The IPO market was relatively quiet ahead of the holiday week with seven IPOs raising $1.5 billion. 12 SPACs also priced. Two deals failed to get done: childcare giant KinderCare postponed, and Canada-listed Sangoma Technologies(SANG) terminated its proposed US offering. New issuers continued to join the pipeline in preparation for post-Thanksgiving launches, with nine IPOs and 13 SPACs submitting initial filings.

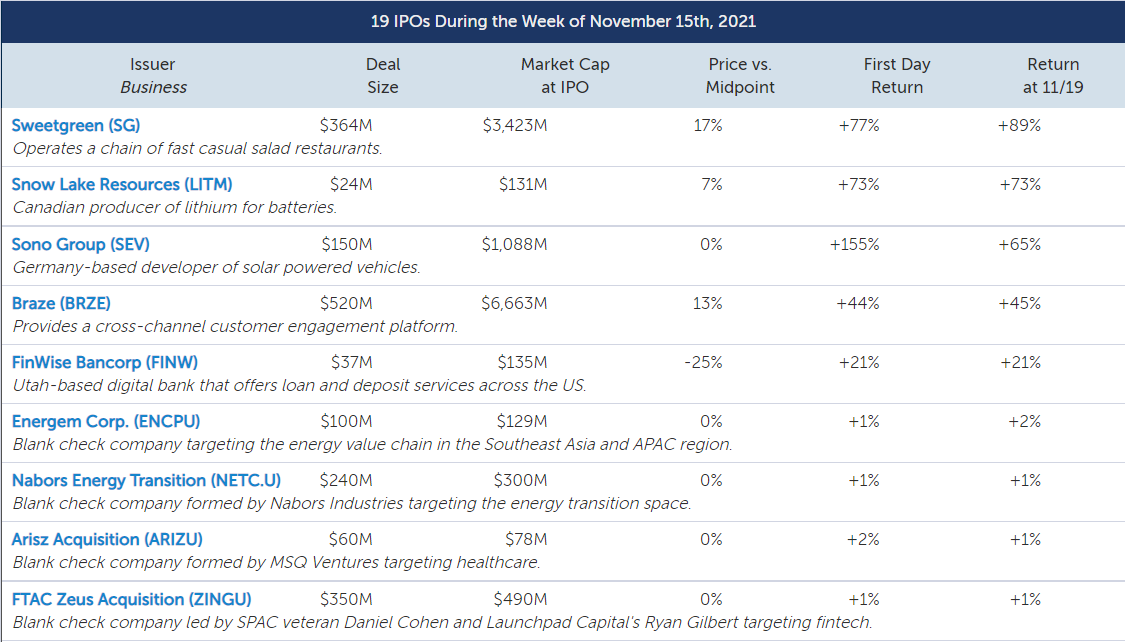

Fast casual salad chain Sweetgreen upsized and priced well above the range to raise $364 million at a $3.4 billion market cap. One of the fastest-growing restaurants in the US, Sweetgreen owns and operates 140 restaurants across 13 states and DC. While it is highly unprofitable, the company has a strong digital presence and plans double its store count in the next three to five years. Sweetgreen finished up 89%.

Germany-based Sono Group priced at the midpoint to raise $150 million at a $1.1 billion market cap. The company is developing what it believes is disruptive solar technology, as well as a solar and battery powered vehicle. Despite already accepting 16,000 pre-orders worth $390 million in net sales, it is not expected to reach commercialization until 2023, and will remain highly unprofitable for years. After popping 155% on its first day, Sono finished the week up 65%.

Braze priced well above the range to raise $520 million at a $6.7 billion market cap. Founder-led Braze provides a customer engagement platform used by businesses to improve their marketing. Unprofitable with strong growth, Braze serves over 1,100 clients with net revenue retention of 120%+ as of 7/31/21. Braze finished up 45%.

