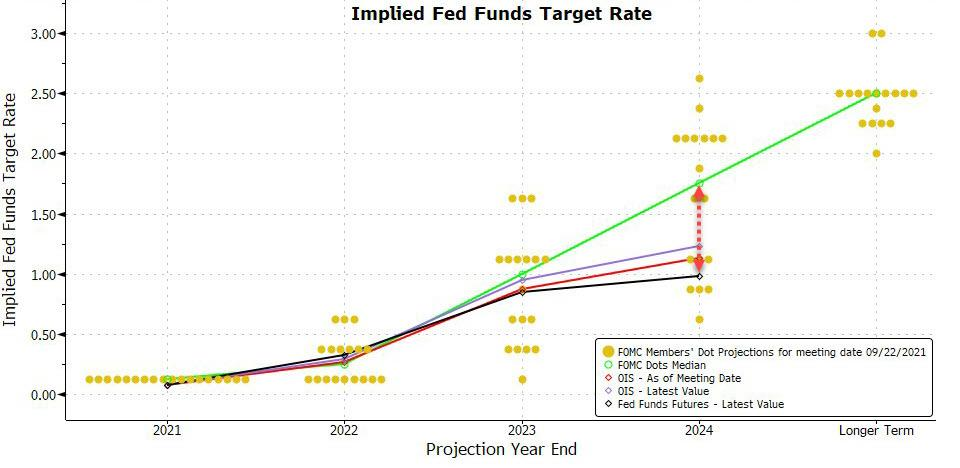

In the end, despite a generally unexpected upward shift in the FOMC dots which pushed the median 2022 dot to indicate one rate hike next year (and another 2 each in 2023 and 2024), the outcome was not nearly the "hawkish surprise" that Nomura'sCharlie McElligott warnedcould tip the market sharply lower... or higher (especially since the market believes that the Fed will end its hiking plans well before they are fully executed, giving the Fed just 1% of breathing room).

- November taper in-line

- Taper length marginal surprise with goal to end mid-year, but still implies near the “expected” $10B / $5B per month reduction

- Where a more “hawkish” dot plot is being viewed somewhat skeptically by the market on account of “a lot of hikes in a short period of time” with 6.5 hikes by end ’24, in addition to upcoming voter / non-voter member turnover which muddles dovish / hawkish balances of voters

- Continued “both sides of mouth” language from Powell, yet again going out of his way to separate the “end of tapering” from the beginning of rate hikes, while noting the policy rate as still accommodative)

All-in, McElligott called the announcement a “low surprise” Fed, which cleared us of “event-risk” while avoiding any sort of “(hawkish) Rate Shock,” as 10Y yields continue their chop inside the well-established range "despite obvious impacts on curves of course, as front (Reds) through belly reprices further, while long end / duration rallied and closed at best levels on the day—because ultimately, taking multple steps closer to removing accomodation ultimately means “tighter financial conditions” that will moderate the economy down the road."

Indeed, one look at the 10Y year today suggests that the market is finally waking up with the 10Y surging to 1.40%, the first time since July.

So with a removal of the primary catalyst for larger rate volatility, the Nomura strategist notes this also "further closes the recent (and awesome) “window for volatility expansion” within the Equities Vol complex, which opened around last week’s Op-Ex cycle turn, and brought with it incredible (and long-awaited) Vol / Stock movement (SPX -4.1% in 3 days hi / lo)."

This then takes us back to a point McElligott has made repeatedly in recent days, namely the “conditioned per back-test”appearance of“reflexive vol sellers”in arresting the crescendoing US Equities selloff peaking which were cratering Monday afternoon, which materialized most notably in the form of Put sellers harvesting rich downside Vols into the accelerating drawdown, in addition to funds monetizing their actual downside hedges, both of which Nomura pointed out beforecreated lots of Delta to buy in the process which then rallied the tape off the lows into the closing bounce

