Can Alcoa repeat Q2 stellar performance in Q3?

seekingalpha2021-10-14

- Alcoa (NYSE:AA) is scheduled to announce Q3 earnings results on Thursday, October 14th, after market close.

- The consensusEPS Estimate is $1.80vs. -$1.17 in Q320 and the consensus Revenue Estimate is $2.92B (+23.2% Y/Y).

- Analysts call for Adj. EBITDA of $697M.

- The aluminum company reported its highest ever quarterly net income and EPS in Q2, as its realized aluminum pricing jumped more than a 60% Y/Y. Net income totaled $309M (vs. -$197M in Q220), while Non-GAAP EPS came at $1.49,easily topping analyst estimates.

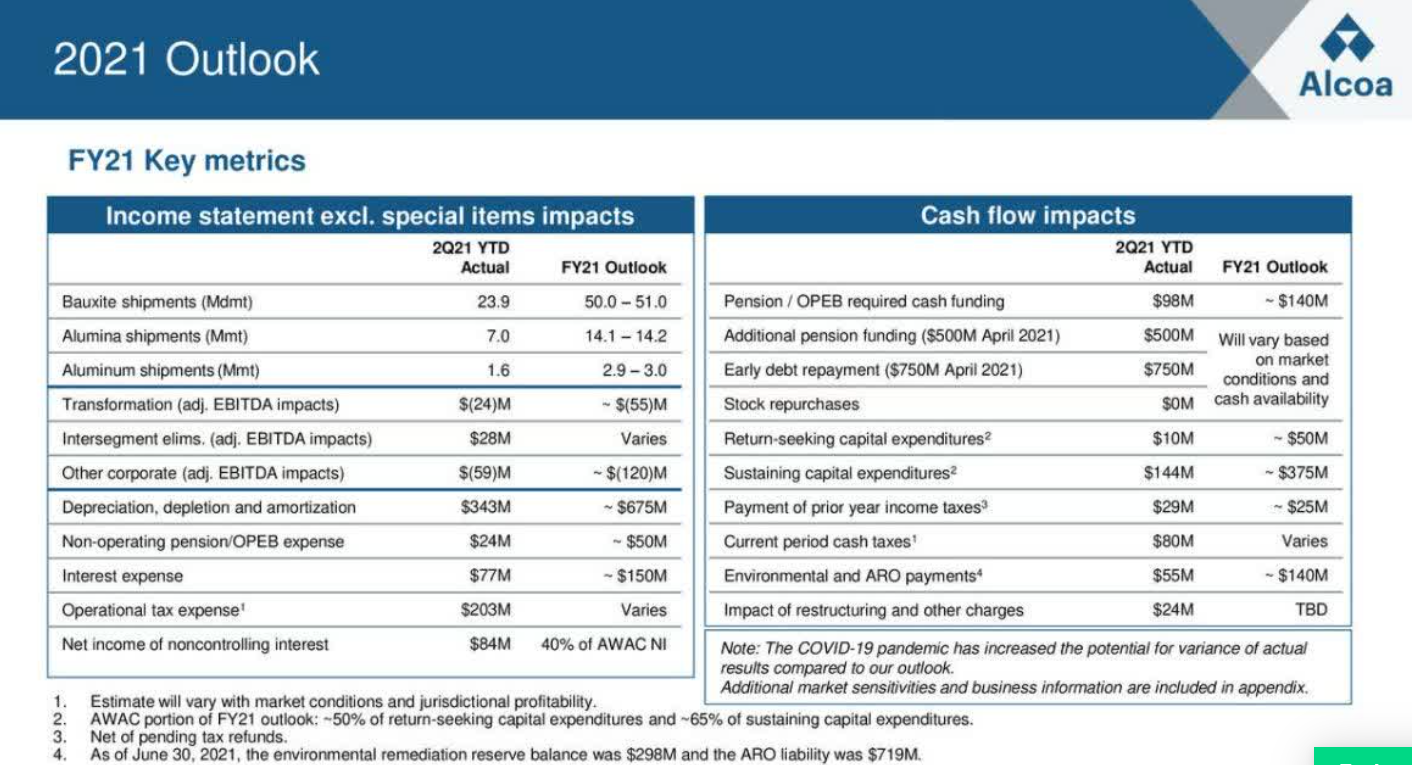

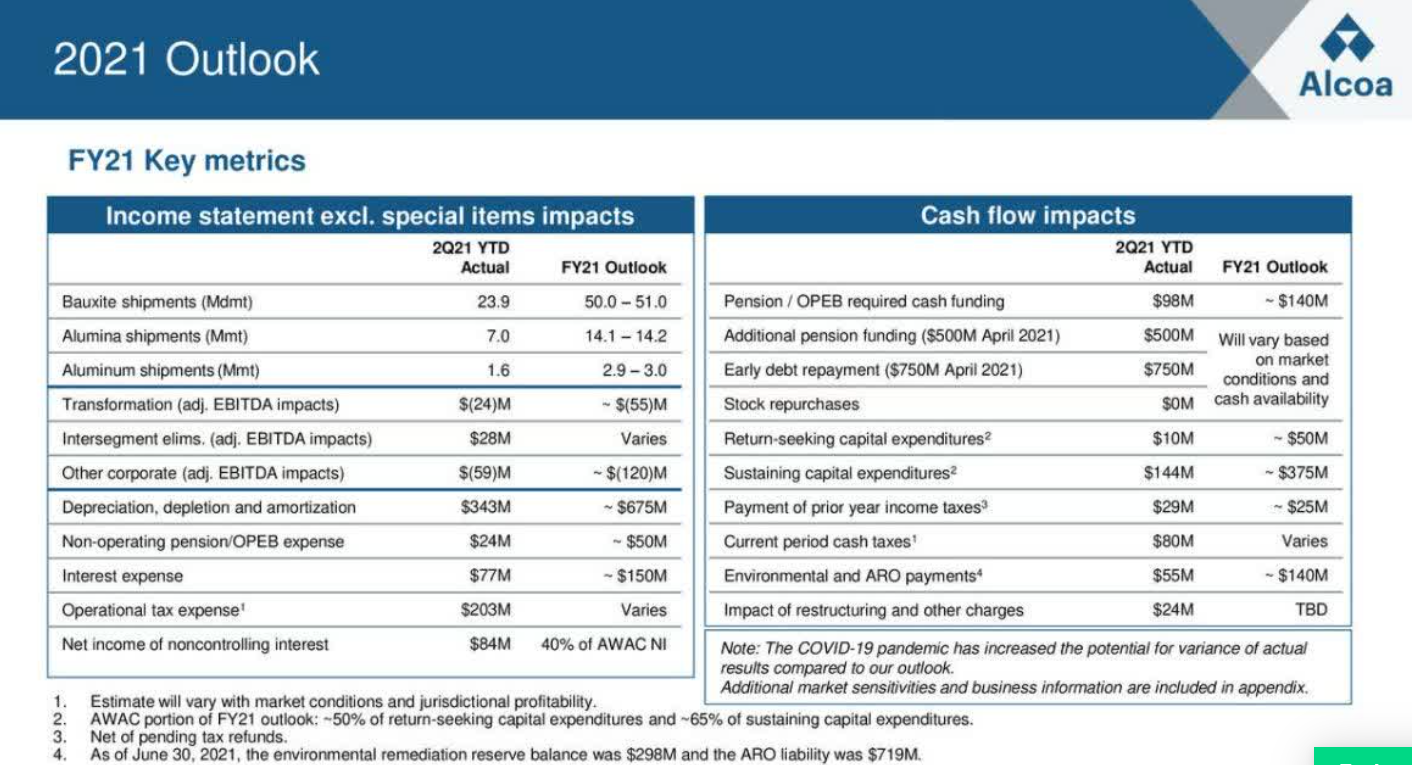

- The management had then guided for a solid Q3 based on continuing forecasts for economic recovery and solid global demand across key end-use sectors. The company had also projected Q3 tax expense to exceed $100M based on alumina and aluminum market conditions at the time. Overall, Alcoa expects a strong yearly performance driven by continued economic recovery and increased demand for aluminum in all end markets.

- The aluminum segment has been propelling bottom line for the company, contributing 65% of its total adj. EBITDA in 1H21. Strong aluminum fundamentals are continuing,with aluminum prices climbing to their highest since 2008earlier this week as production in China, already trimmed by the government anti-pollution efforts, was further curbed by power shortages. China has imposed production curbs on high-polluting industries, such as smelting, to cut power use and emissions, creating large shortages.

- Recently, Morgan Stanley analysts named Alcoaas the top pick among mining stocks in the Americas, stating that the company is well positioned to benefit from a structural shift in the aluminum market, supported by China's capacity cap will lead demand to outpace supply by 2023. The analysts say Alcoa trades at 2.8x EV/EBITDA, well below its historical average of 7.5x, and they see material upside potential vs. consensus estimates.

- On the back of its bullish outlook, Morgan Stanley expects to see accelerating free cash flow generation and potential shareholder returns; the firm rated the stock at "Outperform", raising its stock price target to $62 from $51.

- Over the last 2 years, Alcoa has beaten EPS estimates 63% of the time and has beaten revenue estimates 75% of the time.

- Over the last 3 months, EPS estimates have seen 8 upward revisions and 0 downward. Revenue estimates have seen 5 upward revisions and 0 downward.

免责声明:本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性做出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任。