What Happened:Moderna Inc closed 5% higher Friday after it was announced the U.S. FDA had authorized its COVID-19 booster shot for adults 18 and older.

This is welcome news for bullish traders as the stock has been slumping after the earnings miss on Nov. 4 that had seen the stock drop from $345 down to $211 before bouncing.

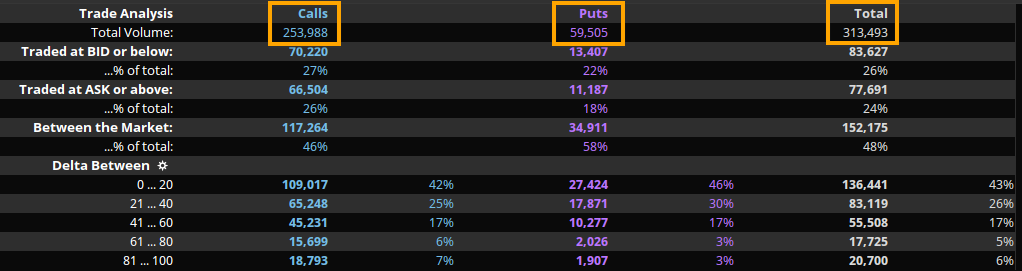

While the stock is trading above-average volume Friday with over 13 million shares versus its 10-day average of 8 million, option traders have been quite active, trading over 313,000 contracts (image below).

Of those 313,000 options, 80% of them have been calls, which is significant and suggests option traders have a bullish bias on the stock.

About 34% of the 860,000optionsare set to expire Friday (~292,000) options, thus a good portion of today's flows could be positions being closed or rolled as almost half of Friday's volume is short dated.

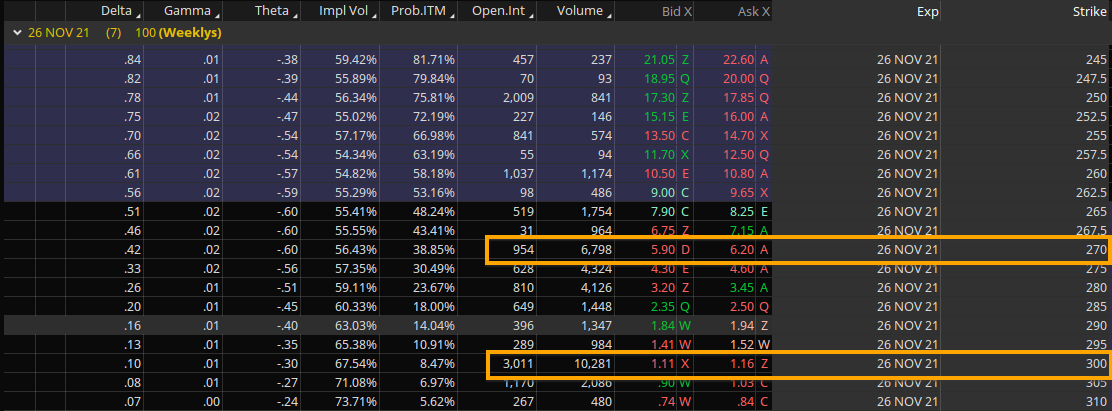

What's Next: The largest expiry by volume is for the Nov. 26 expiry with significant volume at the $270 and $300 strikes (image below).

Beyond that, there isn't much interest past the $305 strike. Meanwhile, support may come in around the $260 and $250 strikes should the stock start to pullback.