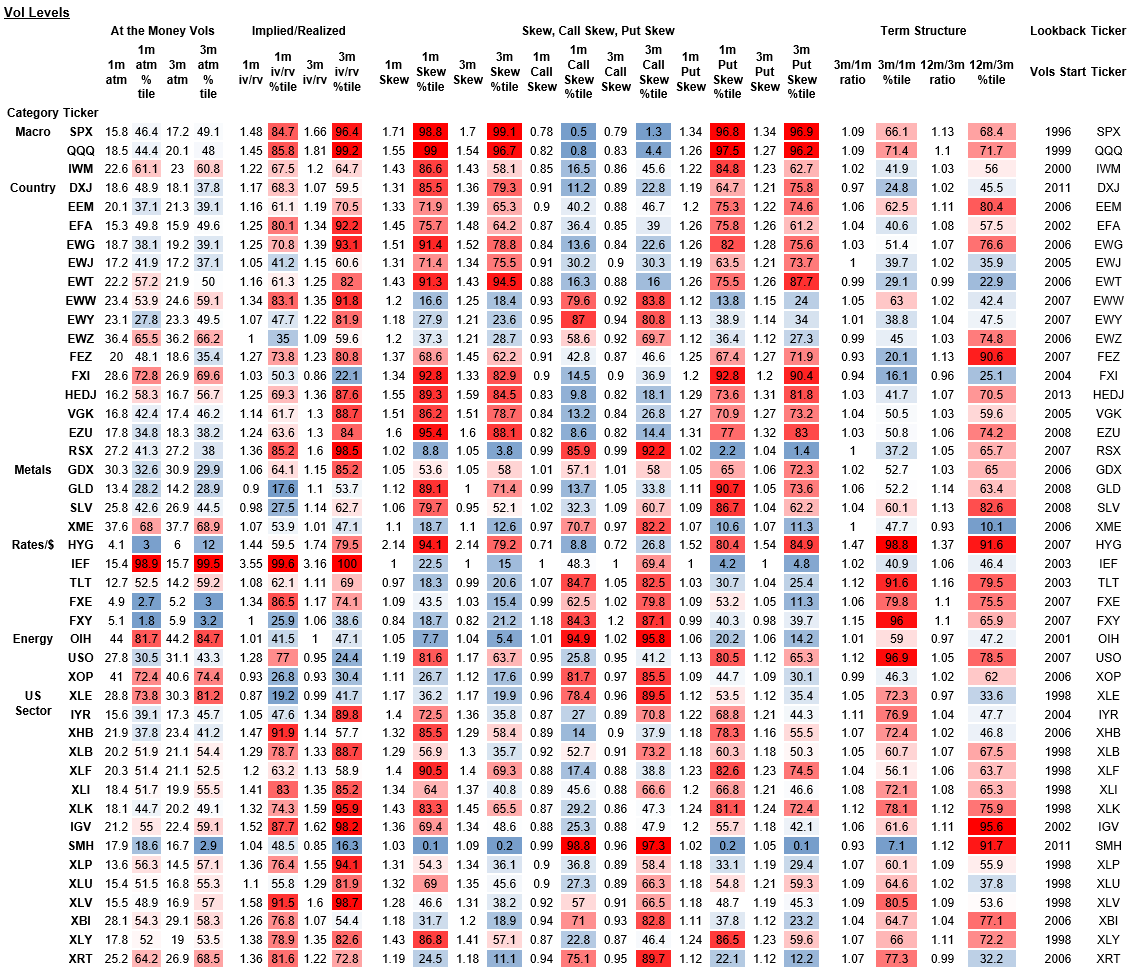

However, in a notable departure from this downside Vol harvesting and hedge monetization, one small, baby-step positive development observed by Nomura is that theSPX Put Skew has come off that prior 99.9%ile “boil”and inflected into something at least a touch less extreme, with McElligott now seeing SPX 1m Put Skew @ 96.8%ile / 3m Put Skew @ 96.9%ile, down from near record highs.

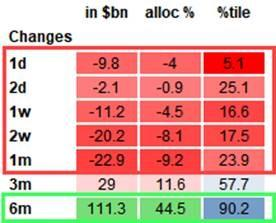

Additionally, the bank continues to seemore profit-taking from “long vol” positions in the VIX ETN space,with the Net (long) Vega position over the past week having decreased by 8.1mm as traders monetized into the Vol spike.

Perhaps most notably, we have also witnessed saw the appearance of some rare buyers of equity upside vol yesterday into the rally, when about an hour into yesterday’s US cash session, 3 large SPY Call Spreads traded,creating ~$1 billion of Delta to buy across aggregated hedges:

- Buyer of 43k SPY Oct 443/452 Call Spreads for $3.89 (463M delta, 670k vega)

- Buyer of 32k SPY Nov 448/460 Call Spreads for $4.36 (236M delta, 635k vega)

- Buyer of 26k SPY Dec 31st 448/470 Call Spreads for $7.91 (263M delta, 900k vega)

There were several other bullish expressions, including someone taking bullish shots in the "utterly left-for-dead" China, with FXI Jan 42 Calls bought and the sale of 7700 EEM Jan 51 Puts.

