‘Short-term reversal strategy’ often does particularly well in July.

June’s worst stocks are good bets to beat the U.S. market in in July.

That’s because portfolio window-dressing at the end of June will have made that month’s poor performers fall even further than they would have otherwise. It’s likely that once this artificial selling pressure disappears, these stocks will bounce back.

To be sure, window dressing is a powerful force on several occasions throughout the calendar, not just at this time of year. It should have the biggest impact at the end of December, since more investors look at their portfolio holdings in early January than in any other month of the year. Fund managers therefore go out of their way to sell their losers prior to Dec. 31 in order to avoid the embarrassment of having to report that they had ever owned them.

Just the opposite is the case for stocks that managers buy for window dressing. These are the stocks that already have been performing well and which managers want to show in their end-of-quarter holdings report. Their cosmetic buying will cause these stocks to perform even better — which, in turn, results in them falling back to earth once the new quarter comes around.

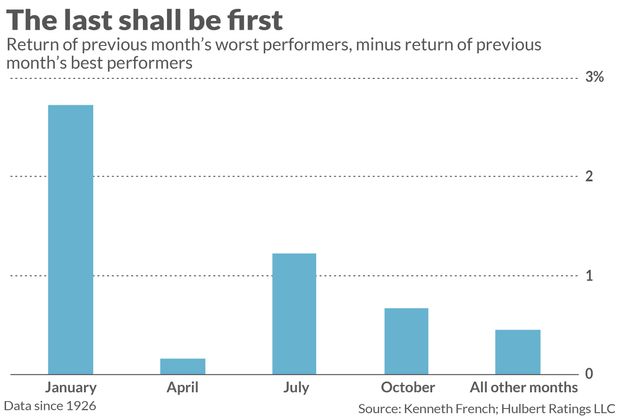

As expected, January is the month in which the previous month’s worst performers fare best relative to the previous month’s best performers — a pattern known as the “short term reversal effect.” This is illustrated in the chart below, which reflects monthly data back to 1926. July is the second-most powerful month for this pattern. That also makes sense because, after January, July is the next most common time for investors to read through their brokerage statements.

Also as expected, end-of-quarter window dressing is less of a factor at the end of the first- and third quarters. In fact, as you can see from the chart, the short-term reversal effect is even less dominant in April than in non-quarter-end months.

How to play the short-term reversal in July

As is often the case, an exchange-traded fund has been created to exploit the short-term reversal effect. Vesper US Large Cap Short-Term Reversal Strategy ETFUTRN,“seeks to capitalize on the tendency for stocks that have experienced sharp recent sell-offs to experience near-term rebounds.”

Because the fund was only recently created, in September 2018, the ETF’s average monthly returns since then are only suggestive of the long-term pattern. But its average return in July has been better (4.1%) than in any other month.

For anyone interested in the individual stocks that performed the worst in June, I constructed the following list. I started with the 50 stocks in the S&P 1500 index with the worst June returns, and then eliminated ones not currently recommended by any of the top-performing newsletters monitored by my newsletter-performance-tracking service.

The 15 stocks listed below survived this winnowing process. I note that, on average, these 15 lost 15.4% during the month of June, versus a gain of 2.3% for the S&P 500SPX.

- Adient PLC ADNT

- Alaska Air Group ALK

- Alliance Data Systems ADS

- America’s Car Mart CRMT

- ArcBest ARCB

- Goodyear Tire & Rubber GT

- KB Home KBH

- LCI Industries LCII

- Mosaic & Co .MOS

- Medifast MED

- Newmont Corp. NEM

- Organon & Co. OGN

- Patrick Industries PATK

- Regions Financial RF

- Sabre SABR

I also note that these stocks have an average price/book value ratio of 3.3, which is well-below the 4.7 ratio for the S&P 500. Having a below-average price/book ratio is the hallmark of a value stock, and it makes sense that value stocks will be favored by the short-term reversal strategy. That’s because value stocks significantly underperformed growth stocks in June — but their fortunes may soon change.