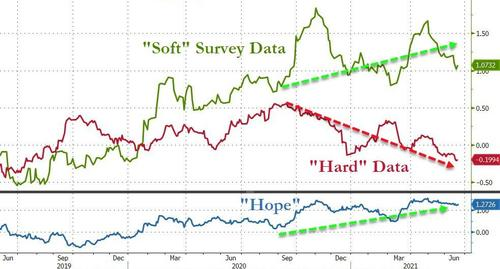

Ugly PMIs (Services recovery collapsed), and even uglier housing data suggest all is not well under the surface of the "excellent" recovery andthat "hope"-filled gap between 'soft' and hard data is set to slump again...

But markets just shrugged it off as the echoes of Powell's dovish promises bounced around their frontal cortexes.

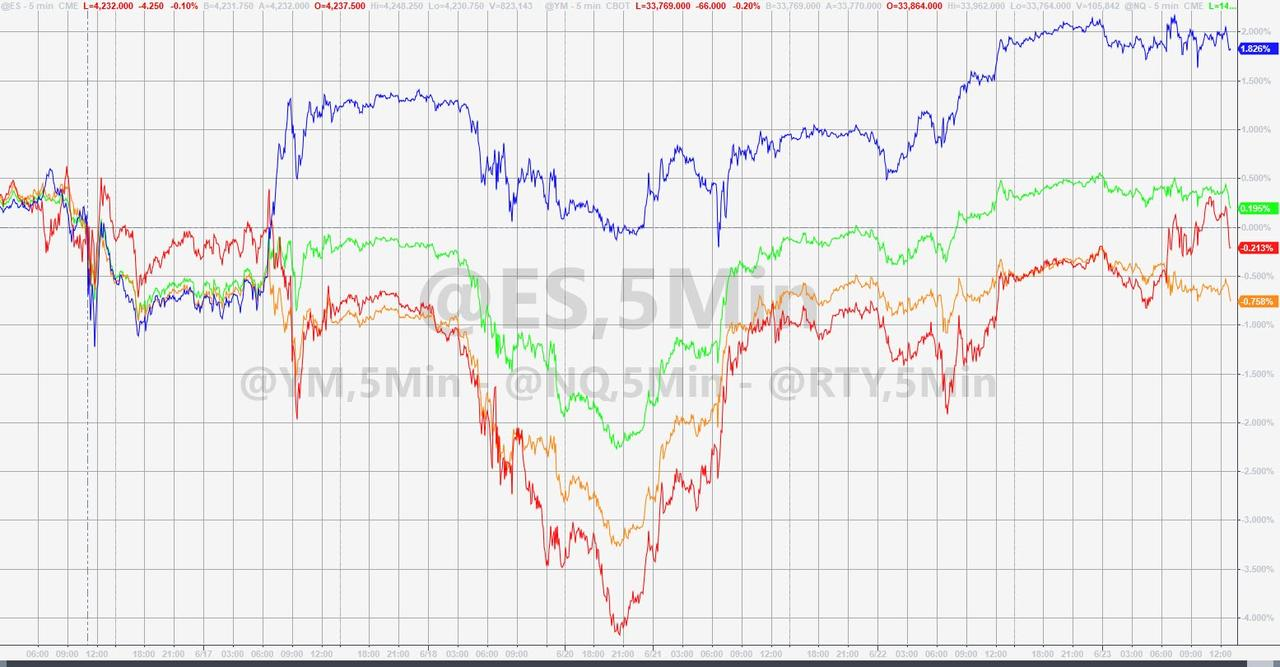

While Small Caps did their manic thing; The Dow, S&P, and Nasdaq all trod water all day in a very narrow range... UNTIL this happened...

The U.S. economy will likely meet the Federal Reserve’s threshold for tapering its asset purchases sooner than people think,said Dallas Fed President Robert Kaplan, who has penciled in an interest-rate increase next year.

“As we make substantial further progress, which I think will happen sooner than people expect -- sooner rather than later -- and we’re weathering the pandemic, I think we’d be far better off, from a risk-management point of view, beginning to adjust these purchases of Treasuries and mortgage-backed securities,” Kaplan said Wednesday in an interview with Bloomberg News.

“If we do these purchases longer than might be necessary, for me it actually may reduce our flexibility in adjusting rates,” Kaplan said.

