Summary

- This article analyzes Walmart from the perspective of its profit sustainability by the most important profit metric: return on capital employed (“ROCE”).

- The results show that WMT has been maintaining a respectable level of profitability with remarkable consistency.

- However, at its current prices, it has reached its full valuation and offers limited long-term returns under these current valuations.

Thesis and Background

This article analyzes Walmart (WMT) from the perspective of its profit sustainability by the most important profit metric: return on capital employed (“ROCE”). Note that ROCE is different from the return on equity (“ROE”) and is more fundamental and important than ROE. Because ROCE considers the return of capital actually employed, and therefore provides critical insight into how effectively the business uses its capital to earn a profit. A consistent and high ROCE is the hallmark of a business with a sustainable moat.

The results show that WMT has been maintaining a respectable level of profitability with remarkable consistency. However, at its current prices, it has reached its full valuation and offers limited long-term returns. A long-term return can be expected in the mid single-digit range under these current valuations. Given the consistency of the business, its financial strength, and the current low-yield macroeconomic environment, it is really a good substitute for treasury bonds as argued in my last article.

Moat and Profitability

WMT owns the world’s largest retail chain, operating a chain consisting of thousands of stores both in the US and globally. Its US operation consists mainly of 3,570 supercenters, 374 discount stores, 599 Sam’s Clubs, and 799 Neighborhood Markets. And its global operation consists of more than 6,100 stores.

Its sheer scale forms its most valuable moat. As an example, 70% of the U.S. population live within five miles of a WMT store, and 90% live within 15 minutes drive of one. Such extent of reach and scale provides a level of efficiency, cost-saving, and logistic superiority difficult to match by competitors.

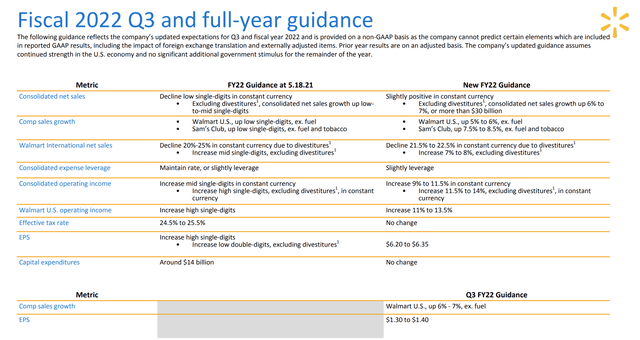

Protected by such a wide and durable moat, the business has been boasting a remarkable level of consistent profitability as to be elaborated later. And in the short term, the management is very confident and optimistic about the business. As seen from the chart below, management just raised their outlook guidance for the near year in the most recent earnings release. In terms of the topline, they expect WMT U.S. sales to go up 5% to 6% excluding fuel, and Sam’s Club sales go up 7.5% to 8.5% excluding fuel and tobacco.

In terms of the bottom line, they expect the consolidated operating income to go up by 9% to 11.5% in constant currency and raised the EPS guidance to $6.20 to $6.35. Finally, the business has been investing and growing its eCommerce aggressively in recent years. Sales from eCommerce have more than doubled, up 103%, over the past two years.

Long-term return and ROCE

After addressing the debt concern, let’s move on to analyze potential returns. If you, like this author, are a long-term investor who subscribes to the concepts of owner’s earnings, perpetual growth rate, and equity bond, then the long-term return is simpler. It is “simply” the summation of the owner’s earnings yield (“OEY”) and the perpetual growth rate (“PGR”), i.e.,

Long-Term ROI = OEY + PGR

Because in the long term, all fluctuations in valuation are averaged out (all luck at the end even out). And it doesn’t really matter how the business uses the earnings (payout as dividends, retained in the bank account, or repurchase stocks). As long as used sensibly (as WMT has done in the past), it will be reflected as a return to the business owner.

OEY is the owner’s earnings divided by the entry price. All the complications are in the estimation of the owner’s earnings - the real economic earnings of the business, not the nominal accounting earnings. Here as a crude and conservative estimate, I will just use the free cash flow (“FCF”) as the owner’s earning. It is conservative in the sense that rigorously speaking, the owner’s earnings should be free cash flow plus the portion of CAPEx that is used to fuel the growth (i.e., the growth CAPEx). At its current price levels, the OEY is ~4.1% for WMT (~24.4x price to FCF).

The next and more important item is the PGR. To understand and estimate it, we will need to first estimate the return on capital employed (“ROCE”). Note that ROCE is different from the return on equity (and more fundamental and important in my view). ROCE considers the return of capital actually employed, and therefore provides insight into how much additional capital a business needs to invest in order to earn a given extra amount of income – a key to estimating the PGR. For businesses like WMT, I consider the following items capital actually employed:

1. Working capital, including payables, receivables, inventory. These are the capitals required for the daily operation of their businesses.

2. Gross Property, Plant, and Equipment. These are the capitals required to actually conduct business and manufacture their products.