Yet despite the return of such scattered bullish flows, McElligott notes thatthere remains much angst in the Vol space(Skew still roofed as downside demand remaining extreme), versus still “pervasive skepticism” towards broad Equities upside index / ETF / sectors / industries (Call Skew still nuked)

- SPX (Mega-Cap US Eq) 1m Skew 98.8%ile, 3m Skew 99.1%ile; vs no upside love, with 1m Call Skew 0.5%ile, 3m Call Skew 1.3%ile

- QQQ (Nasdaq / Secular Growth / Tech) 1m Skew 99.0%ile, 3m Skew 96.7%ile; while 1m Call Skew just nowhere at 0.8%ile, 3m Call Skew 4.4%ile

- IWM (Russell / Small Cap) 1m Skew 86.6%ile; no love for upside tho with 1m Call Skew 16.5%ile

- FXI (China) 1m Skew 92.8%ile, 3m Skew 82.9%ile; but still seeing negligible desire for upside with 1m Call Skew 14.5%ile

- FWIW, the only “upside tail” / bid to Call Skew remains parked in those “inflation sensitive” idiosycratic spots like OIH / XOP / XLE / SMH

Looking at this latest flow menu, McElligott notes that the bottom line here is that "we are seeing *some* normalization in select vol metrics (e.g. term structure in SPX and QQQ, or aforementioned “off the worst” levels in extreme Put Skew)…but we continue to price-in “stress” and definitely not giving anything close to an “all clear” just yet." This dynamic matters because it will continue to “drag up” trailing realized volwhich can then continue to both constrain VaR/lead to netting- and gross-down behavior as well as drive further near-term de-allocation pressure from Vol Control.

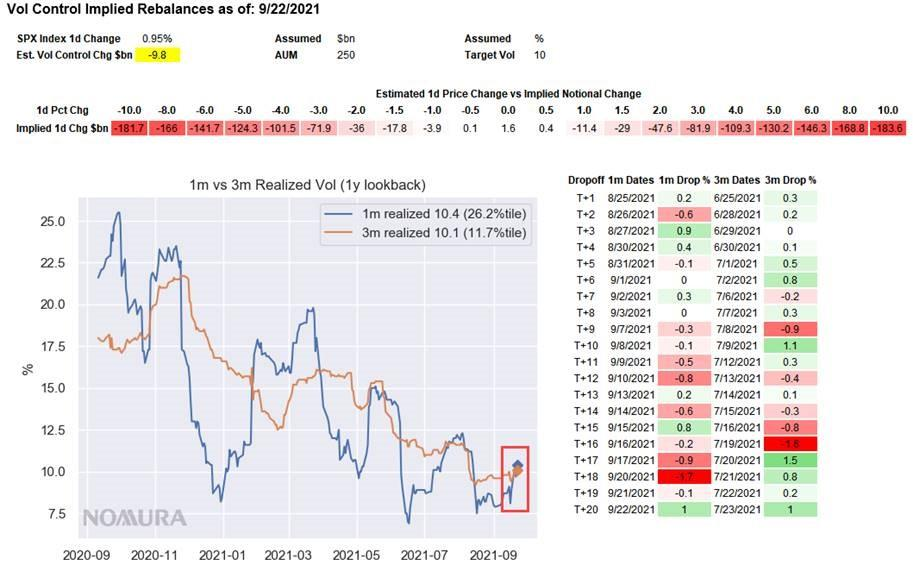

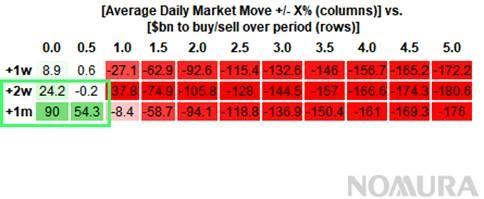

Indeed, and in keeping with McElligott's recent warning that vol-control has a lot to sell here, his Vol Control model estimates a sale of $9.8B SPX futs yesterday from the universe, in aggregate bringing total selling to $20.2B over the past 2 weeks.