“I’d rather start tapering, assuming we meet our conditions, sooner rather than laterso that we have more flexibility in deciding what we want to do on rates down the road.”

And the selling began sending The Dow, S&P and Nasdaq into the red for the day...

Since just before the FOMC statement last week, The Dow and Small Caps are in the red and Nasdaq the big outperformer...

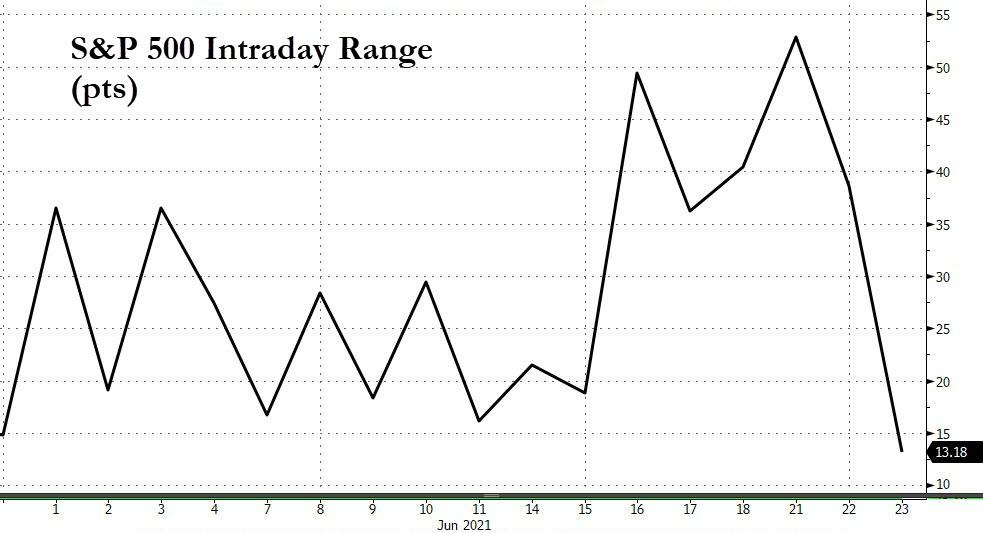

VIX fell to a 14 handle intraday...

This is how quiet it was...

Treasury yields also went nowhere fast, eventually rising 1-2bps across the curve on the day (10Y now unchanged from pre-FOMC)...

And while the dollar chopped around, it ended spectacularly unch...

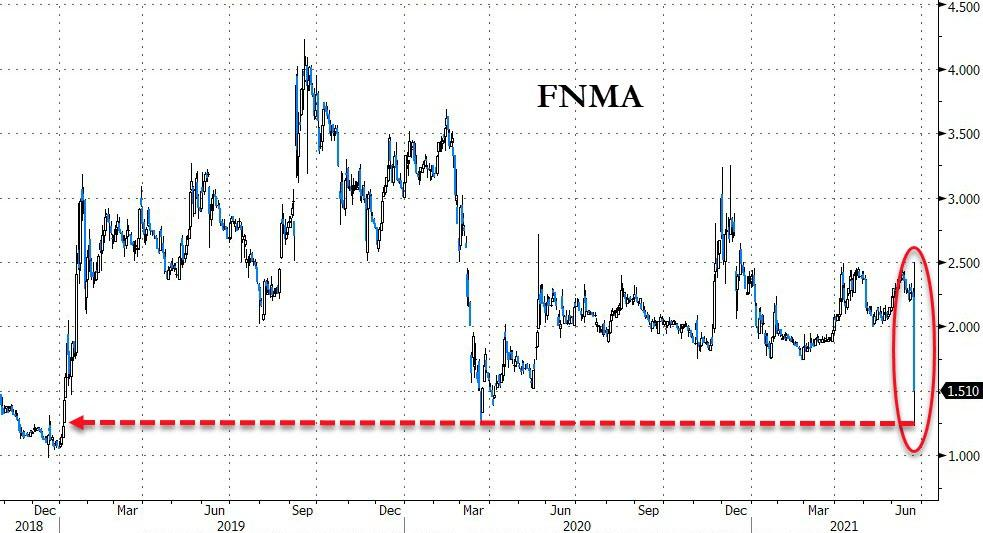

There were some fireworks of note.

