There are some signs of a recovery attempt following Monday’s wipeout, chiefly for techs. The Nasdaq CompositeCOMPisteetering toward correction territory and the S&P 500SPXand Dow industrialsDJIAare halfway there. With jobs data looming for Friday, even the bravest dip buyers may have second thoughts.

Don’t look for reassurance in our call of the day, where the founder and CEO ofBullAndBearProfits.com, Jon Wolfenbarger, predicts U.S. stocks may be “on the verge of starting the biggest bear market since the Great Depression.”

“Now with the Fed talking about tapering and money supply growth slowing significantly from 39% y/y in February to only 8% y/y in August, perhaps that is enough of a ‘tight monetary policy’ to change investor psychology to a more bearish mood? We will see,” he said in a Monday interview and follow-up comments with MarketWatch.

Wolfenbarger, who spent 22 years as an equity analyst at Allianz Global Investors, said while he’s not a permabear — his newsletter offers strategies for profiting when markets go both ways — investors should heed some warnings signs.

Overbullish sentiment, economic weakness, excessive debt levels and limited policy tools are key ingredients for a market rout worse than that seen in 2008-09, he said, adding that a top for the S&P 500 reached a few weeks ago could have been the start.

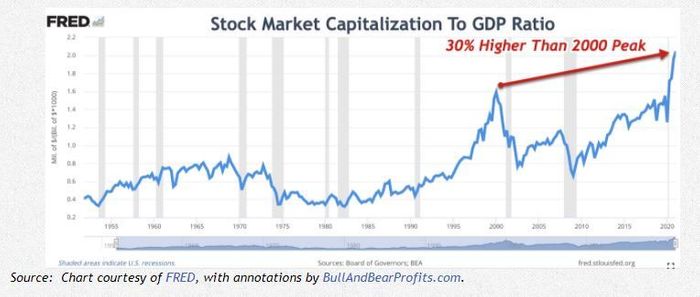

One chart he’s watching that predicts future long-term stock returns— a favorite of legendary investor Warren Buffett, the chairman and CEO of Berkshire HathawayBRKBRK— shows equities 30% above the prior all-time high seen in the tech bubble peak of 2000.

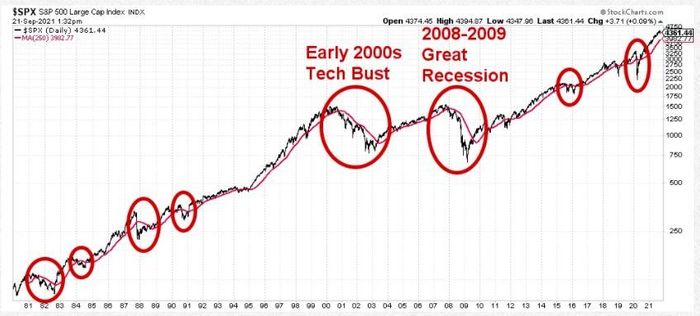

Wolfenbarger is watching S&P 500 moving averages closely. If the 250-day, currently at 4,020, were to “really break through” that could trip a major drop for stock. His below chart shows the S&P 500 price (black line) with its 250-dma since 1980. The red circles indicate when it fell below the 250-dma and the 250-dma slope was falling.

As for what investors should do — Wolfenbarger advised using exchange-traded funds that actually go up in bear markets, which could be the iShares 20+ Year Treasury Bond ETFTLTor SPDR Gold SharesGLD, though he prefers inverse ETFs such as ProShares UltraShort S&P 500SDSand the ProShares Short S&P 500SH.

“I personally think it’s easier for most people to just buy an inverse ETF because it moves the same way as a normal stock and ETF, and the SH went up 89% in the last bear market,” he said, adding that SDS went up 184%.

Wolfenbarger said he has honed his strategies after adhering for years to Buffett’s advice of just buying and holding an S&P 500 index fund.

“But then I started looking at history and you know it took 25 years for the market to get back to the 1929 peak, and I don’t have 25 years,” said Wolfenbarger, who is in his early 50s. “Any given investment can go down 50% to 90% and it can stay down for decades, at least 10 to 20 years.”