The Apple Maven presents three reasons why Apple stock may be a better pick than Amazon today.

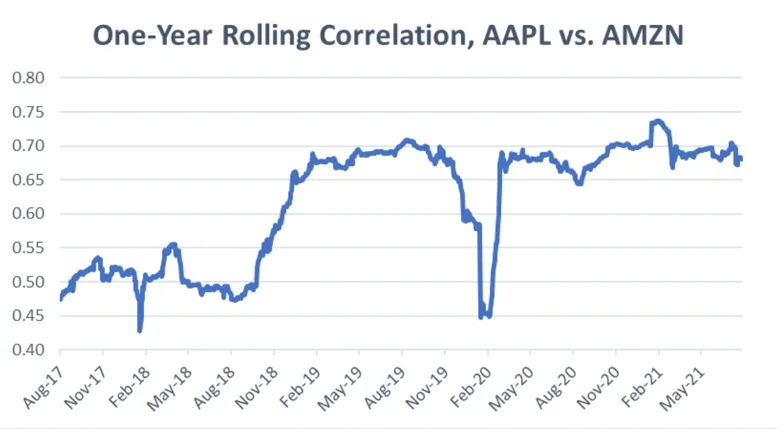

Amazon or Apple stock? Maybe picking one over the other might not make too much difference, since both have behaved similarly, especially in the past year or two. See the rolling one-year correlation chart below – the closer to +1, the closer the stocks’ daily returns track each other.

But today, the Apple Maven presents three reasons why AAPL may be a better bet compared to its peer AMZN. For those interested, our sister channel Amazon Maven will soon take the other side of the argument. Check out both theses to determine which makes most sense.

#1. Post-pandemic outperformer

Since reporting Q2 earnings, Amazon stock has failed to gain any lift. The culprit has been a sharp deceleration in the online store’s revenue growth rate. Amazon has proved that the pandemic period was particularly beneficial for the company’s e-commerce business, but that the party might be over.

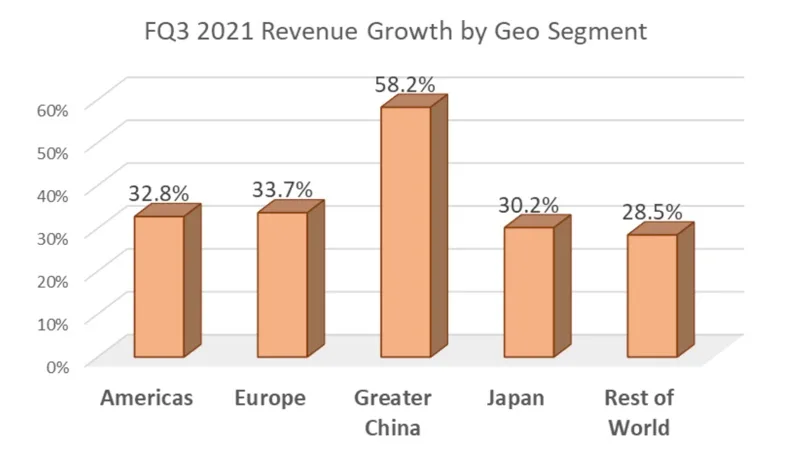

The opposite has happened to Apple. While the more pessimistic analysts believed that the post-pandemic environment would be a headwind to the company’s financial performance,Apple proved them wrong: astounding revenue and earnings growth of 36% and 101%, respectively, in fiscal Q3.

#2. Valuations more appealing

In absolute terms, it is undeniable that Apple stock is a more affordable play than Amazon. The chart below shows how AMZN is substantially more richly valued than Apple, both in terms of trailing earnings (nearly twice more expensive) and free cash flow (substantially more expensive).

In an environment in which assets are not priced for perfection, paying a bit more for what one might consider a better stock could make sense. But during a period like the current one, in which equity valuations seem stretched thin, being a bit more conservative on the price tag may be the best approach.

#3. Underappreciated growth

Lastly, Amazon has been growing its top and bottom lines at a faster pace than Apple – and analysts expect this to still be the case going forward,according to Seeking Alpha. However, while Amazon’s growth opportunities in e-commerce and cloud seem to be well-understood, Apple stock price may not properly reflect the company’s two- to five-year growth potential.

The Cupertino company could be introducing a new mixed reality headset next year or in 2023,followed by an Apple Car that could drastically change (improve?) the company’s financial performance.Valued at an attractive current-year P/E of 25 times, I suspect that the market has not properly factored these opportunities into the share price.