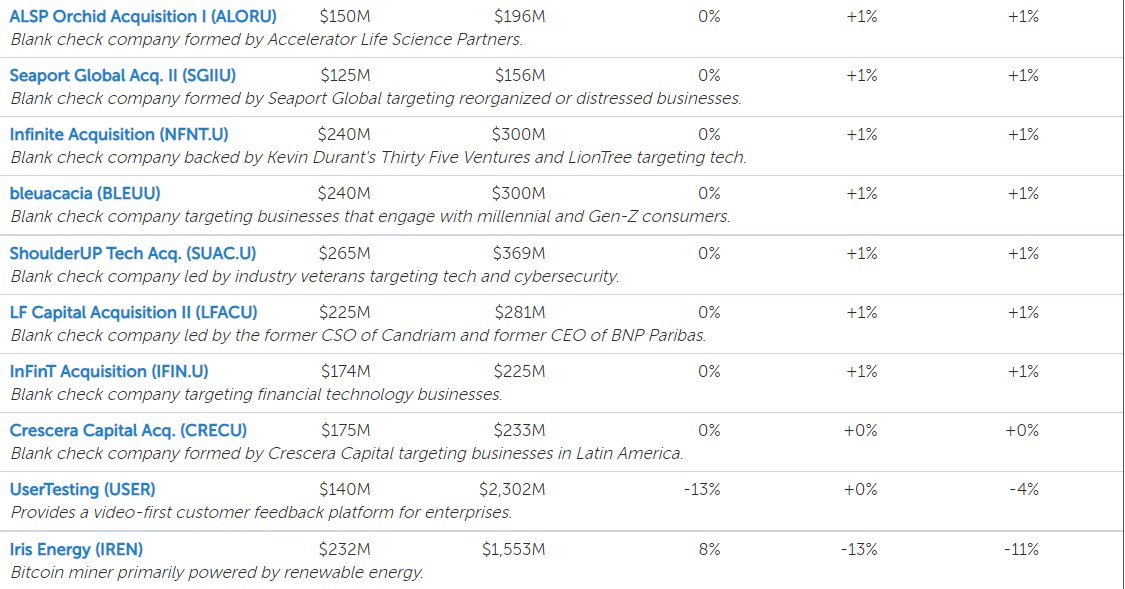

UserTesting downsized and priced below the range to raise $140 million at a $2.3 billion market cap. The company provides a video-first customer feedback platform for enterprises driven by capturing various human signals. While it has a diverse customer base and strong net dollar-based retention, the company remains unprofitable due to high S&M spend. UserTesting finished down 4%.

Australia’s Iris Energy , a Bitcoin mining company primarily powered by renewable energy, priced above the range to raise $232 million at a $1.6 billion market cap. Iris acquired its first site in British Columbia in January 2021. The company is dependent on the Bitcoin market, and while prices have risen near all-time highs, it remains highly volatile. Iris finished down 11%.

Utah-based digital bank FinWise Bancorp priced within the range to raise $37 million at a $135 million market cap. FinWise Bank makes loans to and takes deposits from consumers and small businesses across the US. As of 9/30/21, FinWise Bancorp had total assets of $338 million, total loans of $249 million, total deposits of $253 million, and total shareholders' equity of $69 million. FinWise finished up 21%.

Canadian lithium mining company Snow Lake Resources (LITM) upsized and priced at the high end to raise $24 million at a $131 million market cap. Snow Lake aims to focus sales to the EV and battery storage markets in the US and abroad. The company has a limited operating history and has not generated any revenue to date. Snow Lake finished up 73%.

