A new month is off to a bullish start, or so it seems, as stock futures climb following Friday’s better-than-expected,916,000 gain in March jobs, which underpins investor hopes for a strong post-COVID-19 rebound.

As for the data, there’s a lot to like, according to Tim Duy, chief U.S. economist at SGH Macro Advisors.

“Assuming the pandemic only comes under greater control this year, I suspect a substantial impediment limiting the pace of job growth this year will be the pace at which firms can hire employees. Firing is easier than hiring and employers are now scrambling to add workers,” Duy told clients in a note.

Hence, watch for those “we can’t hire worker” stories, to come, he says.

Onto our call of the day from Fundstrat Global Advisors’s founder Thomas Lee, who says the “face ripper” rally he recently predicted shows no signs of easing up. And there’s a $4.5 trillion reason to believe gains will carry into April, he told clients.

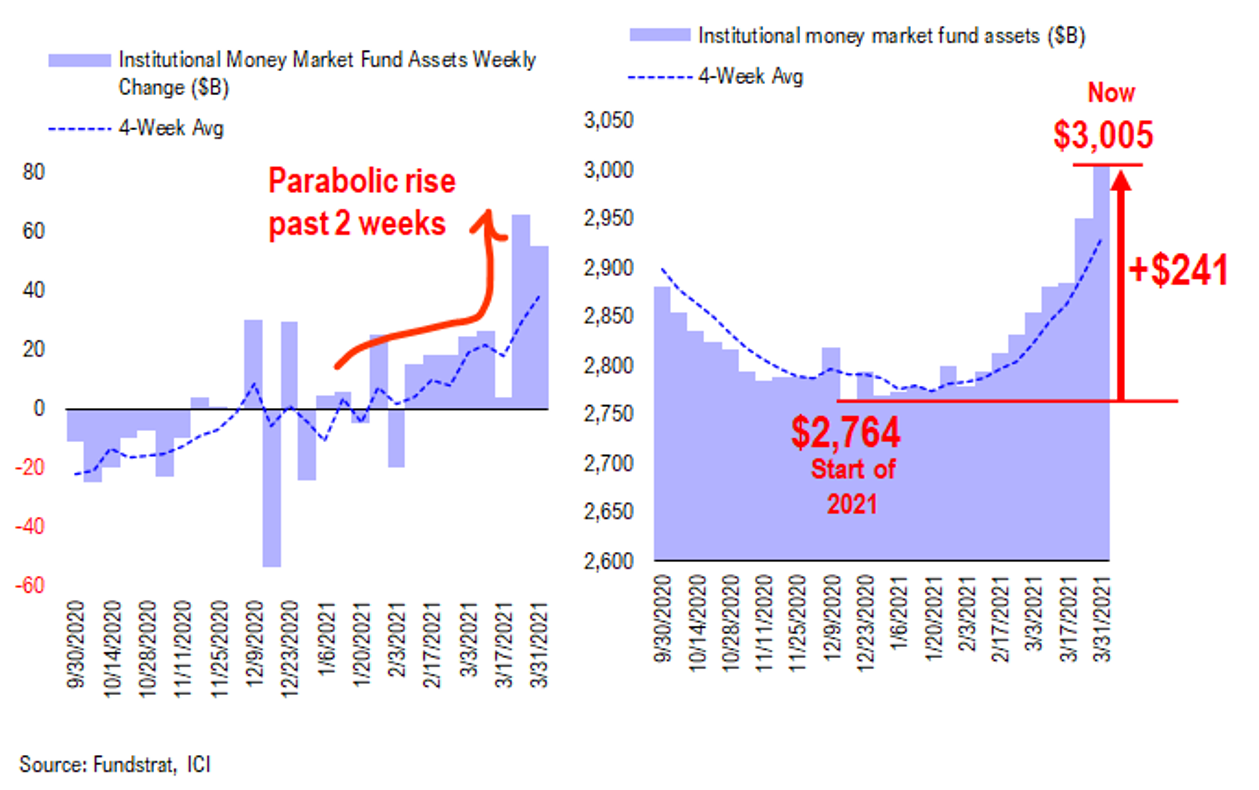

Aside from the positives out there already for this market — a strong economy and vaccine rollout — Lee points to a pile of institutional money on the sidelines, with cash balances at $3 trillion, the highest since June 2020. That’s against $2.764 trillion at the start of 2021, a “dramatic” gain of 9% or $241 billion, said Lee.

A cautious stance by institutions that went “parabolic” in the last half of March, adds to the $1.5 trillion in retail money market cash.

“Total cash on the sidelines is $4.5 trillion = tons and tons of firepower on the sidelines. This bodes well for April equity gains,” said Lee.

Lee expects small-caps, energy and cyclical stocks — geared toward an economic recovery — to continue leading into the second quarter.

“Recall that cyclicals are only 33% of the S&P 500 overall weight and more than 60% of the Russell 2000 index. So if Cyclicals, aka Epicenter, work, small-cap stocks will outperform,” he said.

Watch this chart

Adam Kobeissi, founder and editor in chief of The Kobeissi Letter, expects the bullish jobs report to send the S&P 500 to 4,035 to 4,050 in the near term, but from there he’d like to see it pull back to 3,950 to 4,000, to set up for another higher low before a move toward 4,100.

“Therefore, we are remaining on the sidelines to start this week, as stepping in front of a market this strong is not a stance we want to take, and will maintain a medium term bullish outlook with the intention of getting back into our bullish positions in the wake of a drop in the market,” Kobeissi told subscribers.