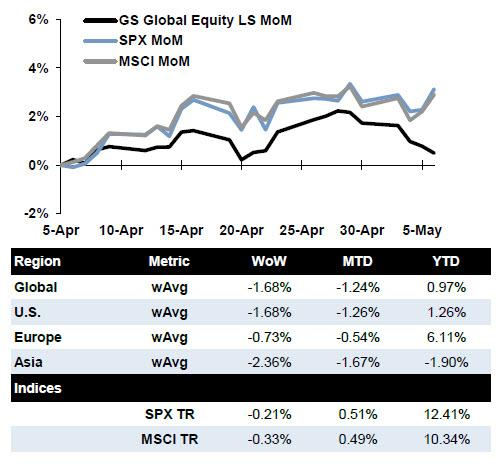

Hedge funds had another rough week according to Goldman's Prime Brokerage, with the GS Equity Fundamental L/S Performance Estimate falling -1.68% between 4/30 and 5/6 (vs MSCI World TR -0.33%), driven by alpha of -1.11% – the worst weekly alpha in two months – and to a lesser extent beta of -0.57% (from market exposure and the market sensitivity factor combined). As a result, global fundamental equity L/S hedge funds lost almost two-thirds of their YTD gains in just the past week, bringing their total YTD return to just 0.97% in what is setting up as another dismal year for the 2 and 20 crowd.

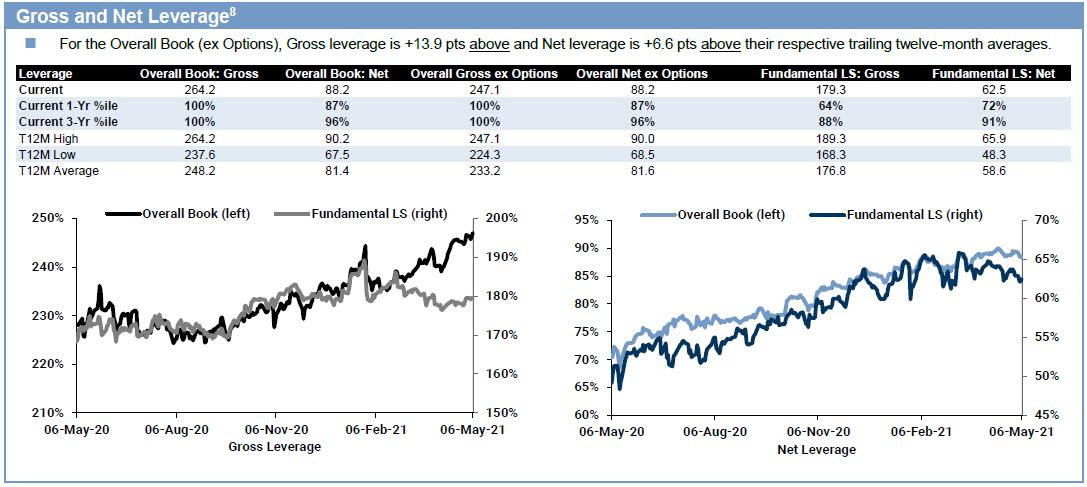

What is remarkable is just how sensitive to overall market beta the hedge fund space has become, and there is a reason for that: according to Goldman Prime,overall book Gross leverage rose +1.7 pts to 247.1%, the highest on record,while Net leverage fell -0.9 pts to 88.2% (not quite an all time high, but still 87th percentile).

Looking at the composition of hedge fund purchases,the overall GS Prime book was modestly net bought again in the past week(+0.15 SDs), driven by risk-on flows as long buys outpaced short sales. Specifically, single Names were net bought while Macro Products (Index and ETF combined) were net sold. North America and to a lesser extent Europe were net bought driven by long buys, while DM Asia and EM Asia were net sold driven by short sales. 8 of 11 global sectors were net bought led in $ terms by Consumer Disc, Health Care, Staples and Real Estate, while Info Tech, Materials, and Financials were net sold.

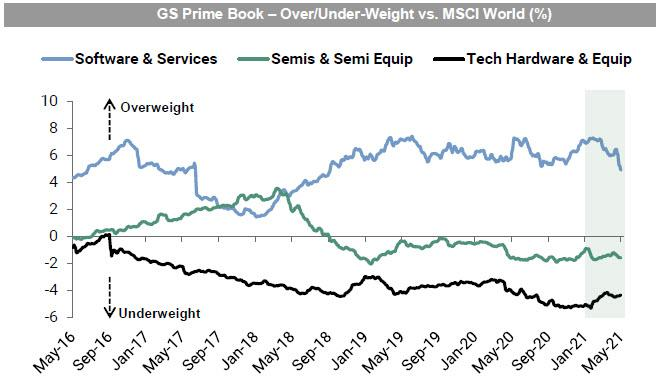

Meanwhile, continuing the trend first observed last weekwhen we noted that hedge funds shorted tech sharesfor 9 of the previous 10 days, Goldman notes thatInfo Tech saw the largest net selling in nine months as managers reduced exposure for a third straight week.And in a surprise reversal to months of bullishness on IT, GS Prime points out that hedge funds are currently Underweight Info Tech stocks by -1.4% vs. the MSCI World,the lowest level since last November and in the 3rd percentile vs. the past five years.

Some more details from the Goldman reports:

- Info Tech, the worst performing sector this week,was also by far the most net sold sector on the GS Prime book driven by short sales outpacing long buys 7 to 1.

- Info Tech stocks were net sold for a third straight week and saw the largest week/week $ net selling since last August (-1.6 SDs). Net trading flow diverged on a subsector level – Semis & Semi Equip, Software, and Electronic Equip were the most net sold, while Comm Equip and IT Services were the most net bought.

- Hedge funds are currently U/W Info Tech stocks by -1.4% vs. the MSCI World,the lowest level since last November and in the 3rd percentile vs. the past five years.

- From an industry group standpoint, hedge funds are still O/W Software & Svcs by +4.7% (28th percentile) and U/W Semis & Semi Equip and Tech Hardware by -1.6% (13th percentile) and -4.3% (18th percentile), respectively

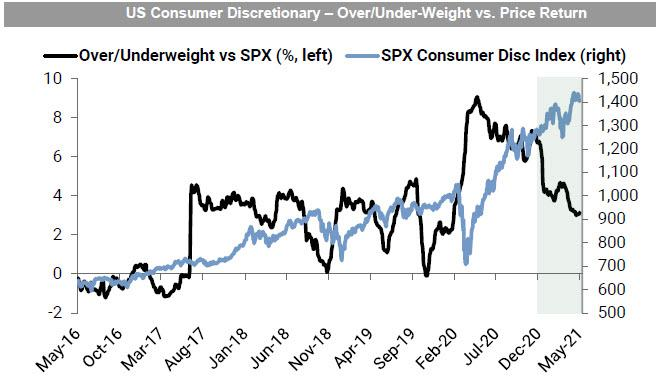

- In $ terms, Consumer Discretionary was the most net bought US sector on the GS Prime book this week, driven by risk-on flows with long buys outpacing short sales 4 to 1.

- The sector’s aggregate long/short ratio (MV) on the GS Prime book ended the week at 2.53, which is in the 2nd percentile vs. the past year and in the 77th percentile vs. the past five years. The GS Prime book is now O/W US Consumer Discretionary stocks by +3.3% vs. the S&P 500, which is in the 9th percentile vs. the past year and in the 50th percentile vs. the past five years.