AMC Entertainment has led the charge in meme stocks this summer. Is the run about to end or can it continue higher? Let's look at the chart.

AMC Entertainment (AMC) -Get Report has taken over the online forums and stock trends over the last few weeks.

The leader of the recent meme-stock rallyhas been on fire. Shares have risen almost 400% over the last month, despite the stock being down 22% from the highs set earlier this month.

AMC has beendiligent about raising capitalamid the surging stock price - just as the company should.

Given that AMC was hit so hard during the pandemic, raising so much capital allows the company to, in the words of CEO Adam Aron, go fromplaying defense to playing offense.

The rally in AMC has helpedelevate other stocks too, including BlackBerry (BB) -Get Report, Clover (CLOV) -Get Report, Beyond Meat (BYND) -Get Report and others. Interestingly, GameStop (GME) -Get Report has not played as big of a role as the last short-squeeze bonanza earlier in the year.

After the recent run though, investors are wondering if AMC’s time in the sun is done.

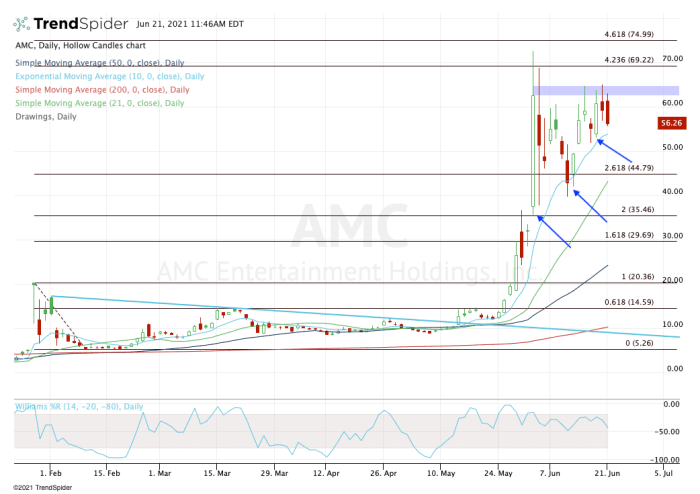

In early June, AMC stock exploded higher and topped out at $72.62.

In the next session, shares tried to take out the high but couldn’t. In fact, AMC stock posted an incredibly wide range of more than $30 that day, failing to take out the prior day’s high or its low. Neither have been taken out since.

Instead, shares continue to grind higher, using the 10-day moving average as a support level. However, the advances above $60 continue to act as resistance.

Trading an asset this volatile is not easy, but I wouldn’t say the run is necessarily over.

First and foremost, I want to see the 10-day moving average and $52.75 area continue to act as support. As long as that’s the case, the stock can continue to consolidate and build for a potentially larger rally.

A close below $52.75 opens up $50 and a potential test of the 21-day moving average. Below the latter and we could see further selling pressure down to the $35 to $40 area.

On the upside, let’s see how AMC continues to handle any moves north of $60. The $62.50 to $65 area has clearly been resistance, but a move above that zone (and even better, a close above this area) puts $70 to $75 in play.

That’s where the stock previously topped out and would put AMC between two key extensions from the previous range.