Consumer prices (CPI) increased at an annualized rate of 7.3% during the first six months of 2021, while core consumer prices rose 6.2%. Both represent the most significant gains in several decades. As important as the rise in consumer prices is for the general public and policymakers, there still is a lot of misinformation and false statements about the current inflation cycle. Below are some of the misstatements and false impressions.

CPI inflation of 2021 is not as high as that of the 1970s---False.It's not possible to compare inflation across several decades because of significant changes in measurement. The CPI of the 1970s included house price inflation, and the current measure does not.

Here's a simple illustration of how significant including and not including house price inflation can be. In 1979, CPI rose 11.3%, and that included a 14% increase in the price of existing homes. In the past twelve months, CPI has increased 5.4%, and the 23% increase in existing home prices is not part of that. Government statisticians have created an arbitrary owner rent index (up 2.3% in the past year) to replace house prices.

Owner housing accounts for nearly one-fourth of the CPI index, so one can guestimate how much current inflation would be if the same measurement practices were still in place. My guess is it would be double-digits.

Inflation in one market can be inferred by inflation in another market---False.Accurate price measurement can only occur if there is a direct sampling of a consumer item or market or a record of actual transactions. The current estimate of owners' rent comes from the tenant market. The tenant market and the owners' market are fundamentally different in character, location, and, most importantly, vacancy rates. As is the case nowadays, homeowners would base their rent estimates on the shrinking availability of homes on the market and housing inflation in a red-hot market. The current measurement approach creates a considerable error in the reported inflation statistics by relying on the tenant market for price inflation for owners.

Long-lived items are not part of the CPI---False. One of the arguments for not including house prices in the CPI is it a long-lived asset that consumers consume over a series of years. If CPI were only to have perishable items or used in a short time, then it would include food and energy and a few other products and services. But the CPI already includes items that consumers consume over long periods.

For example, used cars and trucks are in the CPI, and their life span can run more than a decade. That's not as long as housing, but it still is significant. Used cars and trucks prices have a weight of 3% in the CPI, and house prices have a zero weight. Does that make any sense?

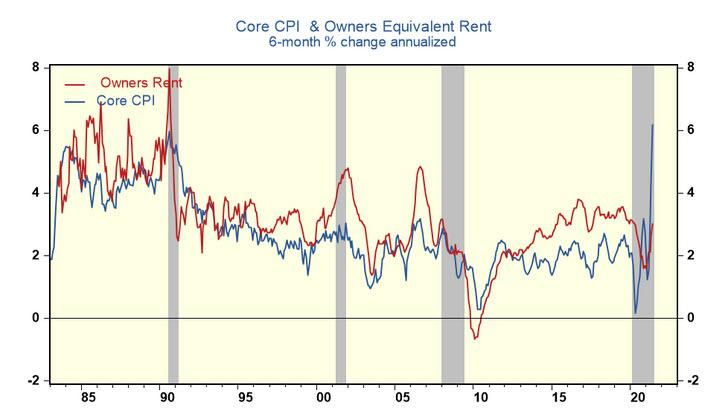

The inflation cycle of 2021 is unlike anything experienced in decades. It is fast and broad, and one of the most surprising features is that owners' housing costs are running less than half as fast as the core. Owners' rent index will accelerate in the coming months as market rents continue to increase.

In my view, policymakers are continuing to promote a public perception of inflation that is false.