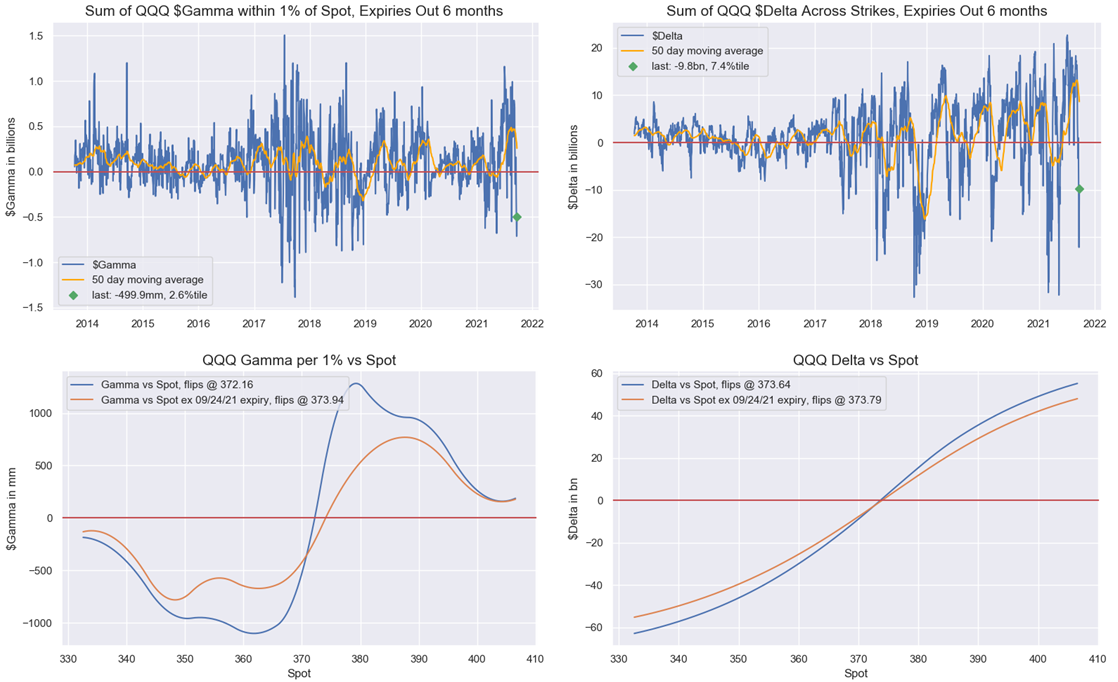

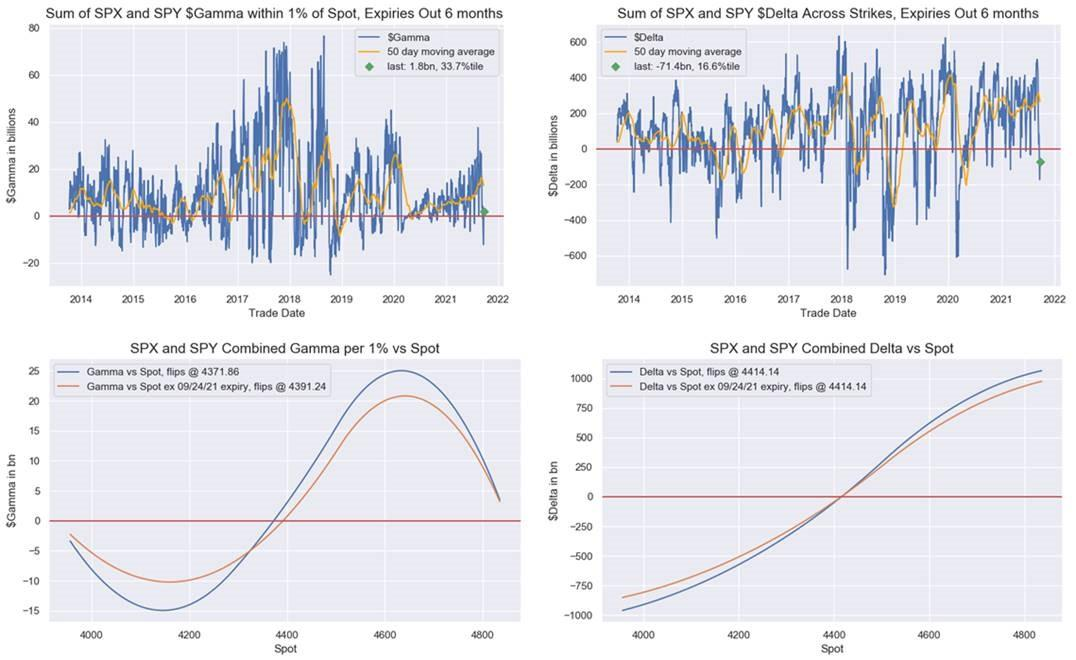

To be sure, we saw the impact of the still-extreme negative Dealer Gamma vs spot across SPX SPY, QQQ and IWM in the +2% rally off the yesterday morning lows, with what McElligott dubbed “spastic” accelerant flow which required more buying the higher spot went.

But now that spot is higher and billions in Delta has been added, the market is in a far more comfortable spot; indeed,the latest options positioning analytics now shows that SPX / SPY Dealers are back in a more stable “long Gamma vs spot” position ($1.8B, 33.7%ile, flips below 4371)...

It is this normalization in gamma that McElligott concludes sets us up for the“stability now, big rally later”:as stocks continue to rise, the positive feedback loop emerges asthe resumption of “long Gamma” stabilization from Dealers beget more overwriting/ options selling flow from the usual suspects,which in turn leads to a reversal over the next few weeks out of what has been this local “realized vol rallying up to implied”dynamic that is behind much of the recent selling. When we do, expect to see the now traditional resumption of tighter daily ranges and lower rVol. Looking out; looking out 2 weeks to 1 month is when he expects "lumpy re-allocation flows from Vol Control types" who also join the bullish fray and the slow, steady and never-ending meltup makes a triumphal return.