Summary

- We continue to believe that Palantir’s upside appears to be limited and its future growth is already priced in.

- Our analysis shows that Palantir’s fair value is $8.22 per share, which represents a downside of over 60% from the current market price.

- The dilution risk and the continuous selling pressure are likely going to prevent the appreciation of Palantir’s stock anytime soon.

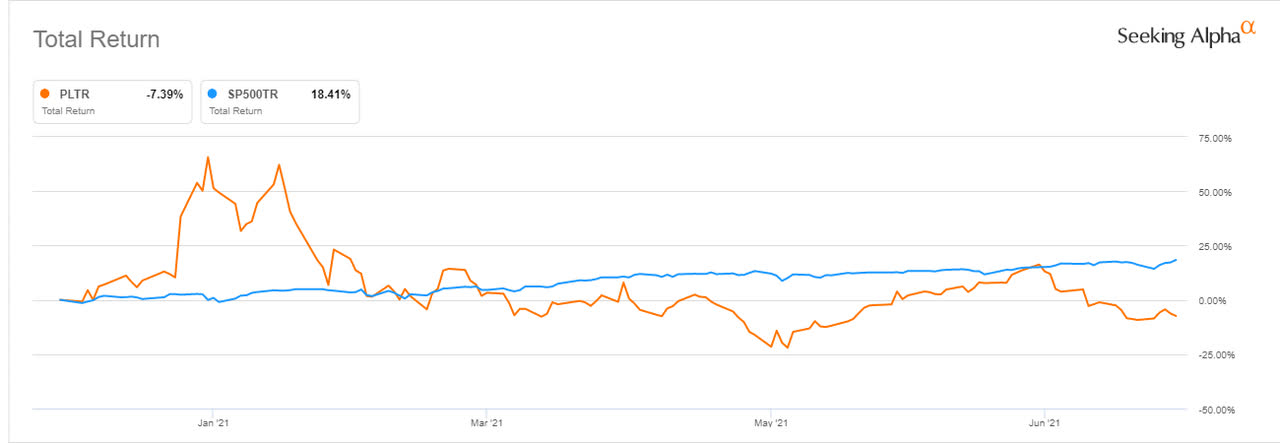

Palantir (PLTR) has been underperforming the market in recent weeks and we believe that its stock still has more room to fall. Our analysis shows that Palantir is extremely overvalued at the current levels and several issues are likely going to prevent its stock from appreciating further anytime soon. For that reason, we continue to believe that it’s better to avoid Palantir at the current price, as its upside appears to be limited.

There Are Several Red Flags, Which You Shouldn’t Ignore

Palantir specializes in creating custom software solutions for collecting data for its clients, who are mostly government agencies and public companies. While some might think that Palantir is a young company with lots of potential, the reality is that it’s not a startup, as it has been in the business for almost two decades already, and since that time it has managed to add less than 200 customers. As a result, the company is exposed to a limited pool of organizations, who generate most of the revenues. This is mostly because Palantir doesn’t have a scalable business. The value of the company’s average contract ranges from $5 million to $6 million, which prevents small and medium businesses from using its services. While Palantir tries to tackle this issue by offering its Foundry platform for the commercial sector at attractive terms, it’s still too soon to tell whether it will improve its affordability to most of the third parties and have any major impact on its financials in the long run.

In addition, while bulls might want to deny this, but Palantir operates like a consulting company. The company has a special position of a forward-deployed engineer, who analyzes different processes of potential clients and then explains how Palantir’s software could help them improve their operations. Considering this, it’s safe to say that Palantir doesn’t have a unique business model since its whole proposition is that it can analyze the available data better than others. However, nothing stops new entrants from entering the field and offering similar solutions, and nothing stops organizations' internal IT departments from developing better tools to analyze all of the processes at a more affordable price.

Another downside of Palantir is that despite the increase in margins and gross profit in recent quarters, it never made a profit in its history after being so long in the business. Its operating loss has onlywidenedin recent years from -$600 million in 2018 to -$1.17 billion in 2020, to -$1.22 billion in the last twelve months. This is due to the excessive stock-based compensation program that results in increased expenses and massive dilution, which is something that a lot of bulls tend to ignore. Let’s not forget that the company’s expenses relating to the SBC program increased by around 257% year over year last quarter and were $193 million. At the same time, Palantir already has 1.8 billion shares outstanding, an increase from 1.52 billion shares, which were outstanding at the end of last year. The problem is that the excessive SBC program will continue to be a major issue for the company’s investors since there are still 477 million optionsoutstanding, which will dilute the current shareholders by more than 20% if fully exercised.

For that reason, we continue to believe that Palantir’s stock will continue to be an unattractive investment and it’ll likely continue to underperform the market. It’s already down ~15% since our bearisharticlewas published a month ago and we believe that there’s more room for a depreciation.

