cash based on the 265.5 million diluted shares outstanding at the end of Q1. And Zillow will likely need to keep a fair amount of cash in order to offset its higher risk profile due to direct exposure to the housing market. That is because history shows us the US housing market can change on-a-dime and could catch ZG holding a rather large inventory of homes.

Summary & Conclusion

While Zillow's Q1 report was certainly much improved on a sequential basis, the company's own Q2 guidance seems to be more indicative of the thesis I presented in my last article on the company. That is, the stock's valuation simply appears to be substantially out-of-whack in comparison to its demonstrated growth metrics. More shares, falling sequential adjusted EBITDA in Q2 despite a hot and highly appreciating housing market and ... well, I just cannot understand the current valuation level. As a result, I maintain the opinion from my previous article: I wouldn't be interested in ZG until it reached the ~$50/share level.

I will end with a five-year price chart of ZG and note that my $50 target is roughly where the stock was prior to the pandemic. Certainly the EPS reports issues since that time do not justify the rapid and substantial increase in the shares to $200 ... or, even the current $110 level.