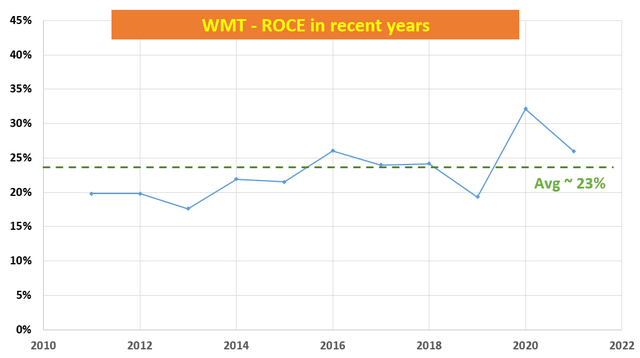

Based on the above considerations, the ROCE of WMT over the past decade is shown below. As seen, WMT was able to maintain a quite respectable ROCE at the beginning of the decade: on average 23%. To put things in perspective, as detailed in my previous articles for Lockheed Martin (LMT) and General Dynamics (GD), ROCEs for these defense business leaders, who almost enjoy a monopoly moat, are also “only” in the range of 20% to 30%. And also note that the ROCE has been remarkably consistent, only fluctuating within a narrow range between 20% and 27.5% most of the time – a hallmark of a business with a stable and durable moat.

Reinvestment rate and long-term return

In the long term, the growth rate is given by: PGR = ROCE * Reinvestment Rate. We’ve examined OEY and ROCE in the above section already. So the last piece of the puzzle to the long-term return is the reinvestment rate, i.e., the fraction of income that business reinvests in itself to fuel future growth. For WMT, the fraction has been about 5-10% in recent years.

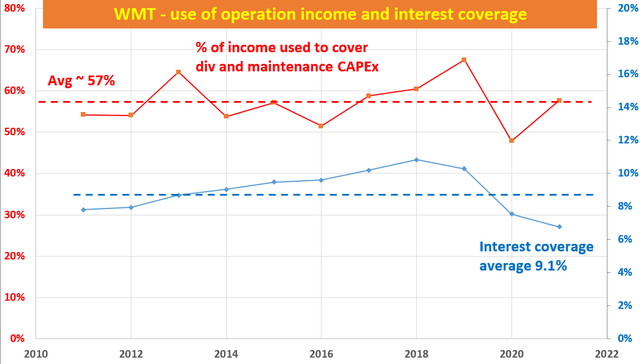

The following chart shows more details of the capital allocation decisions of the business in recent years. The business is in a very strong financial position, as shown in the chart. It is essentially debt-free thanks to its strong cash generation capability. Its interest coverage (EBIT divided by interest expense) is current than 14.7x. In other words, it only takes less than 6.8% of its EBIT income to cover its interest expenses.

In contrast, the interest coverage for the overall market represented by SP500 is about 6x. Also as shown by the orange line in the chart, thanks to its strong profitability (and stable return on capital as aforementioned), it only takes about 57% of the operating income to cover its dividend after covering maintenance CAPEx. As a result, WMT enjoys quite a bit of flexibility in terms of capital allocation. It has plenty of organic cash to fuel future growth and it’s a matter of identifying such growth areas (such as its e-commerce in recent years).

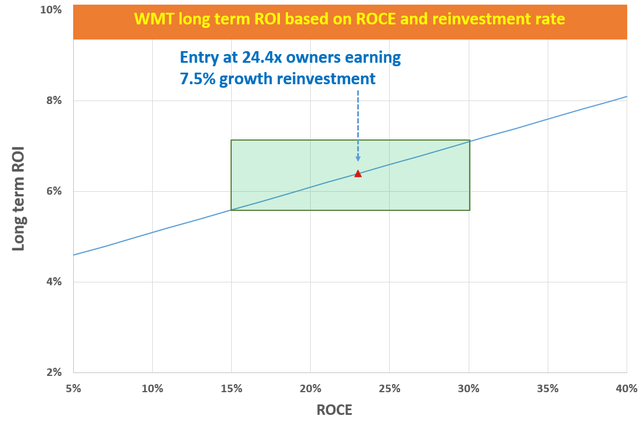

With a 23% ROCE, it means that even if WMT reinvests 10% (the upper range in recent years) of its earnings to expand the capital employed, it could maintain a 2.3% PGR (PGR = ROCE * fraction of earnings reinvested = 10% * 23% = 2.3%).

Now we have both pieces of the puzzle in place to estimate the long-term return. At its current price levels, the OEY is estimated to be ~4.1% for WMT, and the PGR is about 2.3%. So the total return in the long term at the current valuation would be a mid-single-digit around 6.4% as shown in the chart below. Also as seen, even when ROCE fluctuates somewhat, the fluctuations wouldn’t change the long-term return dramatically.

Conclusion and final thoughts

This article examines WMT’s profit sustainability by the most important profit metric: return on capital employed (“ROCE”). ROCE considers the return of capital actually employed, and therefore provides critical insight into how effectively the business uses its capital to earn a profit. A consistent and high ROCE is the hallmark of a business with a sustainable moat.

The results show that WMT has been maintaining a respectable level of profitability with remarkable consistency. Its ROCE has been remarkably consistent, only fluctuating within a narrow range between 20% and 27.5% most of the time over the years – a hallmark of a business with a stable and durable moat.

However, at its current prices, it has reached its full valuation and offers limited long-term returns. A long-term return can be expected in the mid-single-digit range of about 6.4% under these current valuations, consisting of about 4.1% from the owner’s earnings yield and 2.3% from long-term organic growth.

As such, it is certainly not a stock I would recommend to investors mainly seeking capital appreciation. But given the consistency of the business, its financial strength, and the current low-yield macroeconomic environment, it is a solid choice for conservative investors seeking reliable dividend income. In other words, it is a good substitute for treasury bonds as argued in my last article.