Apple stock continues to push forward ahead of earnings – but have valuations gone too far, too fast? The Apple Maven looks at three key ratios to determine if shares might be overstretched.

In a matter of less than six weeks, Apple stock climbed from a 2021 low of about $116 per share to nearly $135. A similar spike of at least 15% within the same short period happened last in January,ahead of fiscal first quarter earnings, when Apple reached its all-time high of $143 apiece.

But since getting to that early 2021 peak, Apple stock corrected as much as 19%, and remains underwater today. Therefore, the recent rally must have Apple investors wondering if the stock might have rushed too fast and too far from the business fundamentals.

Apple stock: a look at relative valuation

One way to address this concern is to look at relative valuations. These are ratios that link stock price (numerator) with certain financial metrics, including earnings and cash flow (denominator). The higher the valuation multiple, the more investors are willing to pay for a company’s fundamentals.

Today, I look at three popular relative valuation metrics on Apple stock:

- Price-to-earnings: probably the most well-known of them, P/E compares the price of a share of equity to the company’s net earnings per share. Here, I use the trailing metric based on historical earnings figures.

- Price-to-book: this is another multiple that focuses on equity value. P/B is the ratio between the market price and the book value of the stockholder’s ownership in the company.

- Enterprise value-to-earnings before interest and taxes: this is a total firm, rather than an equity-only, valuation multiple. EV/EBIT measures the market value of debt and equity combined, relative to the company’s pre-tax and pre-interest income.

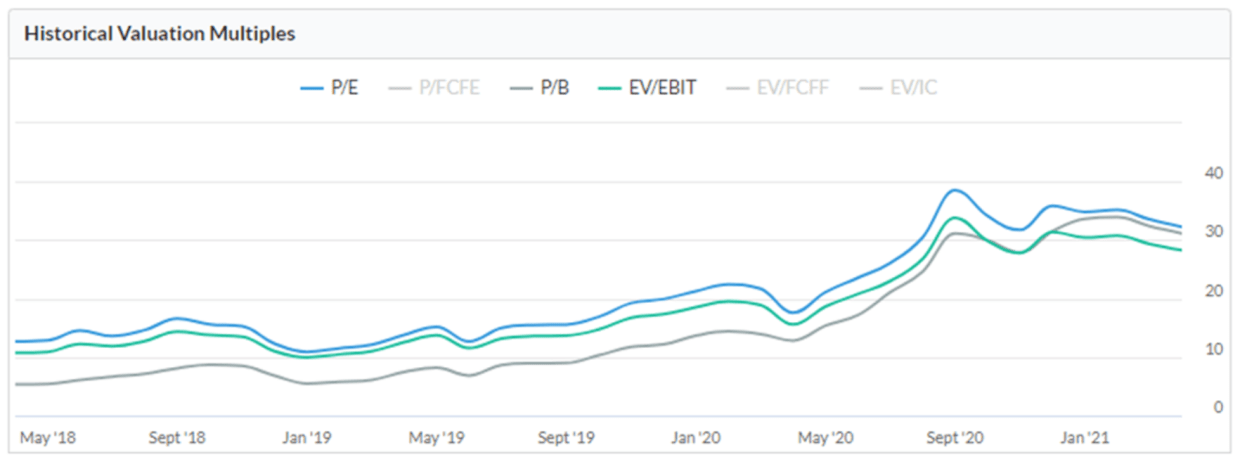

The graph above depicts the three different valuation metrics described, but generally tells the same story. At least over the past three years, likely much longer, Apple stock has been trading at sky-high multiples this year, even if they seem to have moderated a bit since September 2020.

The P/E ratio has passed the test that I proposed in late February: the multiple seems to have found a floor of 33 times, below which it has not stayed for long since around August 2020. The bad news is that Apple stock has consistently failed to sustain a P/E of more than 38 times, and the multiple seems range-bound for now.

The P/B ratio catches my attention for having climbed very sharply since 2018: from a low of only 5 times to a whopping 34 times now. At play here are not only factors like higher growth expectations and lower interest rates, which impact most valuation multiples, but also the fact that Apple has been retiring equity aggressively. The fewer shares outstanding, the higher P/B tends to be.

The Apple Maven’s take

The data seems clear: Apple’s key valuation multiples look stretched, certainly relative to their own history. The harder question to answer is: are the ratios overdue for a pullback?

Higher valuation multiples can reflect a number of assumptions, including: higher growth expectations, lower interest rates, a perception of decreased risk of ownership, among others. I believe that Apple stock probably deserves to be valued more richly now than, say, three or five years ago.

At the same time, I think that Apple’s rich multiples could find upside resistance from here. Should Apple stock price rise, which it very well may, it will likely be the result of growth in financial metrics (sales, earnings, cash flow) rather than valuation expansion.

Is the price right?

Looking at a company’s business fundamentals is only half the work needed to find a good stock. How much one pays to own the shares is a key factor in the success of any investment. This is why valuation analysis is so important.