Santa Claus rally? Apple investors have reasons to be more excited about what comes next. Here is what the data suggests might happen to AAPL share price in the next two weeks.

Santa Claus almost skipped Wall Street this year. The S&P 500 dipped 3.5% between December 15 and 20, putting into question the year-end rally that some expected to see. But quickly, bullishness came flooding back, as the index jumped 4% in only three days.

If the “Santa Claus rally” is real, what happens after the Christmas holiday is over? And more importantly for the Apple Maven: which way will Apple stock head next?

Is Santa Claus real?

The first question to ask is whether the Santa Claus rally is even evident in the data, or simply a myth. Do stocks really tend to spike ahead of December 24?

There are a few different ways to approach this one. I looked first at the S&P 500’s performance over any two-week period since the early 1990s. Then, I compared my findings against the market returns in the two weeks that precede the Christmas break.

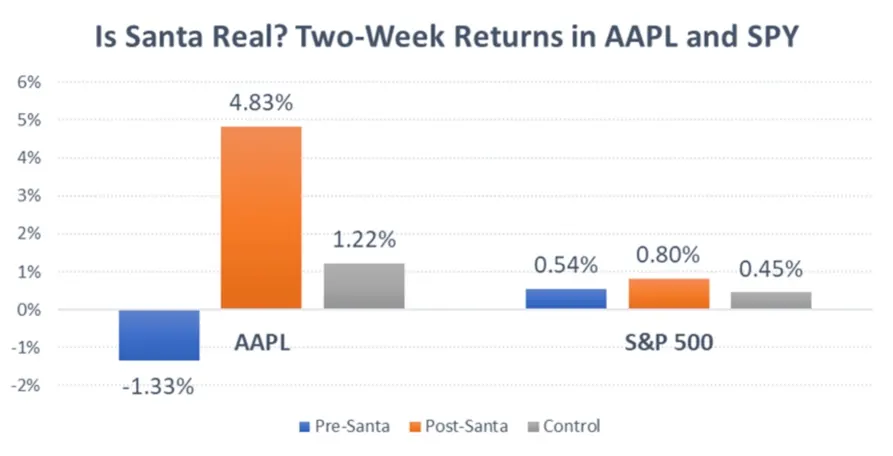

It turns out that yes, the S&P 500 has historically performed better during the pre-holiday period — but only minimally: average two week return of +0.54% vs. the year-round average of +0.45%. If an extra 9 basis points of performance in two weeks seems exciting enough to you, then sure, Santa Claus has been good to Wall Street.

The same thing can not be said of Apple stock and its investors. For the past three decades or so, AAPL has produced outstanding average two-week returns of +1.22%. However, in the two weeks preceding Santa’s arrival, returns have been dismal: an average loss of -1.33%.

This observation is consistent with the idea that the holiday period tends to be seasonally weak for Apple shares. December has only been the ninth best month of performance for Apple stock in the year since the launch of the iPhone, in 2007.

The most likely rationale: investors probably buy into AAPL before the big catalysts, namely the launch of the newest iPhone model in September and Black Friday. During the holiday shopping weeks, investors “sell the news” and shed some of their AAPL holdings.

What next for AAPL?

If Apple investors feel left out of Santa’s list, they should be more excited about what comes next. Since the early 1990s, Apple stock has produced an average gain of +4.83% in the two weeks following Christmas, which is well above average. This is probably a rebound effect from the traditionally dull, pre-Santa performance. See chart below.

Something similar happens to the S&P 500, although not to the same extent: the average post-Christmas gains of 0.80% tend to be better than those produced by the Santa rally.

In the next few trading days, will Apple stock and the broad market perform as well as they have in prior years? We will keep monitoring price action through the year-end holiday to find out.