12 SPACs went public led by Cohen and Gilbert’s fintech-focused FTAC Zeus Acquisition, which raised $350 million.

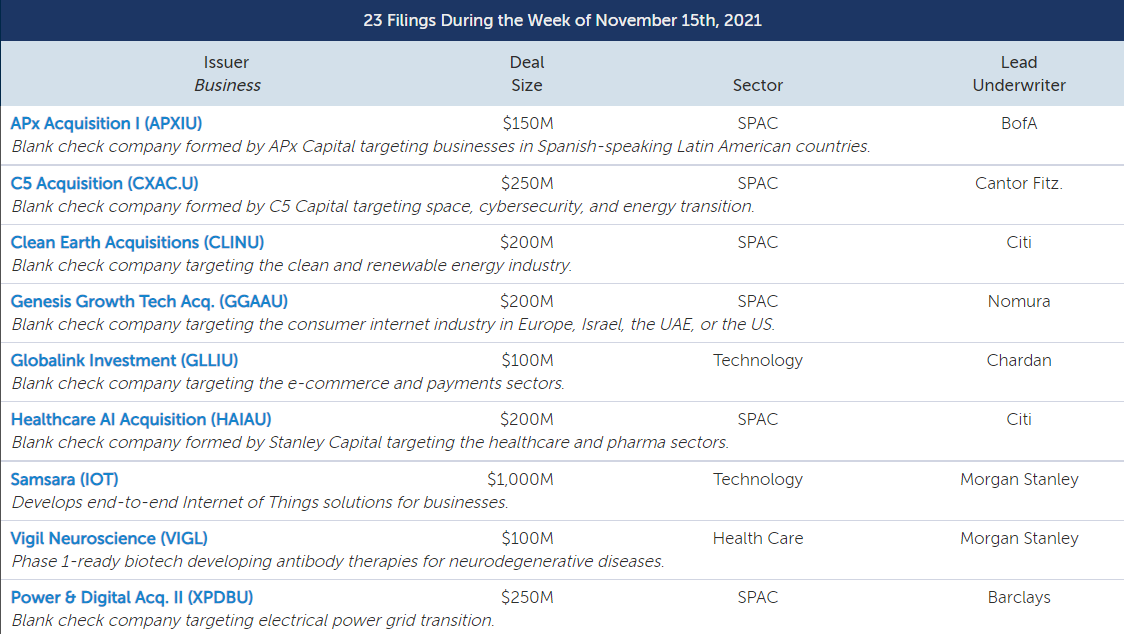

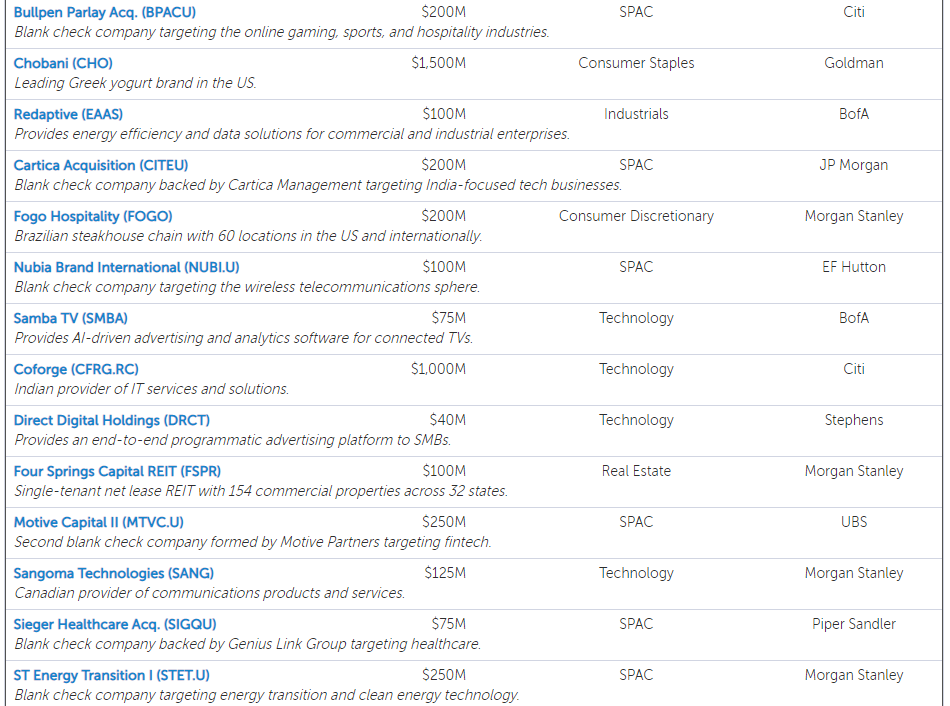

13 SPACs submitted initial filings, led by power-grid focused Power(PW) & Digital Infrastructure Acquisition II(XPDBU), fintech-focused Motive Capital II(MTVC.U), energy transition-focused ST Energy Transition I (STET.U), and national security-focused C5 Acquisition (CXAC.U), which all filed to raise $250 million.

The Renaissance IPO Indices are market cap weighted baskets of newly public companies. As of 11/18/2021, the Renaissance IPO Index was up 5.2% year-to-date, while the S&P 500 was up 25.3%. Renaissance Capital's IPO ETF (NYSE: IPO) tracks the index, and top ETF holdings include Snowflake (SNOW) and Uber Technologies (UBER). The Renaissance International IPO Index was down 20.0% year-to-date, while the ACWX was up 9.4%. Renaissance Capital’s International IPO ETF (NYSE: IPOS) tracks the index, and top ETF holdings include Meituan-Dianping and SoftBank.