Fannie & Freddie were destroyed by SCOTUS ruling...

Crypto ended very marginally higher after giving back some overnight gains. Bitcoin briefly touched $35k before sliding...

WTI whipped higher and lower on OPEC+ production, inventories, and weak data...

Gold followed a similar trajectory - ending unch...

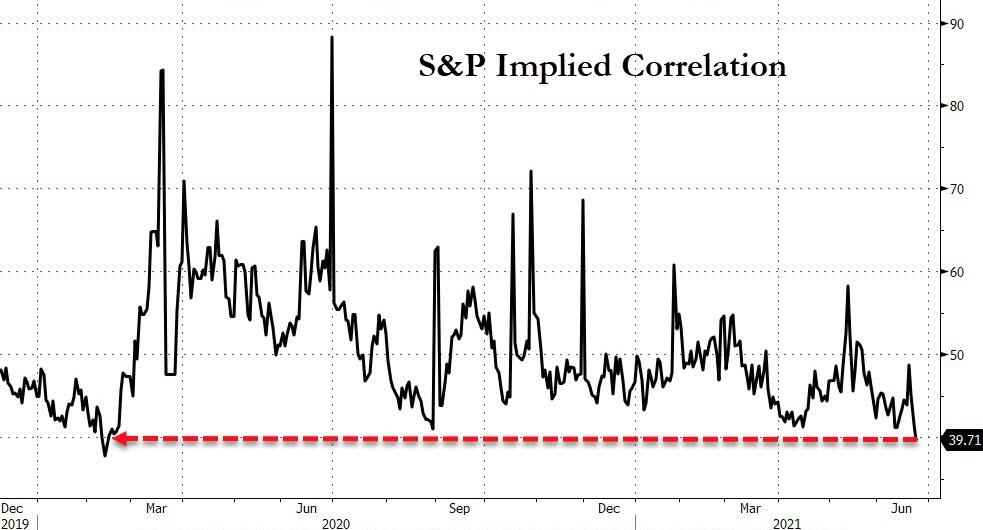

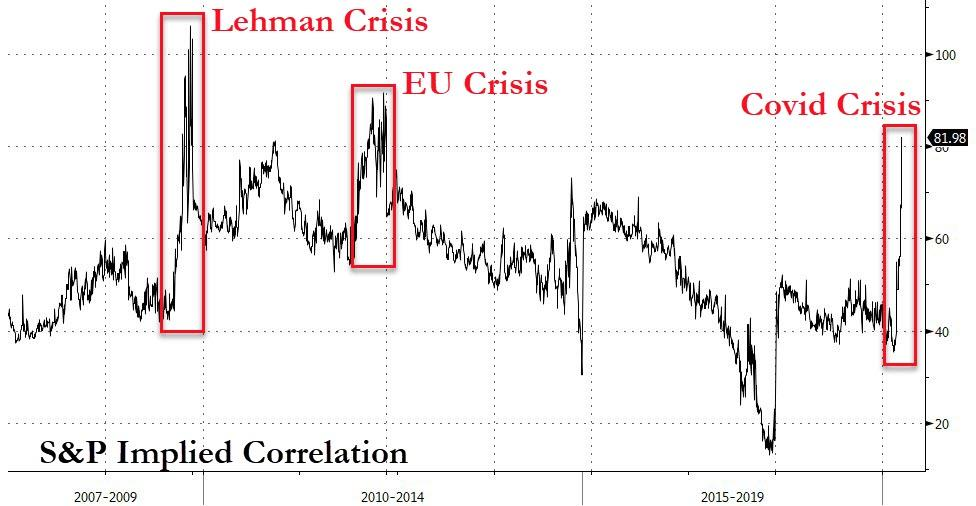

The implied correlation,a topic we have discussed in the past at length, quantifies the difference between the index's volatility and the summation of the underlying volatility of the names in an index. In a nutshell,the implied correlation measures the relative demand for instant liquid index macro protection relative to its underlying names(a slower less liquid way to protect yourself). Thehigher the correlation, the greater the risk of a very significant systemic downside move(since correlations tend to approach 1 when systemically bad events occur).

By implicitly measuring the market's demand for this relative protection - and its implicit downside risk sentiment -implied correlation is much more applicable as a measure of investor sentiment... which right now is about as complacent as its ever been.