Another reason to be bearish about Palantir is due to the fact that there’s an extreme selling pressure, which is created by the company’s insiders and its CEO in particular, who are constantly dumping their shares on an open market. In July alone insiderssoldin total $63 million worth of Palantir shares, which is only $31 million slightly less than what they sold in Q1 when the lockup period expired. Considering this and the fact that they still have ~10% ownership stake in the company, it’s safe to assume they’ll continue to sell their shares and create an even greater selling pressure, which is likely going to prevent the stock from significantly appreciating from the current levels.

Valuation

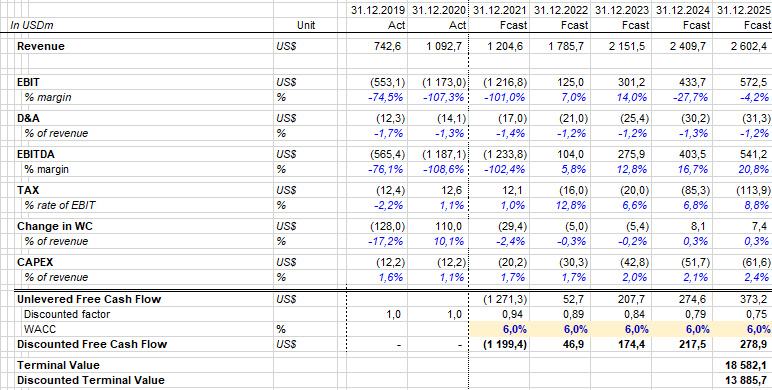

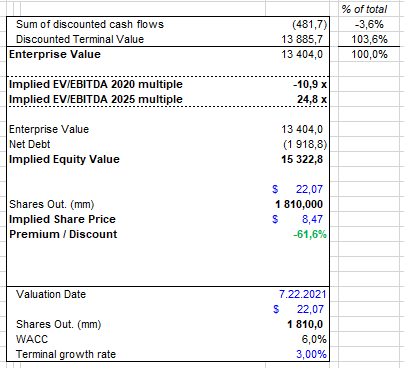

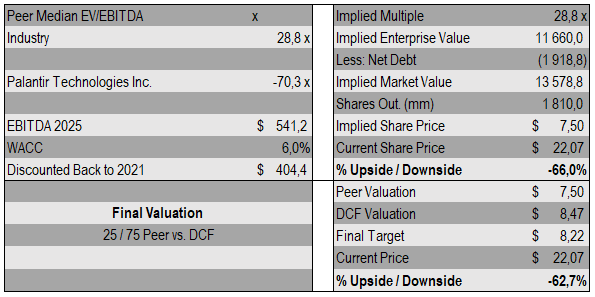

We created a discounted cash flow model to find Palantir’s fair value. The weighted average cost of capital in our model is 6%, while the terminal growth rate is 3%.

After doing all the necessary calculations, our DCF model showed that Palantir’s fair value is $8.47 per share, which represents a downside of over 60% from the current market price.

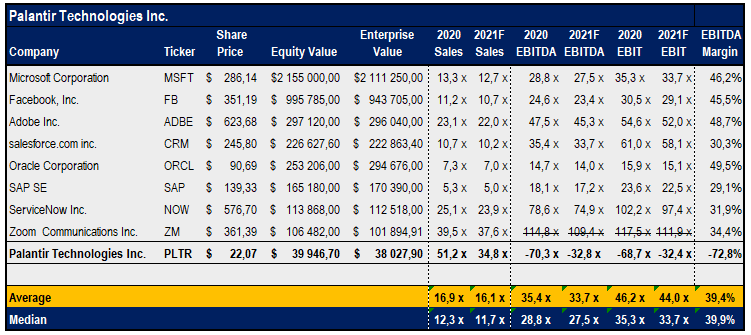

For relative valuation, we compared Palantir to eight other companies from the tech industry and the SaaS niche in particular. By looking at the numbers below, we could safely say that Palantir is extremely overvalued to others, especially since its EBITDA margin of -72.8% is the worst among its peers, and at a market cap of ~$40 billion, its stock is overpriced.

By consolidating the DCF model and the relative valuation method and giving the former 75% weight in the final analysis, while giving the latter 25$ weight in the final analysis, we concluded that Palantir’s final fair value is $8.22 per share, which is significantly below its current market price of ~$22 per share.

Takeaway

Despite its advanced data software solutions, Palantir continues to be an unattractive investment in our opinion and its stock is unlikely to move significantly higher anytime soon. The company doesn’t have a unique proposition at an affordable price on the market and there’s every reason to believe that its expenses will continue to increase in the following years due to the higher inflation and increased competition, while its bottom line will continue to suffer. As a result, despite signing new multi-million contracts from time to time, it’s still hard to justify its ~$40 billion market cap. Considering this, we strongly believe that Palantir is not a value investment at this stage, and not a growth play as well since the dilution risk and the continuous selling pressure are likely going to prevent the appreciation of its stock anytime soon.

While we don’t expect the stock to depreciate to its fair value of $8.22 per share in the foreseeable future, a decent decline from the current market price is more than possible, especially since the company already trades at 28 times its revenues and is considered to be overvalued. For that reason, we stick to our opinion that Palantir’s upside appears to be limited and its future growth is already priced in.